A federal tax reform bill was passed in the House of Representatives and a separate version was approved by the Senate. Now the two are undergoing a joint committee review and compromise with the hope of putting a final version to a full Congressional agreement by Christmas. The compromise is likely to get swift approval by the president.

This may seem to be a rushed process, but in fact tax reform has been debated in both chambers for several years. If the changes are indeed enacted, it will be the first major tax reform in 30 years.

For corporations:

A significant reduction in the corporate income tax rate has been proposed, from 35% to 20% by the House and Senate. Such a reduction has the potential to boost earnings for many companies in the S&P 500 by 6% on average according to Citibank* with some benefiting much more.

Further, both the House and the Senate plan to reduce the tax on cash repatriated from overseas which should benefit many of the companies in our G50 and G33 portfolios. Repatriated cash is expected to be used to invest for growth, buy back shares and increase dividends.

For non-service pass-through income companies (partnerships, S corporations and sole proprietorships) the tax reform bill is likely to contain a provision for a reduction in the tax rate.

The prospects for permitting companies to write off capital expenditures 100% in each of the next five years before gradually declining holds promise for a dramatic rise in machinery sales in the coming years along with higher after-tax profits for the machinery buyers.

For individuals:

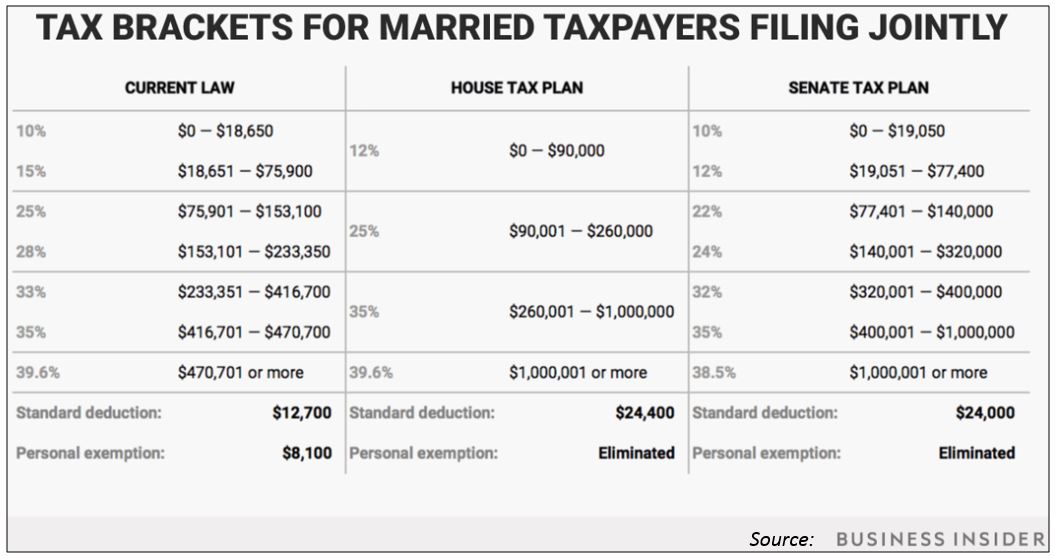

Individual tax brackets are going to change. The top individual tax rate is reduced in the proposals, with the threshold for top rates nearly doubles for married filing jointly. See the current tax brackets with the proposed House and Senate tax brackets in the chart below.

In the Senate bill the standard deduction will be doubled while the majority of itemized deductions will be eliminated. This alone will dramatically simplify tax filings. Child tax credits are also doubled as are the estate tax exemptions, to $22 million for married taxpayers.

Both the House and Senate bills would limit property tax deductions on a primary home to $10,000 and would eliminate state and local tax deductions on federal tax returns. A variety of other itemized deductions and exemptions are on the table for elimination.

The majority of middle-income taxpayers will experience an immediate tax cut, according to the Urban-Brookings Tax Policy Center, an independent analytical group. However, they estimate that 15% to 20% of those earning between $86,000 and $300,000 will experience an immediate tax increase.

The final bill on its own is expected to add to the deficit over the next ten years when the bill will expire (a mandated limit). However, that is expected to be offset by accelerated economic growth and thus added tax income anticipated under the plan.

In summary, the proposed tax bill should benefit the profitability of many of the US companies in which we invest as lower corporate taxes benefit earnings growth. Also, lower individual rates should benefit our consumer-driven economy.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.