The current bull market in US stocks has been in place since early 2009, which puts us at roughly eight years. That’s not the longest bull market in history, but it’s close. The fundamentals have supported this long bull market, they are:

- A stable and growing economy

- Corporate earnings growth

- A low interest rate environment (which makes stock returns more attractive)

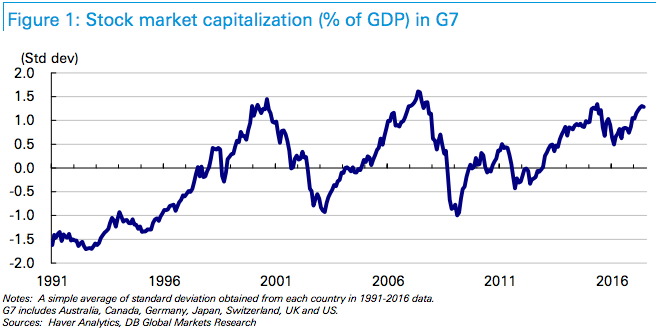

It’s been an ideal environment for stock markets to achieve new highs, but the recent updraft in the first half of 2017 has some folks talking about corrections and crashes again. Most of their basis for a correction is based upon some sort of valuation metric or contrarian indicator. The chart below is a great example of this; it shows the biggest stock markets in the world (G7 countries) combined market capitalization as a percentage of their collective GDP’s:

We can see that it’s approaching the highs of 2001 and 2007 peaks. It’s not up to the 1.5X level but it’s getting closer.

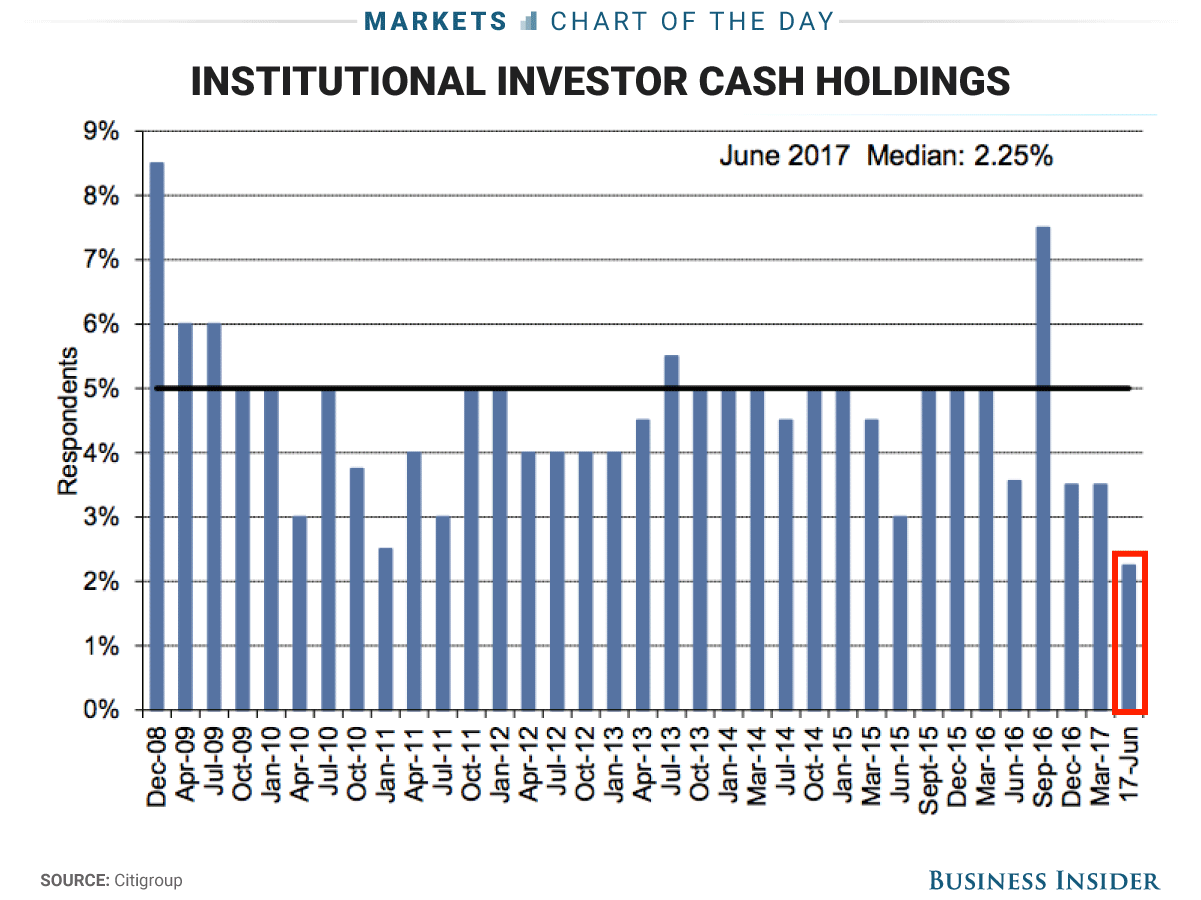

Another chart that’s surfaced recently illustrates the amount of cash institutional investors are holding right now. Yes, it’s currently at eight-year lows. Bears might argue that there’s no more money left on the sidelines to buy stocks and push markets higher. See below:

