Ten months ago we forecast that things would be more difficult for the US stock markets in 2015. We looked at:

- The slumping price of oil

- The strong dollar

- Near zero year over year corporate earnings growth

- Above average market valuations

and surmised there would be a good chance stock markets would be flat for the year. Through October the US markets are indeed relatively flat, primarily as a result of sluggish corporate earnings growth. At this point we don’t see a lot changing through year end.

As 2015 progressed the US market was strong out of the gates (up close to 5%), started to fade into the summer, went through a volatile period (down 12% from the peak) in August, and subsequently recovered in October. The strong dollar and rock bottom oil prices are simply causing an “earnings recession” in the S&P 500 this year, and keeping stock prices in check.

The question is will an earnings recession turn into an economic recession. We don’t think so. In fact, the US economy is doing quite well, check out the data below:

- Second quarter GDP was revised to a strong 3.9%

- Consumers are increasingly confident

- Household net worth is rising

- Inflation remains low

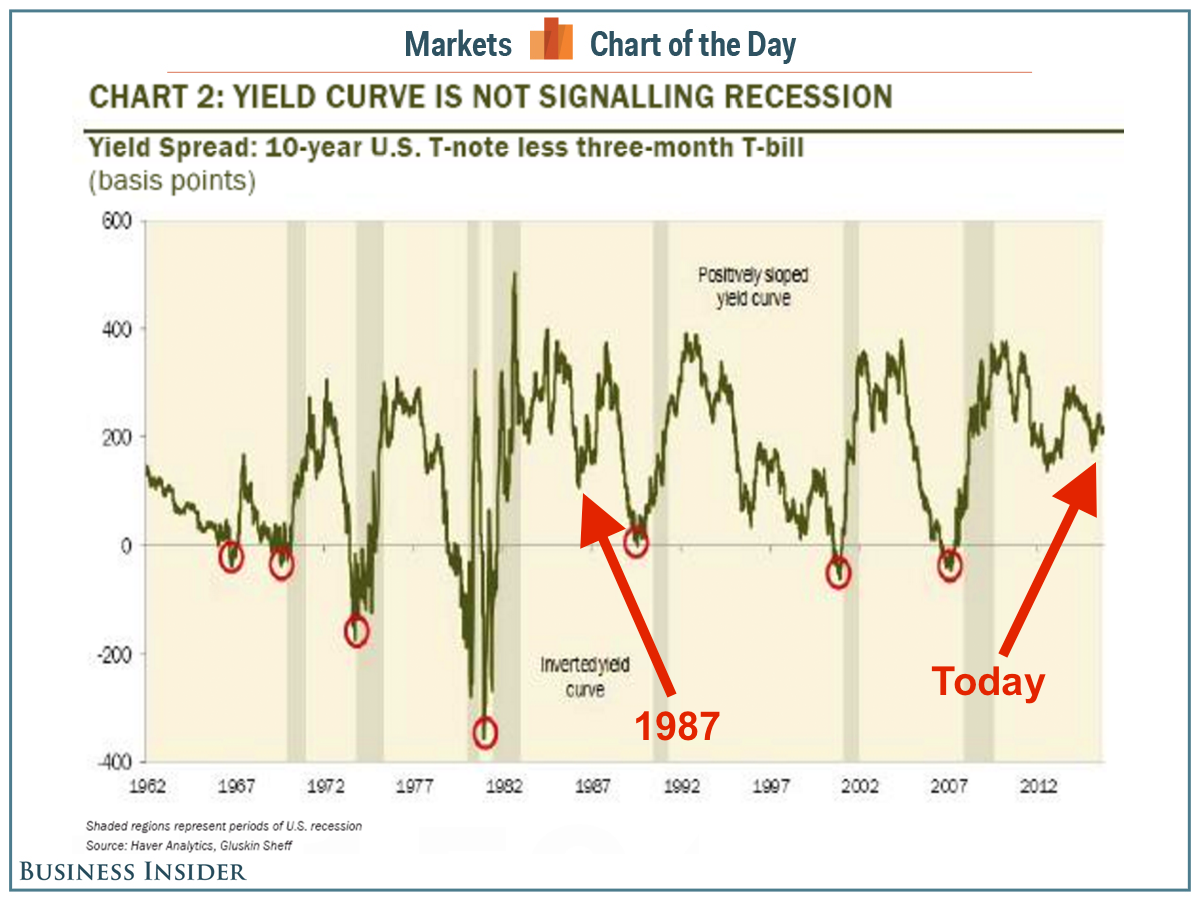

Despite good economic data there are still questions. If the earnings growth picture isn’t good, is there a chance we could go into a recession? One thing that’s signaled recent recessions is an inverted yield curve. This occurs when short-term interest rates become higher than long-term interest rates. The chart below shows how an inverted yield curve (red circles) signals an approaching recession and has occurred before every recession (shaded bars in the chart) dating back to the 1960’s:

Today the yield curve is positively sloped (10 year interest rates are at least 2% higher than short-term rates). This lends support to our belief that even though we’ll have market corrections (even like the big correction of 1987), a recession and an ensuing end to the bull market is not in the cards right now.

