The votes have been counted and the Brits have opted to leave the European Union (EU). The market rally leading up to yesterday’s vote was based on the consensus opinion that Britain would vote to stay in the EU and life would continue virtually unchanged. Instead, the anticipated uncertainty of the vote itself has been replaced with new uncertainties:

· Will the breakup be amicable?

· Will other countries follow Britain and go it alone?

· Is a recession coming to Britain and other European countries?

· Will the next leg of a strong U.S. dollar reignite a headwind in our equity market?

· Is the Federal Reserve now on the sidelines for the remainder of 2016?

We sit today with more questions than answers. Past history tells us markets do not like surprises or uncertainties. Since we now have both, expect more volatility in the coming days.

It is important to put today’s headlines into perspective of the overall market and our portfolios. The S&P 500 has been moving higher since mid-February 2016 and was approaching its all-time highs. Yesterday alone the S&P 500 was up 1.30% on expectations Britain would stay in the EU. The S&P 500 opened today down 2% on the news of the vote, a net 0.70% decline. While further short-term downside is likely it is important to consider how your portfolios are reacting to the current headlines. Within the Gradient portfolios, we own diversified portfolios built to smooth out the ride in volatile times. We are NOT over-allocated to international markets in any of our portfolios.

The Tactical Rotation Portfolio (GTR) is and has been invested in the S&P Low Volatility (SPLV) exchange trade fund (ETF). On a relative basis this holding will likely outperform the broader market in a volatile time. The Endowment Portfolios also hold SPLV and a currency hedged ETF (DBEF) which will benefit from the stronger dollar. Within the Endowment series, gold is held in the alternative asset category, a clear winner today. The fixed income portfolios are benefiting from the flight to quality and lower interest rates around the globe. No one likes losing value, but cushioning the blow helps emotionally.

Remember this is not the end of the world but rather a journey to a slightly different world. If you are truly a diversified long-term investor with a solid financial plan, you are accustomed to the noise and will allow your portfolio to work for you over time. If you are inclined to react to headlines, try to temper your reaction by making minor adjustments versus wholesale changes to your portfolio. This is not the first and won’t be the last world event…..recall past events like Greece, the U.S. Fiscal Cliff, the downgrade of U.S. debt, etc.

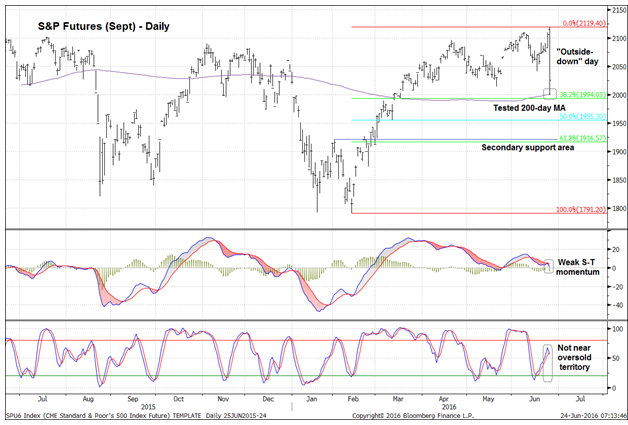

For those looking for technical insight, there is a first level of support for the S&P 500 in the 2,002 to 2,020 range and then again at the 1,929 to 1,947 range. The chart below highlights those levels. We will watch the markets and these levels carefully in the coming days and weeks.

As active portfolio managers we will be looking for opportunities in the coming days and weeks to take advantage of any unwarranted price corrections.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222