At Nevada Retirement Planners, we primarily use exchange traded funds (ETFs) for our bond allocations. In the past, we have been asked why we don’t use individual bond holdings instead of ETFs. In the below reflection, I will provide our justification for using ETFs instead of individual bonds for investor’s fixed income allocations.

Primary Reasons for using bond ETFs

- Diversification

- Liquidity

- Cost

Bond ETFs provide diversification which reduces individual issuer credit risk. For example, we use the SPDR Aggregate Bond ETF (Ticker: SPAB) in our portfolios. SPAB has over 4,000 bond holdings. Individual investors, who may have only a few bonds in their portfolio, would be subject to greater risk of credit events (such as defaults) that can have a negative impact on portfolio returns.

Second, because of their significant daily trading volume, bond ETFs tend to provide greater liquidity compared to individual bonds. Finding a counterparty to purchase a small allocation of an individual bond may be difficult, or may be at prices that are significantly lower than stated value, especially when attempting to sell these assets.

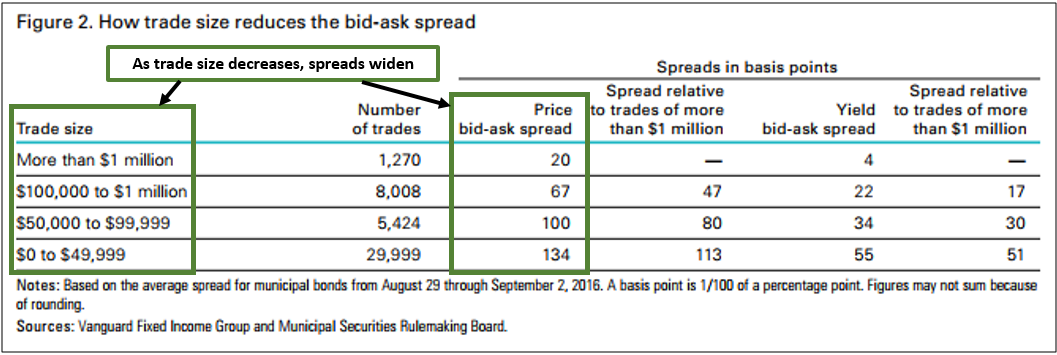

Third, bond ETFs provide diversification and liquidity at relatively low cost. With the above example, SPAB trades an average of 926,000 shares per day (source: Yahoo Finance) and charges a 0.04% expense fee. The reason that comparative costs of transacting in individual bonds can be higher over time is due to wider bid-ask spreads. The below data from a Vanguard study reflect this cost, where transaction spreads (the price to buy versus the price to sell) are wider, or more costly, as the aggregate purchase size gets smaller.

Individual bonds versus bond ETFs in rising rate environments

A common discussion point for holding individual bonds over bond etfs is that individual bonds have less risk in rising rate environments. This is based on the fixed maturity as opposed to bond ETFs that do not mature. While this is functionally true that bond ETFs do not mature, for most investors, fixed maturity does not tend to actually provide added value.

The reason is that most investors tend to reinvest proceeds from bond coupon and principal payments. Because bond coupon payments are typically not enough to repurchase another bond, there can be a “cash drag” as assets are held in lower returning cash/money market accounts until there is enough to purchase an additional bond. In regard to principal reinvestments, individual bond investors do not have the “cash drag” issue, but as we discussed prior, transaction costs for purchasing relatively small amounts of a bond tends to be higher and will also likely act as a drag to long term portfolio returns.

Lastly, remember that bond ETFs are simply a collection of individual bonds. They have a variety of holdings that are maturing at various times and are reinvesting proceeds regularly. In rising rate environments, those reinvestments will be done at higher rates and average portfolio yield will likely increase. In addition, bond ETFs have the advantage of better pricing and less credit concentration risk compared to individual bond holders. Also, the ability for investors to reinvest their coupon proceeds back into ETFs allow for less “cash drag” in portfolios.

In summary, we feel that allocations to bond ETFs for most retail investors is the preferred method. The advantages of diversification and liquidity more than offset the added expense fee. We actively manage our bond ETF investments to ensure we are providing allocations that are based on our stated investment purpose while continually evaluating products to enhance returns and/or reduce costs.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.

Sources:

Wall Street Journal – https://www.wsj.com/articles/five-myths-of-bond-investing-1393024811

Vanguard- https://personal.vanguard.com/pdf/ICRIBI.pdf

Northern Trust – https://www.northerntrust.com/docum…y/maturity-bond-funds-vs-individual-bonds.pdf