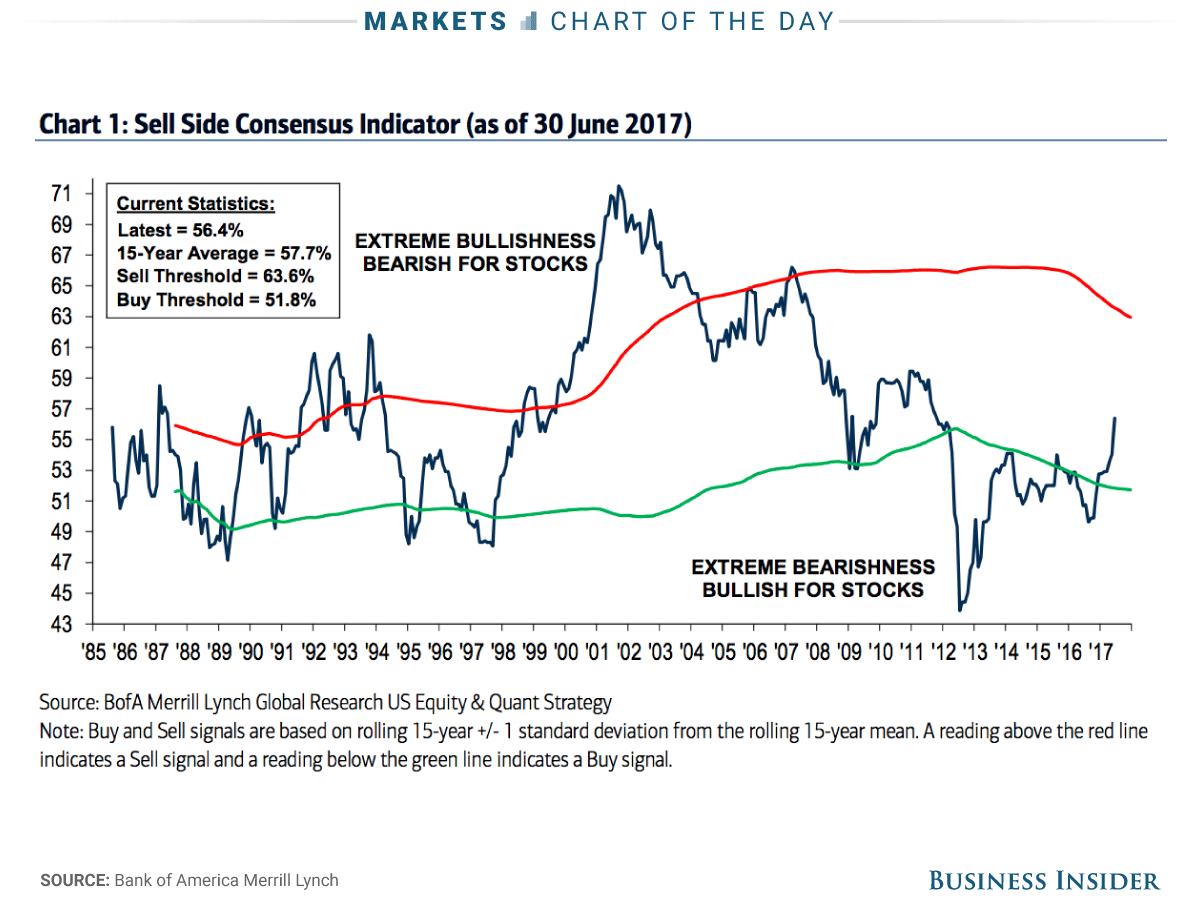

And finally, Banc of America has a sell-side contrarian indicator that is getting some press lately. The chart below are the results from a survey of Wall Street strategists’ recommendations. The indicator measures the collective bullishness/bearishness of the strategists. An indicator below the green line is bullish for stocks, and above the red line is bearish. Right now, the reading is at 6 year highs, but still in neutral territory. See below:

We’re not going to argue that the market isn’t expensive these days, it is. S&P 500 PE Ratios are above their 5 and 10 year averages, but in our opinion, they deserve to be higher than normal due to the constructive fundamental environment we’re in. In addition, valuation rarely kills a bull market, deteriorating fundamentals do, and right now fundamentals are OK. Our investment team watches the market every day and we constantly survey the fundamental landscape, both here and abroad. Right now, we consider the following critical to moving the market forward:

- Corporate earnings growth. Earnings season begins this week and should solidify forecasts of 10% growth this year

- Economic growth. Global GDPs, labor market metrics and manufacturing statistics are always on our radar screen. Right now, all are still in expansion mode

- Finally, interest rate movements. We understand that rates will most likely move higher over time, but we expect rate normalization to be slow and measured

We understand the anxiety a mature bull market can present, but if valuation and contrarian indicators are the only evidence bears are bringing to the table, that’s not enough to call it a wrap. Disappointing earnings growth, recession and high interest rates can kill a market. Yes, fundamentals can change, we’re watching, but not seeing signs of these metrics deteriorating yet. Remember, markets have been hitting new highs since 1817 when the NYSE was established. It’s never a straight line, we do have corrections, but over the last 200 years markets continue to be resilient.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222