I think a disconnect exists between investor skepticism on the economy and actual economic data. The lack of earnings growth due to the effects of the strong dollar on corporate profits and low oil prices on energy sector profits is souring investors, but these effects are not permanent and could potentially become additive to earnings in 2016.

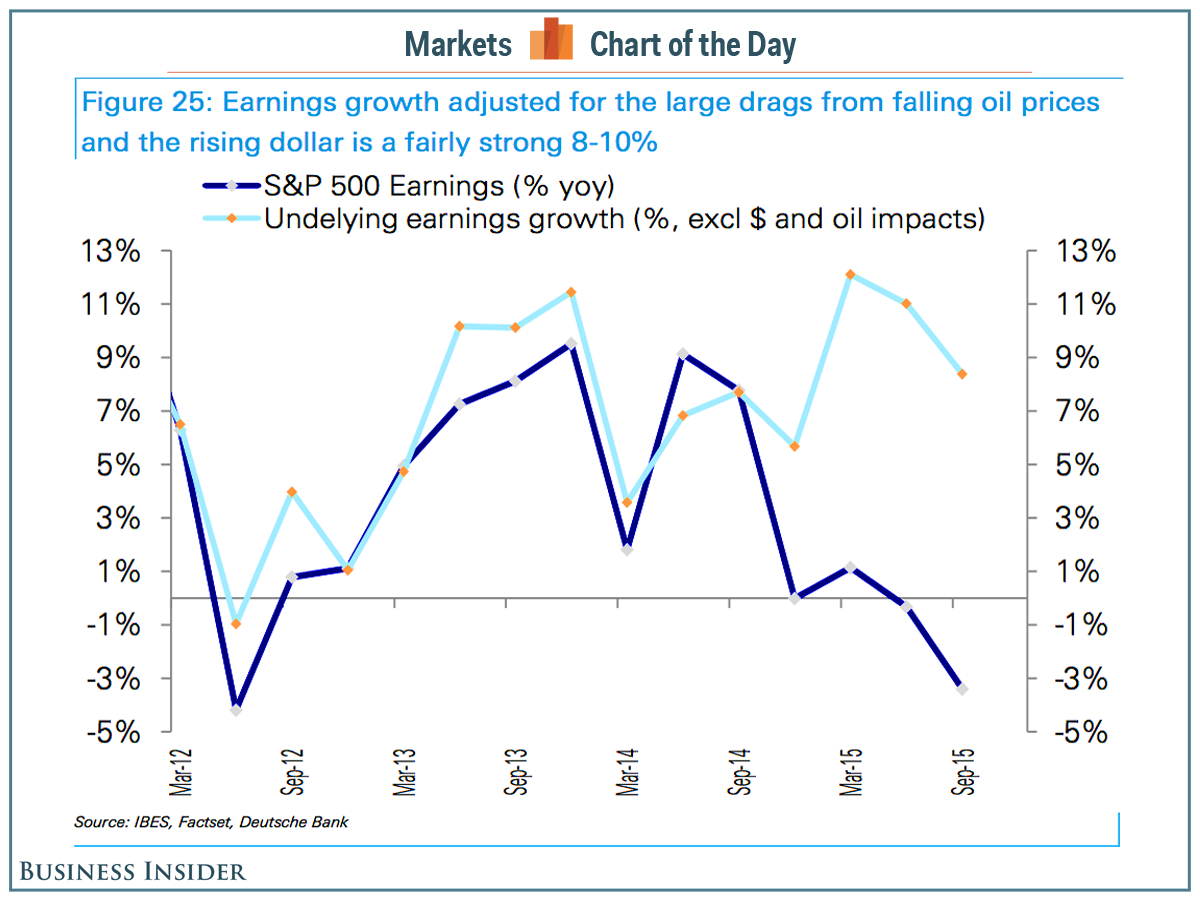

We know actual earnings in the 3rd quarter of 2015 will be down year over year, but what would earnings look like if we exclude the impact of oil and the dollar? The chart below shows actual 3rd quarter forecasted earnings of -4% (blue line) along with underlying earnings growth excluding oil and dollar impacts (light blue line):

If we strip out the temporary drag of oil and the dollar, underlying earnings growth is actually quite robust. All in all the economy continues to grow in 2015 and underlying earnings growth (ex oil and dollar effects) is good. This could potentially set the stage for a good 2016.

As of October 19th, 2015:

Dow Jones US Moderately Conservative Index is up 0.10% (TR) for the year

Dow Jones Industrial Average closed at 17,230 down 1.49% (TR) for the year

S&P 500 closed at 2,032 up 0.41% (TR) for the year

Russell 2000 closed at 1,163 down 2.35% (TR) for the year

MSCI Emerging Markets down 9.31% for the year

U.S. 10 year Treasury Futures are yielding 2.03% down 0.14% for the year

WTI Crude Oil futures closed at $45.92 down $7.79 for the year

Gold closed at $1,173 per ounce down $10 for the year

To expand on these market reflections or discuss other portfolio strategies please don’t hesitate to reach out to us at 775-674-2222.