Where does the time go? The days are getting shorter, mid-year is already one month in the rear view mirror and July kicked off another round of quarterly earnings releases. Corporate earnings are the fuel necessary to keep this bull market running. If the earnings estimates are correct, the tank will be full and the markets can cruise into October. High octane earnings can be enhanced with some key additives like low interest rates, a healthy consumer, low inflation, less regulation and a steady Federal Reserve Bank. The near future should resemble the recent past.

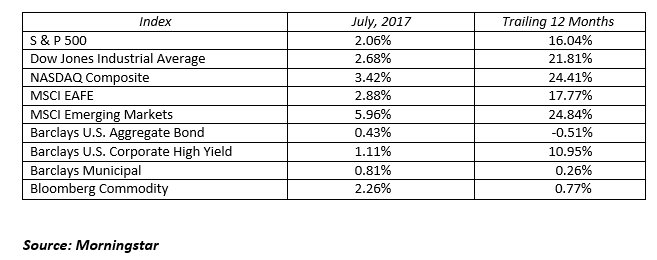

July was another good month for investors as all indices in the chart below produced positive returns. We ended the month in new record breaking territory. Such is life in a bull market. Stock returns were positive around the globe with emerging markets leading the way. This sector has been on fire in the past year and produced a 5.96% return in July bringing their trailing 12-month return to an impressive 24.84%. Emerging markets are in a sweet spot supported by positive currency and solid growth in China and India. U.S. stocks continue to ride the strong second quarter earnings wave. International markets are also in the midst of a good run, making up for some recently troubled years. A recent acceleration in overseas economic growth and compelling valuations as compared to the U.S. is being reflected in international stock price outperformance.

The Federal Reserve expectedly took a pass on raising the fed funds rate in July. They have raised the rate 25 basis points in the final month of the calendar quarter for the last three quarters. Consensus thinking is they will skip September and finish the year with one last quarter point rate hike. At the July Federal Reserve meeting, Chairwomen Janet Yellen said the process of unwinding their inflated balance sheet will begin shortly. As you remember, the Fed embarked on multiple quantitative easing programs post 2008 to stabilize the banks and the economy. They purchased trillions of dollars in bonds from the banks, pumping liquidity into the financial system. This unwind process should begin sometime this quarter, and will take years to complete. Stay tuned for the stock and bond market’s reaction.

Right now the news in the financial markets is supportive of continued success over the short-term. Positive economic growth coupled with low interest rates, improved earnings and a better international outlook keeps a safety net under the market.

As an investor it is important to maintain a long-term focus. Take comfort in the fact that the trend is your friend. At some point there will be a 5-10% correction in the stock market, but don’t let that eventual move take you to the sidelines. When the Dow hit 20,000 many experts were encouraging investors to move to cash and wait for a 10% pullback. Hopefully you ignored the urge to time the market and remain committed to your plan. Now the market is 10% higher and the long-term investor continues to be rewarded. Stay the course despite what you may read or hear. Bring on August.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222