It’s been a fairly wild ride the last several years in the global energy markets. Oil prices crashed from over $100 per barrel to below $30 per barrel back in February of 2016, and have since stabilized in the $50 per barrel area today. See the chart below of WTI crude oil prices since the beginning of 2016:

What’s happened the last couple of years? Below is a quick summary of oil markets the last two years.

- U.S. shale oil production increased dramatically over the last five years.

- This, on top of increasing production in other global regions, led to an oversupply position in the global oil markets.

- As the world produced more oil than it consumed on a daily basis, prices collapsed.

- In reaction to precipitously falling prices, oil producers in the U.S. and globally curtailed production.

- OPEC (led by Saudi Arabia) and non-OPEC (led by Russia) countries instituted oil production cuts.

- Between curtailed U.S. production and the OPEC production cut the global supply/demand equation improved.

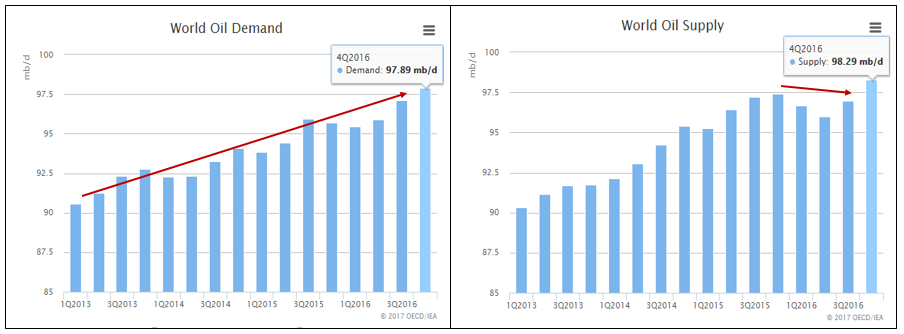

Looking at the charts below of global daily crude oil production and demand, we can see that things are fairly balanced right now after supply on the right-hand chart declined for several quarters:

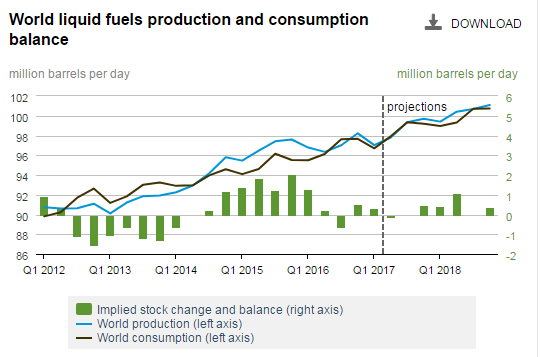

In fact, the U.S. Energy Information Administration (eia) forecasts that future oil market supply/demand conditions will remain balanced into 2018. See the chart below highlighting past and forecasted world production (blue line) and demand (brown line) by the (eia) below:

This balance should lead to more stable-to-rising oil prices going forward. Things to monitor going forward include:

- the increasing level of U.S. production now that prices are stable (the U.S. is now a major swing producer in the global oil markets due to shale oil production)

- the ability of OPEC and Russia to extend and honor their production cuts at the May 25th OPEC meeting

- global economic growth and its effect on oil demand

Stable oil prices are generally a positive thing for the investment markets. We are forecasting WTI crude oil prices to finish close to $60 per barrel as we exit 2017. Oil prices at these levels will benefit:

- the US economy in the form of energy sector jobs and capital investment

- emerging market economies (many tend to be commodity based)

- energy company earnings (about 15% of the stock market) which benefits the overall market

- the high yield bond market and other energy related income producing securities

Overall, oil prices that are too low slow down our economy, just as prices that are too high can choke off economic growth. Prices in the $50 to $75 per barrel trading range will benefit the investment markets in our opinion. Prices in this range should benefit Gradient’s Energy Sector Focus portfolio as well as our more broad emerging market and energy sector holdings in the Gradient Tactical Rotation, Absolute Yield and Endowment portfolios.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222