The 1st quarter of 2015 is almost behind us and investment markets are relatively flat. This lines up with Nevada Retirement Planners and Gradient Investments forecast of a flat US market for the whole of 2015. One quarter into the year we don’t see any reason to change the forecast, but I do think it’s worthwhile to review why we see a flat stock market this year. In the next few paragraphs let’s highlight our rationale behind this forecast.

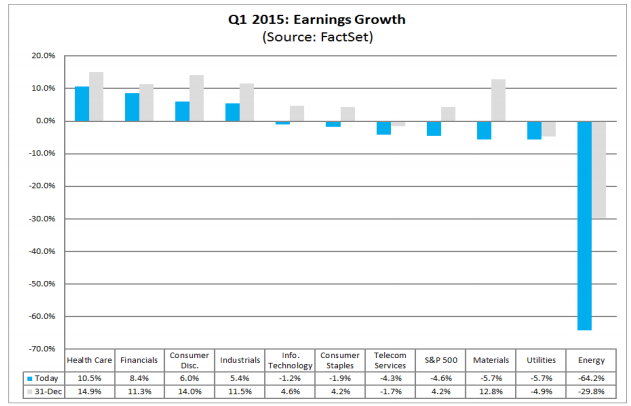

First, S&P 500 earnings estimates have gradually been revised lower this quarter. In fact, S&P 500 earnings growth is now forecast to decline by 4% and sales growth is expected to decline 2% in Q1 of 2015. This could be the first earnings decline since Q3 of 2012. See the chart below of consensus expectations for 1Q 2015 S&P 500 earnings growth.

Large earning declines in the energy sector are the main culprit behind this earnings decline, but the strong dollar is also crimping profits in multinational corporations that sell their goods and services overseas. Bottom line, it’s difficult to get the market moving when earnings aren’t doing well.

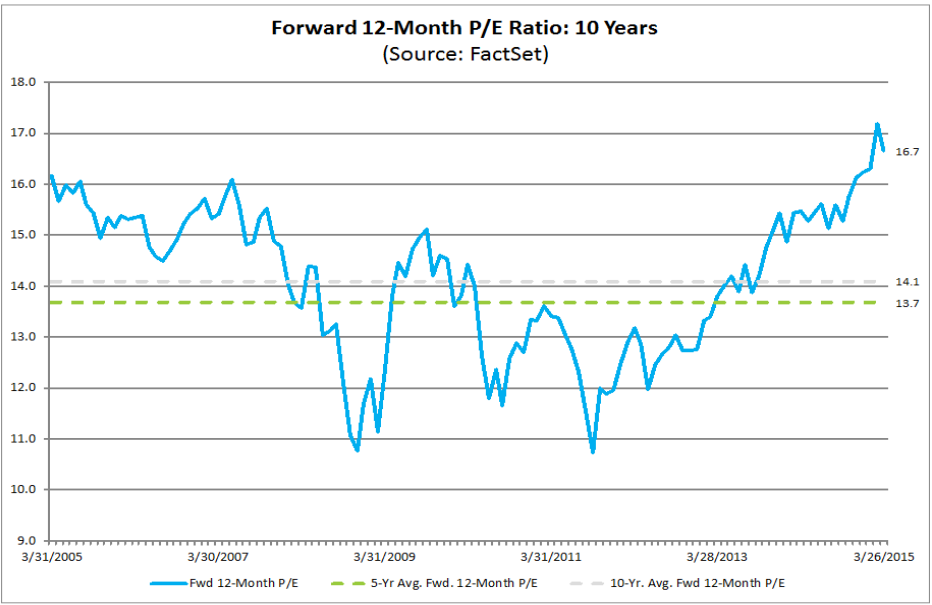

Secondly, the S&P 500 isn’t that cheap anymore. Valuation is currently at a ten year high. Below is a chart that illustrates the “forward price to earnings (PE) ratio” of the S&P 500. The blue line is the forward PE multiple.

The markets current valuation multiple is well above the 5 (green line) and 10 (gray line) year averages. It’s hard to get the market moving when stocks in general are fair to richly valued.

