With spring finally upon us and the promise of summer in sight, sailboat masts are popping up on area lakes. As we enjoy the sights, we recognize there are many investment lessons to be learned from experienced sailors. Below we share eight of the most valuable lessons when comparing sailing to investing.

1. Look for a veteran crew with complimentary skills. Experienced investment managers can help produce consistent performance. Look for managers who’ve navigated through a variety of conditions over numerous market cycles.

2. Sailors set a course and keep an eye on the finish line. Develop a long term investment plan that prioritizes the following key investment objectives:

· Capital Preservation

· Income Generation

· Growth of Principal

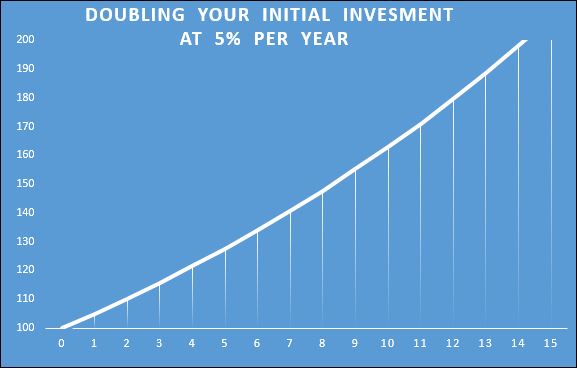

3. Sailors stay focused and so should investors. Don’t get distracted by the latest investment fad. If your investment objective is income generation, then the latest tech IPO is probably not for you. Keep in mind that a 5% annual return will double your money within 15 years.

4. If you’re not familiar with your boat (or investment portfolio), you shouldn’t get into it. Understand your investment strategy, long term objectives and risk metrics.

5. A sailor takes advantage of strong winds. Investors should be aware of positive developments and trends in the financial markets.

6. As weather changes sailors make adjustments. Investors also need to be flexible. Use active managers who can be strategic at the margin and take advantage of opportunities the markets provide.

7. Sailors carry a small toolbox on their boat. Be wary of overly complicated investment concepts that often are short lived. You should focus on a prudent number of sound portfolio strategies which feel right for you.

8. Successful sailors often recognize when to head in a different direction from the rest of the fleet. Investing success is often achieved by choosing a direction that is different from the path the herd is following.

We believe investors can benefit from an experienced investment team. Choose an investment partner that collaborates with you in setting an appropriate course based on your individual investment objectives. Active managers continually monitor the investment markets and make adjustments when the winds shift.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222