The long awaited market correction became a February reality as stock prices fell 10% from their January highs, quickly unnerving investors. This move lower was expected and long overdue. Actually it was the first down February since the infamous February, 2009. The correction came swiftly as volatility spiked and values evaporated in the blink of an eye. Maybe mom was right and it is less painful just to rip the band aid off versus peeling it back slowly. Regardless, a 10% correction still stings.

The silver lining in this dark cloud was the immediate 5% bounce back in stock prices. Investors barely had the opportunity to assess the damage of the original 10% sell off. By the end of the month, some of the initial correction had been reversed but the markets were still under water. What lessons can we take away as we begin our journey through 2018?

Corrections are normal. In an average calendar year, one would expect the stock market to have three price corrections in the 5-10% range. The fact the market went for two years without a meaningful correction is the exception, not the rule.

Don’t let sudden price changes take you off your game. Volatility is likely to remain elevated in the months ahead. While we are sticking with our mid-single digit return expectations from stocks this year, it may come with more intra period price movements than last year. Economic growth is strong, corporate profits are rising and the new tax bill should provide a tailwind. Still, the market will need to come to grips with higher interest rates, risk of higher inflation and corporate earnings variability as we learn the impact of the new tax law.

Allow yourself to think like a contrarian. Last month, we discussed the concept of rebalancing portfolios during periods of extreme market strength or weakness. It’s okay to buy low and sell high. If markets revisit recent highs consider a portfolio rebalance to reduce risk. If markets retest recent lows or make new ones, think buying opportunity.

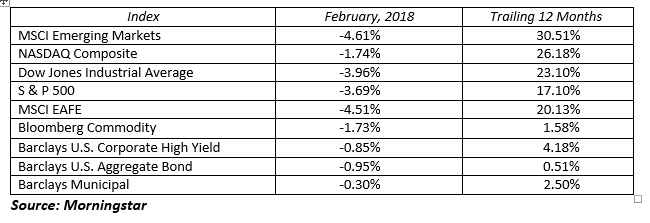

Obviously February was a rocky month. The benchmark S&P 500 was down 3.7% for the month to close at 2,713.83. This still leaves the benchmark positive for the year with a 1.8% year-to-date return. With earning’s season in full swing, the fact that many companies reported revenues and earnings which beat consensus estimates is helping to stabilize the market. A record high number of S&P companies issued positive EPS guidance for this year, raising the 2018 consensus estimate by 7% just since the start of the year. These results are driven in part by the decrease in the corporate tax rate for the year based on the U.S. tax reform legislation. An improving global economy and a weaker U.S. dollar are other factors supporting stronger profits from U.S. corporations.

International and emerging market stocks were not immune to the global market volatility. These two broad sectors also posted negative returns for the month, down 4.5% and 4.6% respectively, but hanging on to year-to date gains of 0.3% and 3.3%.

Bond prices declined as interest rates rose, with the benchmark 10-Year U.S. Treasuries now yielding 2.87%, up 47 basis points in just two short months. The yield curve steepened slightly during the interest rate rise in February. The 2-Year Treasury rose by 11 basis points to finish February at 2.25% while at the long end, the 30-Year Treasury rose 18 basis points to end the month at 3.13%. With the economy gaining momentum, there is a very high probability the Federal Reserve will raise the Fed Funds rate by 25 basis point at their March meeting.

The financial road will be bumpy at times. The market is digesting transitory data related to new signs of wage inflation, higher interest rates, the unwinding of central bank monetary accommodations and a Federal Reserve under new leadership with Chairman Powell. On the other hand, fundamentals are still very positive. Consumer confidence is soaring, home prices are steady, unemployment is low, lower taxes are just beginning and corporate profits should experience double digit growth again this year. While the headlines are designed to scare you into reading, watching, or trading take comfort in the fact the economy is strong and long-term investors with a plan will be rewarded for accepting and properly managing risk.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222