Investing requires patience. Investors usually desire instant gratification on their portfolio decisions, but the market moves on its own timetable. The markets are currently supplying the bulls and bears with ammunition for their cause, and investor patience is being tested every day. The bears are waiting for an elusive ten percent price correction, while the bulls are waiting for stronger global economic growth and meaningful top line corporate revenue growth.

The waiting game is playing out in multiple markets. In the U.S. stock market, we wait for quarterly corporate earnings to justify current stock market valuations. So far, overall second quarter corporate earnings have been positive, but the market has clearly delineated the winners from the losers based on company specific results. The breath of the U.S. is very thin with a handful of stocks supporting the overall market. In the international stock markets, we wait and watch the news from Greece, Europe and China to see how these issues will resolve themselves. In the commodities markets, the story is a strong dollar and declining commodity prices. We wait to see if gold and oil will bottom here or continue their downtrend. We question how strong the dollar will become in this strengthening cycle.

In the U.S. fixed income markets, the Federal Reserve is stringing the markets along regarding the timing of a 25 basis point fed funds rate hike. This year and a half debate continues and investors now speculate whether the inevitable happens in September, December or early 2016. December seems most likely to me, but this well-telegraphed move will be a nonevent. Remember the market is fretting about a move from zero to 0.25 percent after spending six years at zero. More interesting will be what the Fed reveals in the first meeting following the eventual rate hike.

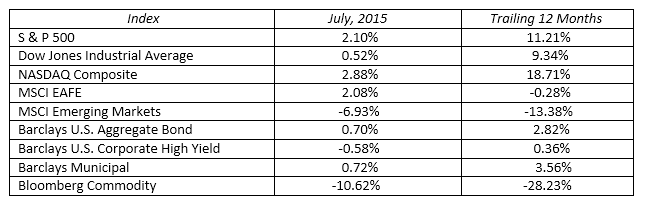

In the first month of the third quarter, results in the stock markets were generally positive with the exception of the emerging markets which fell 6.93 percent. A slowdown in China and concerns about Greece’s financial survival and continued inclusion in the European Union sent shock waves through the emerging markets. The U.S and international developed stock markets were able to reverse the small losses incurred in June. Commodities continued to get pounded as oil prices slipped back into the forty dollar range and gold hit new recent lows. The broad Bloomberg commodity index fell 10.63 percent in July alone.

The U.S. bond market enjoyed a positive month as interest rates declined for bonds that have five years or more to maturity, causing the yield curve to flatten. This is a reversal as compared to recent months where longer term rates rose and the yield curve steepened. The short end of the yield curve increased one to six basis points, and longer maturity rates moved marginally lower. The 10-year U.S. Treasury declined 15 basis points to yield 2.20 percent, and the 30-year was down 19 basis point to yield 2.92 percent.

Flat markets test patience. The sideways action in the financial markets over the past few months can wear on investor confidence. Successful long-term investors have clear goals and objectives, remain focused on their long-term goals and exercise patience during the journey. Realistic return expectations plus appropriate time horizons and patience equals success. The remainder of 2015 will continue to test investor patience. In 2016, the year-over-year comparisons will become more market friendly as the strong dollar and oil price decline will have been over a year in the making.

MARKET BY THE NUMBERS: