At Nevada Retirement Planners we monitor the fundamentals of the market continually. To review, we believe that long-term stock prices are driven by 3 broad fundamental metrics, they are:

- The health of the economy

- The profitability of the companies operating within the economy

- Market and individual stock price valuations

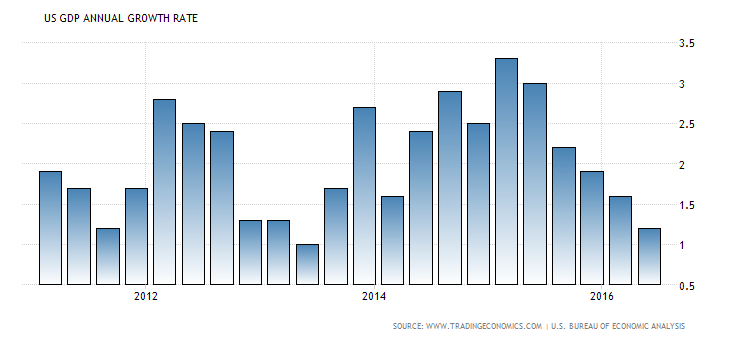

Today let’s do a quick review of the economy. One of the broadest measures of the economy is Gross Domestic Product (GDP). GDP has been growing at a moderate (and fairly stable) pace the last five years. The chart below illustrates how the US economy has been growing between 1% and 3% on an annual basis.

Recently the GDP growth rate has slowed down closer to the 1% range. This is concerning if the growth rate doesn’t accelerate. A reading over 2% is much more indicative of a healthier economy. Let’s break down our economy into two broad sectors.

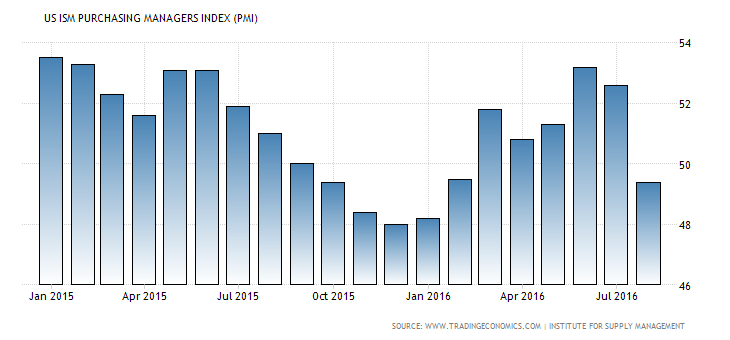

First, the manufacturing sector of the economy has been dwindling over time, but is still important and comprises roughly 12% of the US economy. Every month the “Institute for Supply Management”, or ISM, reports a PMI index which highlights economic activity in the manufacturing sector. A reading above 50% indicates that the manufacturing economy is generally expanding, below 50% indicates that it is generally contracting. In August the PMI came in at 49.4% down from 52.6% in July. The chart below highlights that the manufacturing PMI has not been below 50% (the border between expansion and contraction) since February of 2016.

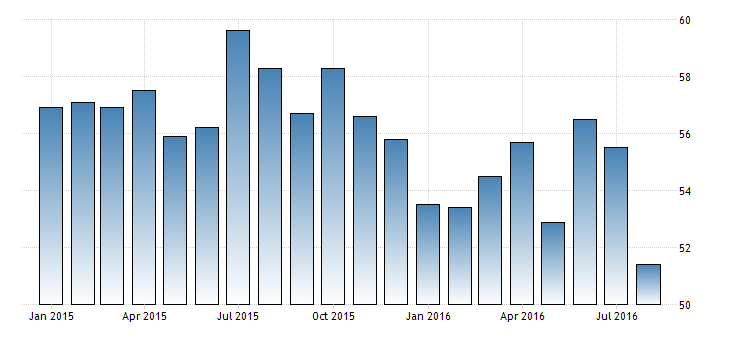

Secondly, we need to look at ISM’s PMI index for the all-important services sector of our economy. The US service sector slowed to a six-year low in August, according to ISM. The PMI index on the service sector came in at 51.4% for August, down from 55.5% in July. That’s still growth, but it’s the lowest reading since February 2010, when the index pulled out of contractionary territory for good following the 2008 financial crisis. See the chart below highlighting service sector PMI readings.

The August slowdowns in both the manufacturing and services sector of the economy point to a potential anemic GDP growth rate again in the 3rd quarter of 2016. In fact, Chris Williamson (Chief economist of Markit) says “taken together, the manufacturing and services PMIs are pointing to an annualized GDP growth rate of a mere 1%, suggesting that those looking for a strengthening in the rate of economic growth will be disappointed once again”.

Monthly data can be volatile, especially during the summer. But we’ll certainly be keeping an eye on upcoming economic reports to determine if the August slowdown was an outlier or a trend.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222