Investors easily toss around the terms “value stocks” and “growth stocks”, but what do these labels actually mean?

Value investing refers to buying stocks that trade below the market averages and their own historical range as measured by price-to-book value, price-to-net asset value, price to earnings, or some other ratio integral to their business. Value investors tend to regard these calculations over market cycles, and make long term estimates of future growth, cash flows and earnings power. Different investors use different metrics, so there is also a second layer of value investing techniques: allowing a significant margin of error from the estimated intrinsic value. Value investors will buy stocks with the lowest current valuations and sell those with the highest current valuations, generally.

Put another way, value investors are buying a stock after others have lost confidence, when the stocks tend to carry lower risk than the market overall. These investors try to sell when the stock price has recovered and others have become euphoric about the stock’s prospects.

Growth stock investing, on the other hand, involves buying companies that have higher expected growth rates than the averages, with a strong cadence of sales growth and profitability. Companies are usually young, with a new technology or service that is expected to disrupt the status quo. These firms may not yet have earnings or generate positive cash flow. Cash is reinvested in people, equipment, facilities and/or research so the stocks provide no dividend yield.

Valuations such as price to earnings ratios are usually higher with growth stocks. Price/earnings-to-growth is an important measure since price to earnings alone does not easily compare with market averages.

Growth investors are searching for higher rewards, while taking on higher than average risks including but not limited to emerging competitive products/services, depth of management, decelerating revenue growth and/or accelerating costs or expenses. This higher risk is associated with better price performance when the general stock market is rising, and with underperformance when the general stock market is in decline.

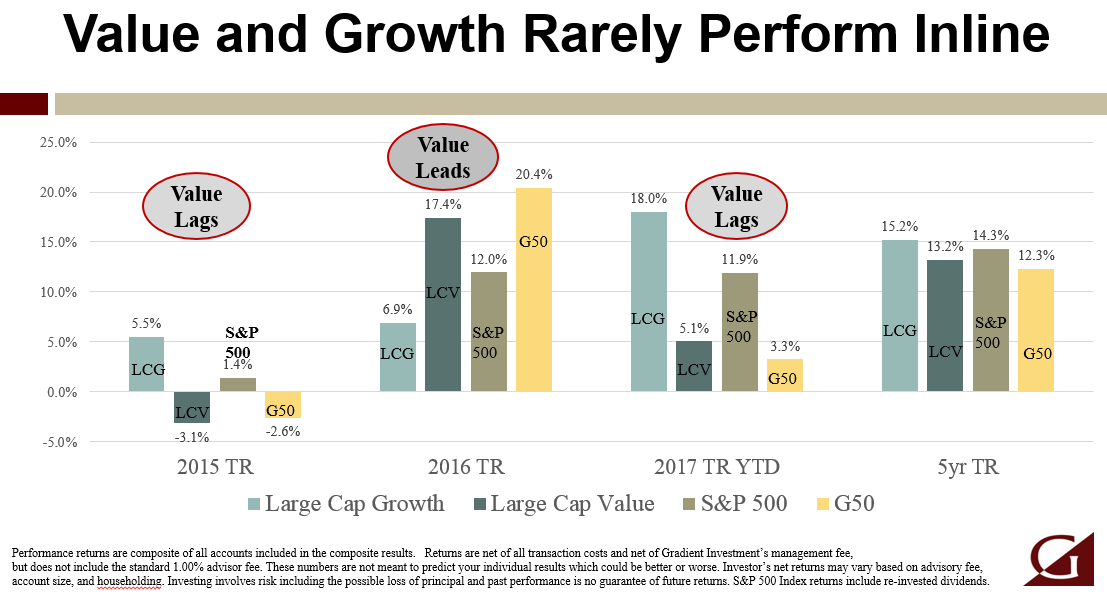

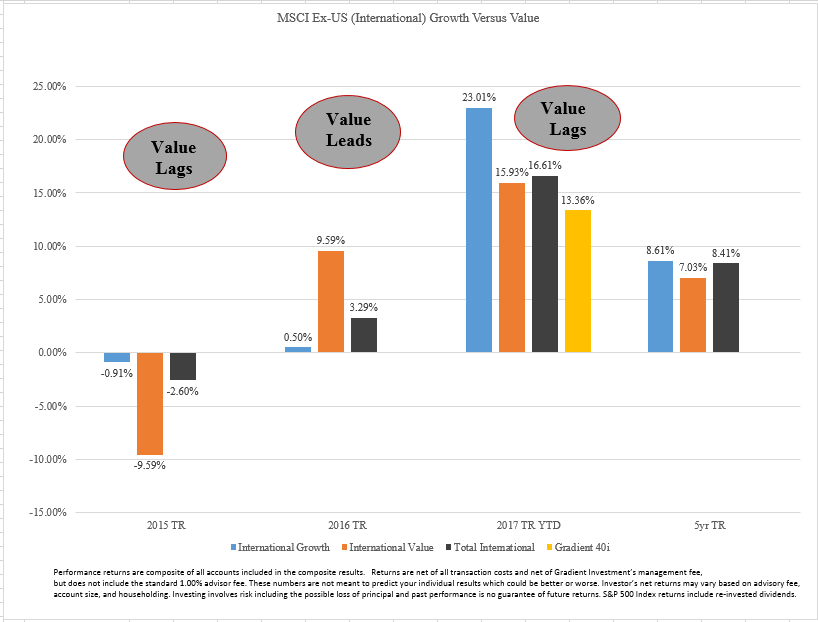

At Gradient Investments we offer a U.S. value-oriented stock strategy, the G50. Over time it carries about 20 per cent less volatility than its benchmark, the S&P 500 index. We also offer the G33 stock portfolio which is U.S. moderate growth oriented and carries about 25 per cent more volatility than the U.S. stock market over time. The growth and value styles rarely perform in line at the same time, but overtime perform roughly the same. Therefore, investors in the G50 or the G33 should not expect them to outperform the U.S. market every year. We also offer an international value-oriented stock strategy, the G40i. Look at the images below to see how the U.S. and international value segments have performed over time.

U.S. Value and Growth Rarely Perform In Line

· In 2016 U.S. Large Cap Value (LCV) was up 17%, while U.S. Large Cap Growth (LCG) was only up 7%

· This year U.S. LCV is only up about 5% while U.S. LCG is up 18%

International Value and Growth Rarely Perform In Line

· In 2016 International Value was up 9.59% while International Value was up only 0.5%

· This year International Value is up 15.93% while International Growth is up 23.01%

Note the G40i inception date was December 31, 2016

When LCV outperforms the broad stock market we can expect the G50 and G40i to do well, and when LCG leads the market we can expect the G33 to do well. The investable universe of blue chip, dividend paying stocks that the G50 and G40i invest in are in the LCV half of the market. See the image below to see how the LCV and LCG sectors of the market are doing through August 31st, 2017:

As with any form of investing, there are various levels to value and growth which entail higher or lower volatility of stock prices. We remind you to know your risk tolerance score and continue to incorporate that into your investment plan. We don’t want to get into a cycle of selling under-performing portfolios and buying portfolios after they have outperformed. That cycle will destroy value over time. Stay with your financial plan, then permit time to work on your behalf.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.