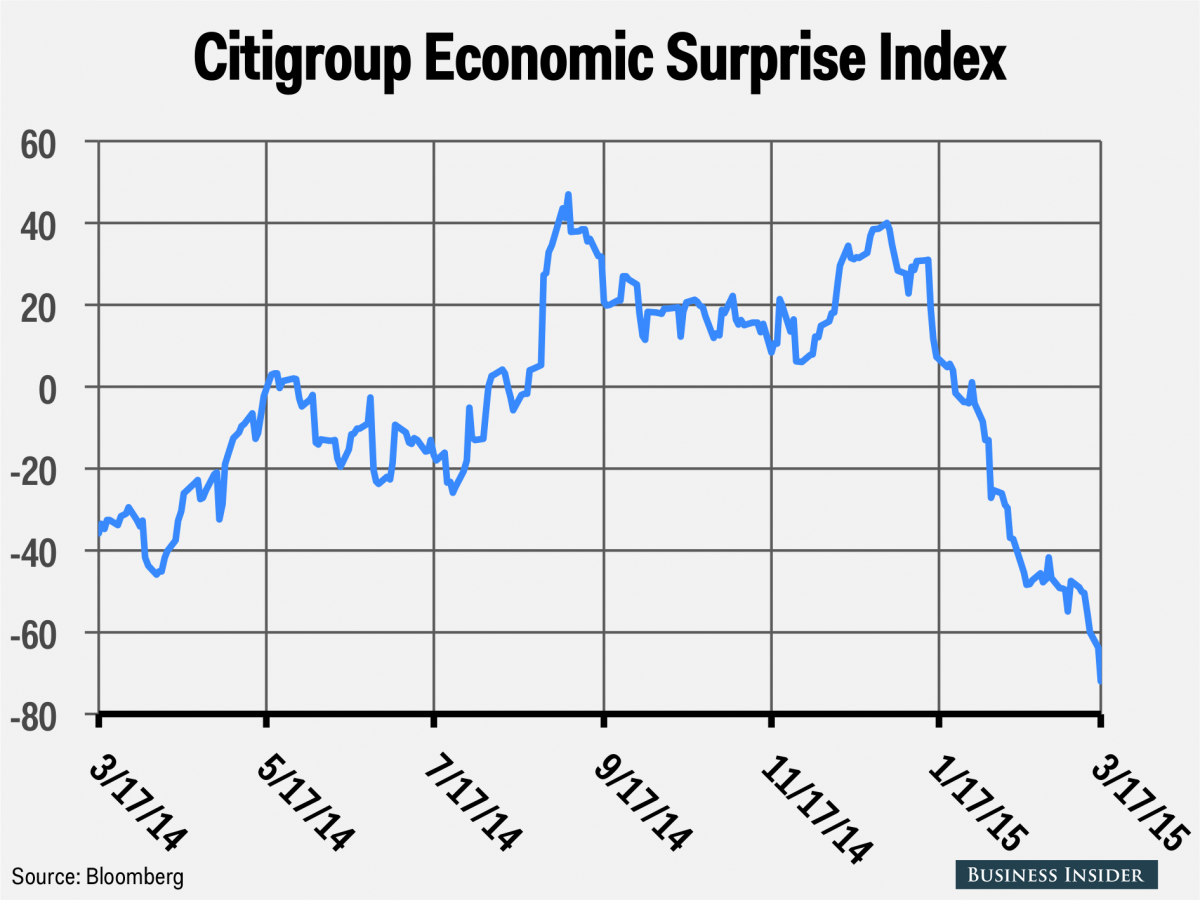

Finally, the economy is still growing, but recently not at the pace economists are predicting. The “Citigroup Economic Surprise Index” is an indicator that measures the amount actual economic data points are exceeding or disappointing economist predictions. In the chart below when the blue line is below zero “actual” economic data is disappointing the predictions of economists.

Recent economic reports like auto sales, durable goods and retail sales have been disappointing. The economy is still growing, just not as fast as many of the experts on Wall Street were expecting. Maybe it’s the recent bad weather, or maybe things are slowing a bit, we’ll see. Regardless stocks perform better when the economy is strong and exceeding expectations (which is not the case right now).

The combination of:

Decelerating corporate earnings growth

Higher market valuations and

Slowing economic data

keeps us comfortable with our current forecast for a flat 2015. Don’t panic, a flat year is OK. Over time stocks provide great long term returns, they just don’t go up every single year. In flat to down years dividends (G50 Portfolio) and yields (Absolute Yield Portfolio) go a long way to assisting performance returns.

We certainly don’t see a big correction in stocks, just not a lot of upside at this time. And we still continue to think stocks will outperform bonds over the next 3-5 years, so please don’t interpret this as a broad based negative call. For the time being let’s be prudent in our allocations, be globally tactical (GTR), keep some dry powder and prepare to allocate more offensively if we get a minor correction in the market.

As of March 30th, 2015:

Dow Jones US Moderately Conservative Index is up 2.50% (TR) for the year

S&P 500 closed at 2,086.24 up 1.85% for the year

U.S. 10 year Treasury Futures are yielding 1.96% down 0.21% for the year

WTI Crude Oil futures closed at $48.71 down $5.00 for the year

Gold closed at $1,183 per ounce flat for the year

To expand on these market reflections or discuss other portfolio strategies please don’t hesitate to reach out to us.