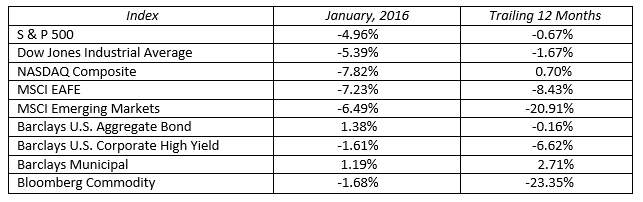

Last year left many investors frustrated. This year, frustration may turn to desperation. Fortunately, one month does not make a year. Just two years ago the stock markets began the year with similar price action. In January 2014 the S & P 500, the Dow Jones Industrial Average and the MSCI Emerging markets were down 3.6, 5.2 and 6.5 percent respectively. These indices finished that year at +13.7, +10.0 and -2.2 percent. This year started on a similar sour note as the same three indices declined 5.0, 5.4 and 6.5 percent in January. Where we finish 2016 is anyone’s guess at this early stage.

The January global market correction was rooted in news from China and the oil industry. The Chinese economy may be slowing at a faster rate than advertised and their U.S. linked currency is being aggressively devalued. This, plus oil prices reaching 13-year lows, stressed stocks, high yield bonds and commodity prices around the globe. January provided a gut check for even the most seasoned investors. There were few places to hide as even the darlings of 2015 were taken down.

One of my favorite Seinfeld episodes is where George comes to the realization that everything he does is wrong, so he commits to doing the exact opposite of his initial thought. George follows his own advice and everything turns to gold for him. Such is the struggle of the average investor. When the markets melt down, like it did in January, the initial reaction is to sell everything and go to cash. Unfortunately the opposite is usually the better answer. Buy low and sell high seems so simple until we allow emotions to decide our next action. When you feel close to veering off course, think opposite.

Thankfully, not everything was down. When stocks suffer investors usually flock to safety. This month was no exception as long U.S. Treasuries and gold were sought for their safe haven qualities. Yields on the 10 and 30-year U.S. Treasuries declined 33 and 26 basis points during the month sending their prices substantially higher. Even gold found a bid as prices rose by 4.8 percent for the month.

The bond market this year may act a lot like the bond market last year. Once again, everyone is expecting higher rates and multiple Fed tightening moves. The Fed believes they will hike the fed funds rate four times at one-quarter point each time. More likely will be the Fed monitoring data in the first half of the year and making one, possibly two twenty five basis point hikes in the second half. The yield on the ten-year Treasury may stay in the 2.0-2.5 percent range until real global economic growth emerges. Bonds are likely to be a boring asset class with low single digit returns. After this past month, a little boring might be just the right prescription for your portfolio.

Don’t expect miracles in 2016. Also do not expect eleven more months like January. The market will take a pause from the China and oil news to focus on fourth quarter corporate earnings. This may well be the catalyst for a much needed price reversal. U.S. stocks will face lighter headwinds in 2016. Stocks will benefit from continued low global interest rates, an eventual bottoming of oil prices, moderation of dollar strength, resilient consumers, and favorable earnings comparisons in the quarters ahead. Remember the goal is to buy low and sell high and resist the emotional pressure to sell low when times are tough. Investing is a marathon, not a sprint. Stay patient and invest for the long haul.