The economic and stock market recovery which began in 2009 has been doubted by many investors. The naysayers believe this recovery was artificially induced by the Federal Reserve’s aggressive management of short-term interest rates and their multiple quantitative easing programs. The bears have patiently waited six years for the other shoe to drop, only to learn the bullish beat goes on. This slow and steady march to higher highs has been driven by improved corporate earnings, confident employed consumers, low interest rates and a steady economic backdrop.

In the U.S. bond market, the war cry has been to fear the coming of higher interest rates and the ultimate end to a 34-year bull market in bonds. Not so fast. Interest rates are low by historical standards and may very well stay at these low levels for an extended period of time. The Federal Reserve would love to return to a normal monetary policy but the Fed needs economic data to support future rate increases. The data is creeping in the Fed’s direction, but is not yet strong enough to invoke a rate hike. Inflation is running below the Fed’s two percent target, the unemployment rate has improved but still many potential workers have given up the search for a job or retired, wage growth is subdued, economic activity as measured by gross domestic product is below historic recovery rates, the dollar is strong, and slower growth around the globe limits the potential aggressiveness of the Fed.

A June rate increase it unlikely while September holds a better chance for a 25 basis point hike in the Fed Funds Rate. As ex-Fed Chairman Ben Bernanke stated in a recent speech, when the Fed finally does raise short-term interest rates it will be anticlimactic. The eventual rate hike will likely be a symbolic move whereby the Fed can state they ended their zero rate interest policy and have returned to a normal monetary stance. Unless the global economic data really heats up, the Fed’s first rate hike may be a one and done.

The U.S. stock market, as measured by the S&P 500, has enjoyed six consecutive years of positive returns, tying a record. This calendar year may break the record, but remember the markets have never had a six year tailwind of zero percent short-term interest rates. First quarter corporate earnings edged higher but slowing profit growth raises some legitimate concern about current valuations. It looks like first quarter earnings will rise by 0.3% from a year ago. A strong dollar and a tough winter have been to blame for the meager quarterly earnings growth. Stock valuations are stretched as the forward 12-month price-to-earnings (PE) ratio for the S&P 500 companies is 17 times. This is above both the five and ten year historical PE averages. Simply stated, the stock market needs lower prices or better earnings to justify these valuations. Let’s hope for the latter.

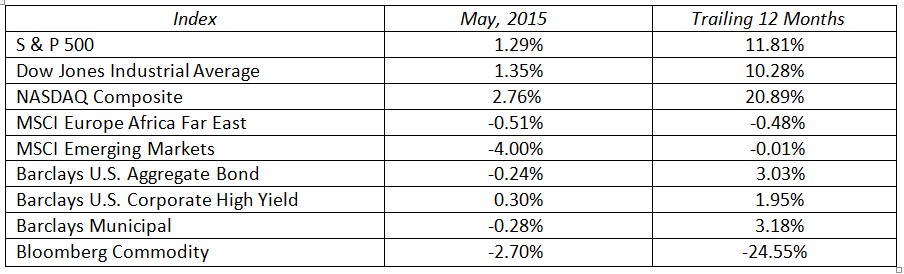

The month of May was another one in string of record highs for the domestic equity markets. After an encouraging start to the year, international stocks underperformed in May. International stocks may be setting up for future outperformance, as foreign central banks are implementing U.S. style easing programs around the globe. Commodities continue to lose value in a world where demand, inflation and fear are all low.

Global interest rates moved 25-50 basis points higher in May as the collective thinking concluded Europe’s economic woes are not as deep as projected. The yields on U.S. bonds, albeit low, are still attractive when viewed in a global context. The 10-year U.S. Treasury yield is back above two percent, but a normal intra year five to ten percent stock market correction would send rates back to a one percent handle in a heartbeat.

At the end of the day, investors need to be invested. With cash yields frozen at zero, your choices are to either sit on the sidelines with inflation quietly eroding your purchasing power or to invest with a long-term purpose. Being a long-term investor with realistic expectations is the right answer. Bond yields are low and likely to stay there so expect annual returns in the two to three percent area. Stocks offer long-term growth opportunities, but given current valuations expect mid to low single digit returns as we move to the end of this year. Keep your portfolio invested within your comfort zone and stay two steps ahead of inflation.

MARKET BY NUMBERS: