The stock market has corrected approximately 10% from its May 2015 peak and volatility has increased. This is a correction, but hasn’t entered “bear market” territory (defined by a 20% decline).

Last week the Dow fell more than 500 points Friday, dropped another 1,000 points on Monday morning before finishing down 588 points for the day. Major stock markets across Europe and Asia also closed sharply lower, with risk assets (commodities, emerging markets, and high yield bonds) hit the hardest.

What’s behind the correction?

- Evidence of a further deceleration in China’s economy

- General concerns over global growth and collapsing inflation expectations

- Chances of a Fed interest rate hike in September diminishing

- Falling oil/commodity prices, suspected to be caused by weakening demand

All of this sent investors scurrying for the safety of bonds and gold:

- The yield on the US 10 year Treasury Note fell below 2.00%

- Gold has begun to rise in price off its bottom

At the beginning of the year we forecast a flat market (+5%/- 5%) for 2015. We saw lower oil and a stronger dollar hurting corporate profit growth, along with a market that was a bit on the rich side, keeping stock prices in check for the year. As of today we don’t see any reason to deviate from this forecast.

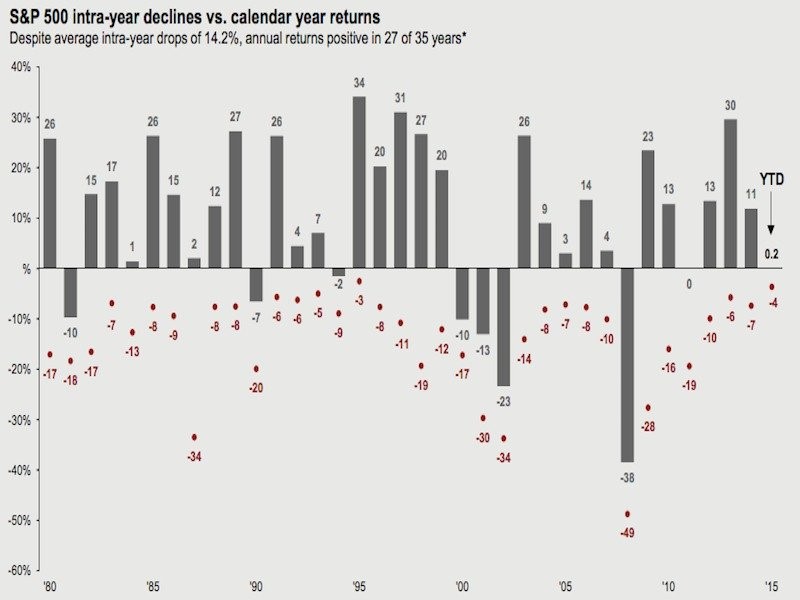

Market corrections are tough and many may tend to panic. This is a good time to remember that big sell-offs occur all the time, even in years when the markets are up. The chart below highlights the fact that stocks don’t go up in a straight line:

*chart provided by JP Morgan Asset Management

*chart provided by JP Morgan Asset Management

The green bars are the annual returns for the year, and the red dots are the intra-year corrections from a peak to a trough that occurred during the year. This is a good chart to remind us that:

“Despite average intra-year drops of 14.2%, annual returns have been positive in 27 of 35 years”

What’s happening in the markets is stressful, but also routine. And while there could be more selling, historically the odds of that happening are actually low. Below are some statistics on market drawdowns/corrections provided by Josh Brown (the reformed broker). Since 1957 there have been:

- 48 drawdowns from all-time highs of 5%

- 17 of 48 became 10%

- 9 of 48 became 20%+

Corrections normally occur every 12 to 16 months. The recent drop seems so sever because the market hasn’t fallen this much in four years. Here’s what we suggest during periods of extreme market volatility:

Remember your time horizon. Stocks are still up substantially since March 2009. You have to take the good with the bad. If you don’t need the money now, why worry about a one-week drop? Markets tend to eventually recover.

Remember why you own various asset classes. A diversified allocation of stocks, bonds and alternatives will buffer your individual portfolio returns in volatile markets.

Keep your perspective. The Dow lost 3.6% on Monday. On Black Monday in October 1987, the Dow lost 22%. Recent stock declines are big but not crashes, when viewed on a percentage basis.

Sell a little if you must. If you think we’re cascading into a bear market, take some money off the table. But don’t attempt to time the market and bail out of stocks completely. If you’re wrong, you’ll likely miss the rebound.

What now?

Volatile markets create opportunity and GI is assessing conditions that take advantage of those opportunities. In fact, we see reasons to be optimistic for those with the proper time horizons:

- The economy is in much better shape than it was in 2008

- In Europe, recent data suggests their economy is starting to grow again

- High yield bonds are cheaper and default rates remain low

- Stock are on sale. The S&P 500 price/earnings ratio is now 14.8X forward earnings, below its 25-year average of 15.7X

- In 2016 corporate earnings are forecast to grow approximately 10% versus 2% this year

We will continue to monitor the US and global investment markets to assess the fundamentals versus our expectations. Remember, “despite all the corrections and bear markets over the past 50 years, investors have seen compounded returns of 6.6 percent, far in excess of the inflation rate of 3.6 percent” says Andy Rachleff of Stanford. If emotions get the better of us during corrections, this type of long term return will be difficult to achieve.

As of August 24th, 2015:

Dow Jones US Moderately Conservative Index is down 2.33% (TR) for the year

S&P 500 closed at 1,894 down 6.81% for the year

Russell 2000 closed at 1,111 down 7.00% for the year

U.S. 10 year Treasury Futures are yielding 2.06% down 11 basis points for the year

WTI Crude Oil futures closed at $38.24 down $15.47 for the year

Gold closed at $1,152 per ounce down $31 for the year

To expand on these market reflections or discuss other portfolio strategies please don’t hesitate to reach out to us at 775-674-2222.