October is usually a challenging month for investors. Once every four years a presidential election cycle adds to the October angst. This year’s emotionally charged political season is no exception as we sit on the eve of a unique election in which both Congress and the presidency could change party affiliation.

Collectively, the markets tend to absorb big news in stride, whereas the individual investor inevitably rides the emotional roller coaster. Think back to the Fiscal Cliff, U.S. debt downgrade, the oil collapse and Brexit as examples of resilient markets filled with fearful investors. After this election, the economy and the financial markets will still be evaluating the same factors driving asset prices today.

The U.S. economy is like a three legged stool. It is supported by the consumer, corporate America and the government. Two of the three legs are on solid footing, but government is the weak leg. After the financial crisis of 2008, the consumer pulled back, deleveraged and eventually righted their ship. Remember the consumer is two-thirds of the economy, so a healthy consumer is critical to a growing economy. Corporate America has been on a massive mission to cut costs and maximize their profitability. The stock market has taken notice. The government’s inability to prudently manage its financial affairs continues to be a drag on economic growth.

As we see it, the consumer holds the key to the economic growth engine. Unfortunately, top speed is likely the one or two percent core growth recently experienced. Government is unlikely to change its ways and corporate America is already lean and looking for top line revenue growth. This leaves the consumer in charge and thankfully strong. September retail sales from the Commerce Department rose 3.4% year over year with core sales (ex-autos) up 2.7%. Restaurant sales were particularly strong, up 6% year over year. Meanwhile retail sales via the internet rose by 11%.

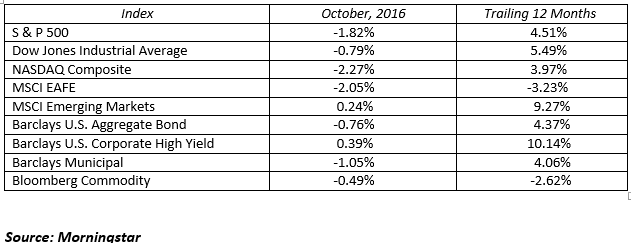

Despite strong consumer news released in October, the U.S. stock market pulled backed for the third consecutive month from their recent record-setting highs. This is not surprising as election concerns took center stage. This too will pass. The S&P 500 had its worst month since January, down 1.82%. Emerging markets eked out a positive 0.24% gain while developed international stocks fell a bit more than the S&P 500, down 2.05% in October.

Corporate earnings season is in full swing, and the results are beginning to show a much awaited turnaround. With year-end fast approaching it’s not too early to think about equities in the upcoming year. We see November and December as a time for the market to digest the election results with sideways price action. Next year, we are hanging our hat on strong consumers and growing corporate profits as the key drivers to a solid year for stocks.

Bond prices fell and yields rose as the benchmark 10-year Treasury rate ended the month at 1.86%, up nearly 23 basis points. We believe the interest rate rise since the end of September reflects the market’s expectations of a small Federal Reserve rate hike in mid-December. While we believe a 25 basis point hike in December is a done deal, don’t be fooled. We expect that the Fed’s future actions will be few and far between. Looking ahead, we expect interest rates to remain low but range bound in a slightly higher range. In 2016 the 10-year U.S. Treasury Note has traded in the 1.50-2.00% range; next year we expect a 2.00-2.50% range as the norm.

The financial journey has many obstacles. On the eve of the election, the markets are handicapping possible outcomes, geopolitical tensions, technical factors, the Federal Reserve and most importantly the constant stream of third quarter corporate earnings announcements. Most of this is market noise. Do not let this noise turn into personal emotion. Stand behind your plan and stay focused on your long-term objectives.

MARKET BY NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222