The June 2015 Federal Reserve Open Market Committee (FOMC) meeting was highly anticipated. This meeting was earmarked six to nine months ago as the meeting where the Fed would likely end their six-year zero interest rate policy and raise the fed funds rate. Well, the meeting is over and the Fed still has not raised rates. Now the debate will focus on if the September or December FOMC meetings will be when they finally raise rates.

What did the Fed say and what does it mean for interest rates and the bond market? The Fed said:

- Economic activity has been expanding moderately after little change in the first quarter

- The pace of job gains picked up

- The unemployment rate remained steady

- Underutilization of labor resources diminished somewhat

- Future economic activity will expand at a moderate pace

- Inflation will remain near its recent low level over the short term with a gradual rise to 2%.

This scenario of moderate growth and low inflation is positive for both stocks and bonds. The bond market has been bracing for the Fed to increase the fed funds rates by 25 basis points for at least six months, and it may take another six months for them to act. The Fed is clear that their future actions will be data dependent (specifically in relation to the employment and inflation figures). The Fed wants economic strength to support a rate hike so they can exit their zero interest rate policy (ZIRP) and normalize interest rates.

While the financial media is hyping Armageddon in the bond market, we’re not ready to throw in the towel on bonds just yet. The Fed will likely institute a symbolic 25 basis points rate hike prior to year end, but it will not change the fundamentals affecting bonds. Slow growth with low inflation is not a recipe for runaway interest rates. Moreover, the following metrics should keep interest rates low for an extended period of time:

- Weak global demand

- Weak commodity markets

- An aging demographic

- Central banks in an accommodative mode across the globe

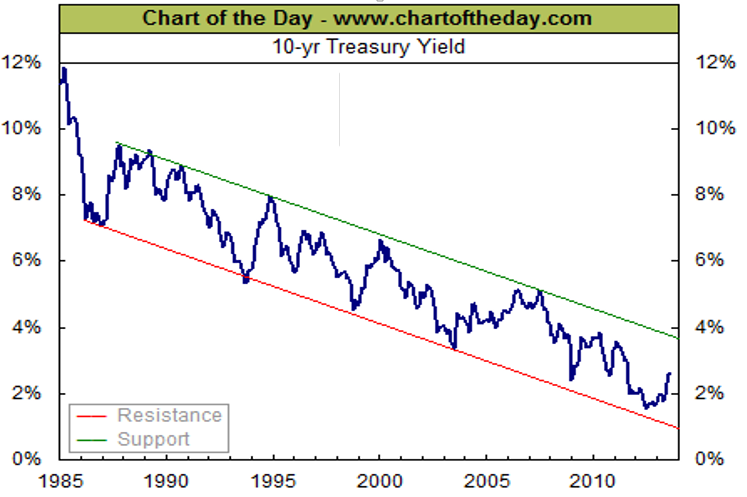

It’s been a generational bull market in bonds and ending it will take an old-fashioned recovery of at least 4-5% GDP growth coupled with full employment. The chart below tells me the bull market in bonds is still alive.

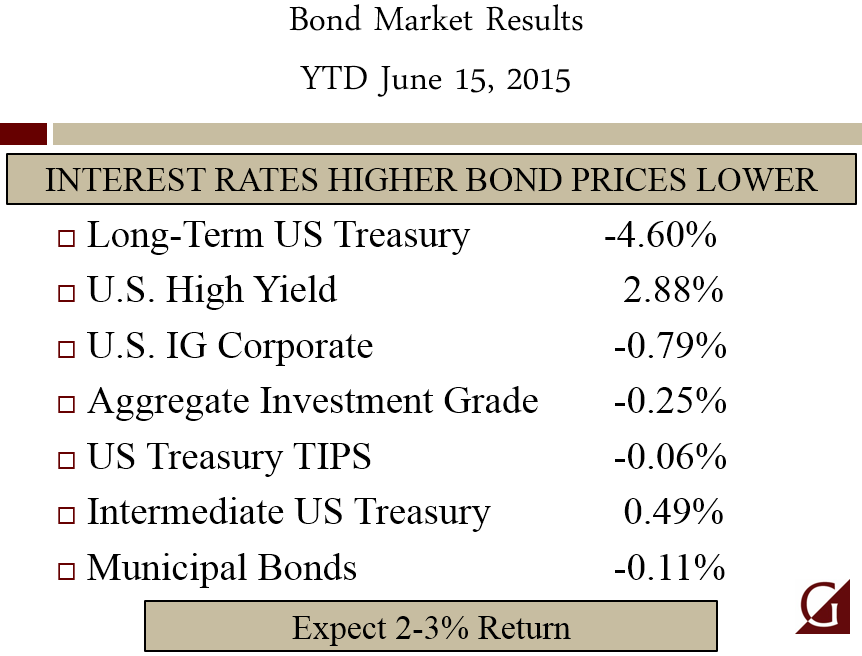

Until interest rates on the 10-year Treasury bond break above its downward trending channel, we’re not worried about major losses in the bond market. Going forward however, we do need to temper our return expectations in bonds. Bond prices rise as interest rates fall; so as rates have moved from 8% to 6% to 4% to 2% there is little room left for capital appreciation. Expectations for future bond returns need to be tied closely to the interest earned (coupons). Expect 2-3% returns from bonds moving forward, not the 5-6% from days gone by.

Through June 15 of this year, returns from the various sectors of the bond market have been relatively flat despite the recent increase in interest rates.

Bonds still have a place in one’s portfolio, but they need to have a clear purpose/objective behind them such as:

- Using a bond ladder to help provide for future cash flow needs

- Helping to diversify risk away from stocks and controlling overall portfolio risk

- Provide a small income in the current environment

- Providing necessary liquidity

The key to owning bonds is to combine the appropriate return expectations with a proper fixed income allocation that matches your investment objectives.

As of June 18th, 2015:

Dow Jones US Moderately Conservative Index is up 2.05% (TR) for the year

S&P 500 closed at 2,121 up 4.03% for the year

Russell 2000 closed at 1,284 up 7.24% for the year

U.S. 10 year Treasury Futures are yielding 2.35% up 0.18% for the year

WTI Crude Oil futures closed at $60.82 up $7 for the year

Gold closed at $1,202 per ounce up $19 for the year

To expand on these market reflections or discuss other portfolio strategies please don’t hesitate to reach out to us at 775-674-2222.