This was another in a string of profitable quarters for investors. It marks the seventh consecutive quarter of positive returns in the U.S. stock market. Not only were stocks higher in the third quarter, but every major asset class also moved higher. Risk was rewarded in the quarter as more risk equated to higher returns. Emerging market stocks led the way, up 7.89% and U.S. Government Bonds generated a 0.38% return. Everything else in between from U.S. stocks, commodities, gold, and all other bond categories moved higher in the third quarter.

Despite tense political and social headlines, the financial markets are taking their cue from the economy. Strong corporate earnings, stable low interest rates, benign inflation and a confident consumer are leading markets to new record breaking highs on a weekly basis. Anticipation of meaningful personal and corporate tax reform in the U.S. is also supporting the markets. The fourth quarter will shed more light on the likelihood of tax reform in 2018.

Emerging markets and international developed stocks once again led the performance parade as investors found more compelling valuations in foreign stock markets. The Gradient Tactical Rotation Portfolio fully participated in this by investing exclusively in the emerging market momentum sector. U.S. stocks continue their “melt up” as other asset classes are comparatively unattractive. Interest rates are low causing bonds to have very limited upside. Low inflation eliminates any urgency to own commodities. Volatility is non-existent so there is currently no fear factor to own stocks. Strong corporate earnings growth makes stock ownership the best game in town.

The Federal Reserve left their key short-term interest rate unchanged at 1.00-1.25% after a 25 basis point hike in each of the first two quarters. The Fed’s next headline action will be the reduction of their inflated balance sheet by selling trillions of dollars of bonds they purchased during the multiple post financial crisis quantitative easing programs. This process will begin in the fourth quarter and will take years to unwind. Expect relative stability in bonds as rates remain low, but inch higher over time.

The 10-year U.S. Treasury Note finished the quarter with a 2.32% yield, down a few basis points since the beginning of the year. The yield curve has flattened this year as the short-term interest rates moved higher and longer-term interest rates are slightly lower. Credit spreads are locked in at the tightest levels of the year thanks to the strong equity market and a healthy risk appetite from investors. Investment grade spreads and high yield spreads remain very tight, helping these sectors outperform government bonds.

Stocks typically have two or three 5-10% corrections within a calendar year. This is normal and expected. This year, the stock market has yet to produce even one 5% correction. If we do finally get a correction in the fourth quarter, remember to use it as an opportunity to buy low. Do not throw in the towel on your financial plan the next time the market is down 5% from its new all-time high. Stay your course, stay invested.

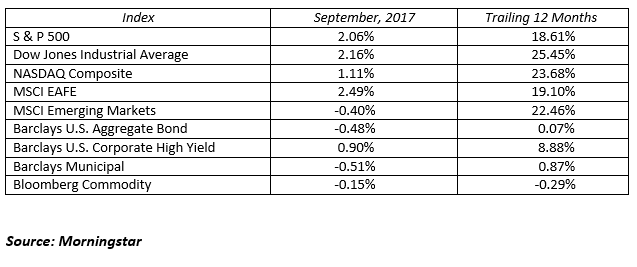

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222