The last Federal Reserve rate hike occurred on June 29, 2006 as the Federal Open Market Committee decided to raise their target for the federal funds rate by 25 basis points to 5.25 percent. At the time, they cited economic growth was moderating, reflecting a cooling off of the housing market. If they only knew. It has been over nine years since the last rate hike and the Fed appears poised to pull the trigger at the upcoming December 15-16th meeting. Their narrative this time will discuss the six-year zero interest rate policy and the need to begin the process of normalizing rates as employment and the economy improve. The Fed will be very clear about the deliberate nature of any future rate hikes.

If the Fed does move, and I believe they will, what impact will it have on the stock and bond market?

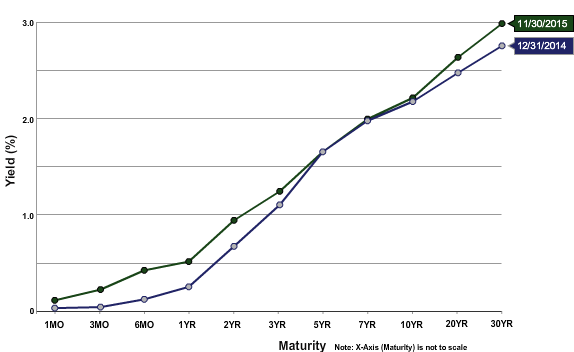

The bond market has been bracing for an inevitable 25 basis point hike for the entire calendar year. In fact, the short end of the U.S. Treasury yield curve already reflects the expectant rate hike. We started the year with the one, two and three year Treasuries yielding 0.25, 0.66, and 1.07 percent respectively. These yields at the end of November, 2015 were; 0.51, 0.94, and 1.24 percent respectively. A graph of the entire yield curve since the beginning of the year shows a minor shift higher across the curve.

When the Fed finally moves; it will be a non-event on the short end of the curve and may actually be bullish for longer term rates. The 10 and 30 year points on the yield curve will embrace low inflation, slow economic growth, and a Federal Reserve willing to take a monetary tightening stand.

The stock market is also well aware the Fed sits on the brink of a 25 basis point rate hike. We believe this is already reflective in today’s stock prices. This is both good news and bad news. On the positive side, the stock market would be encouraged with the Fed’s confidence in the economy if they raised rates at the December meeting. On the flip side, a rate rise would mark the beginning of a new tightening cycle and the stock market will quickly handicap the pace and degree of future Fed action. The Fed will use words like slow, deliberate, data dependent, and calculated to describe future monetary policy. A blow to the stock market would be a faster than anticipated rise in short-term interest rates. With our dovish Fed, this scenario seems highly unlikely.

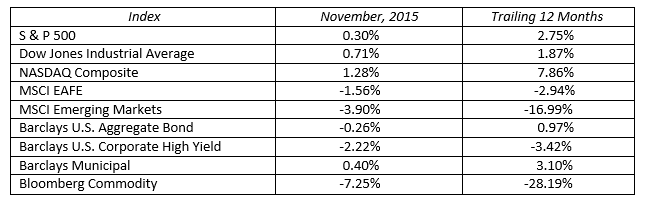

The November stock market was able to hold on to October gains despite unsettling headline risk over the past month. In November, the S&P 500 was led by financials. The laggards were the utility and telecom sectors. Based on these November results, the stock market is betting on higher short-term interest rates which would benefit financial stocks and hurt the higher dividend paying utilities. December will determine if 2015 is the seventh consecutive positive return year in stocks, or first down year since 2008.

What’s ahead? If a crystal ball could tell us the price of oil and the dollar/euro relationship a year from now, one could reach a reasonable conclusion regarding the fate of the 2016 stock and bond market. Based on what we know today, the U.S. central bank will be raising rates and foreign central banks will be easing; thus the dollar should to continue to strengthen and reach parity with the Euro in 2016. This is better for foreign companies. A stronger dollar and slow world growth will likely keep a lid on oil prices. U.S. stocks will face lighter headwinds in 2016, and once again we expect mid-single digit returns. International and emerging market stocks may catch enough of a tailwind from local currency weakness to boost their income statements and relative stock performance.

In the bond market, expect tight trading ranges in the months ahead. The yield on the ten-year Treasury may spend a lot of time in the 2.00-2.50 percent trading range. Expect bonds to be boring with low single digit returns into the foreseeable future. Note the emphasis here is on “low”.

MARKETS BY THE NUMBERS: