The fourth quarter was another celebration for bulls in a year to be remembered for strong returns and an extraordinary lack of market volatility. The proverbial “wall of worry” kept investor’s bullish emotions in check as news flow on health care, tax reform, political uncertainty and elevated market valuations kept investors cautious. The market largely shrugged off these fears, and asset classes rose based upon supportive fundamental growth and strong corporate earnings.

Performance for both the quarter and the year as a whole has been mostly positive across all asset classes. Economic growth, both in the U.S. and overseas, has been positive and accelerating. Jobs and wages have grown in the U.S. throughout 2017. Federal Reserve rate hikes have been measured and well communicated in the U.S., and monetary policy remains mostly supportive worldwide. Global interest rates have remained relatively low, and inflation has been controlled in most major markets. Tax reform that aims to significantly reduce the corporate tax rate has been signed into law. Lastly, corporate earnings grew at double digit rates in 2017, and expectations for continued growth have propelled markets across the globe.

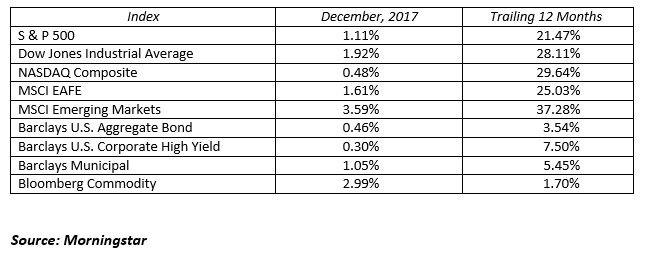

Emerging market equities, as measured by the MSCI Emerging Market Index, earned its way to the top of the charts returning 37.2% for the year. International markets had a significant rebound after several years of under-performance. U.S. stock markets were strong again with growth stocks significantly outperforming value stocks. More amazing than the 21.5% annual return of the S&P 500 was the steady persistence of the market. In 2017 the Dow Jones Industrial Average achieved 71 record breaking closes with only 10 trading days where the market’s close changed by more than 1%.*

The bull market in bonds started over a generation ago in 1981. Technically, this bull market is still alive, but we have entered into an extended period of sideways price movement. Credit spreads (the premium paid to take on risk in bond markets) are near 10-year lows. Interest rates, while off their all-time troughs are still low by historical comparisons.

Looking ahead, what can investors expect for an encore performance? The economy is starting the year with great momentum as earnings growth continues. We forecast the economy continues to grow at a 3% rate as double digit earnings growth repeats itself in 2018 now that the tax bill is passed. While one needs to respect market momentum, it is also important to temper enthusiasm knowing we are nine years into a bull market and have not had even a 5% market correction in over a year.

This is likely a good time to reset your return expectations from 20% in stocks to 5%. Corporate fundamentals should remain strong in 2018 with earnings growth repeating at the 10%-15% level, in our opinion. Valuations, however, have been stretched to the point where the market is now trading at 20 times next year’s earnings. We forecast positive returns next year, but not a repeat of 2017. The bond market will likely have an instant replay year. The Federal Reserve will raise short-term interest rates two or three times, the yield curve continues to flatten, and credit spreads remain tight, in our opinion. Low single digit returns are the expectation here.

Stay invested with lower expectations. If you are compelled to lower the risk of your portfolio, do so with small asset allocation alternations. This is not the time to cash in, nor is it the time to go all in. Stay balanced at a risk level right for you.

* Source: S&P Dow Jones Indices Market Commentary- DJIA Report Card 2017 (12/29/2017)

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222