International stocks can be a significant component of investor portfolio allocations. However, many of the differences between US and International stock market indices may not be widely known. In the following market reflection, we will provide an overview of international markets, including some of the differences in composition to US markets as well as a comparative analysis of performance.

What comprises “international stock markets”?

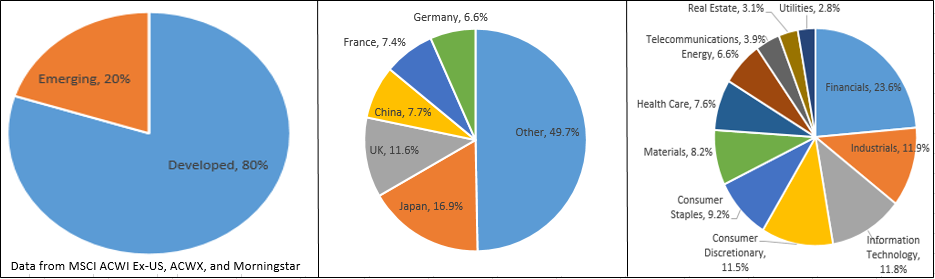

Simply stated, international stock markets are made up of all markets outside the US. A good proxy for international markets is ACWX, an ETF based on the MSCI All World Country Index, Ex-US. The following charts reflect data from the index and ACWX to compile a breakdown of international stocks.

Based on the above data, a few observations:

- Developed markets (like Europe, Japan, Australia) represent 80% of the total international market

- 5 countries (Japan, UK, China, France, Germany) represent 50% of international markets

- China is, by far, the largest emerging market. It represents 38.5% of emerging market stocks

- On a sector basis, Financials (23.6%) is the largest represented sector in international markets compared to Technology stocks (25.2%) being the largest sector in the S&P 500

Performance versus the US markets

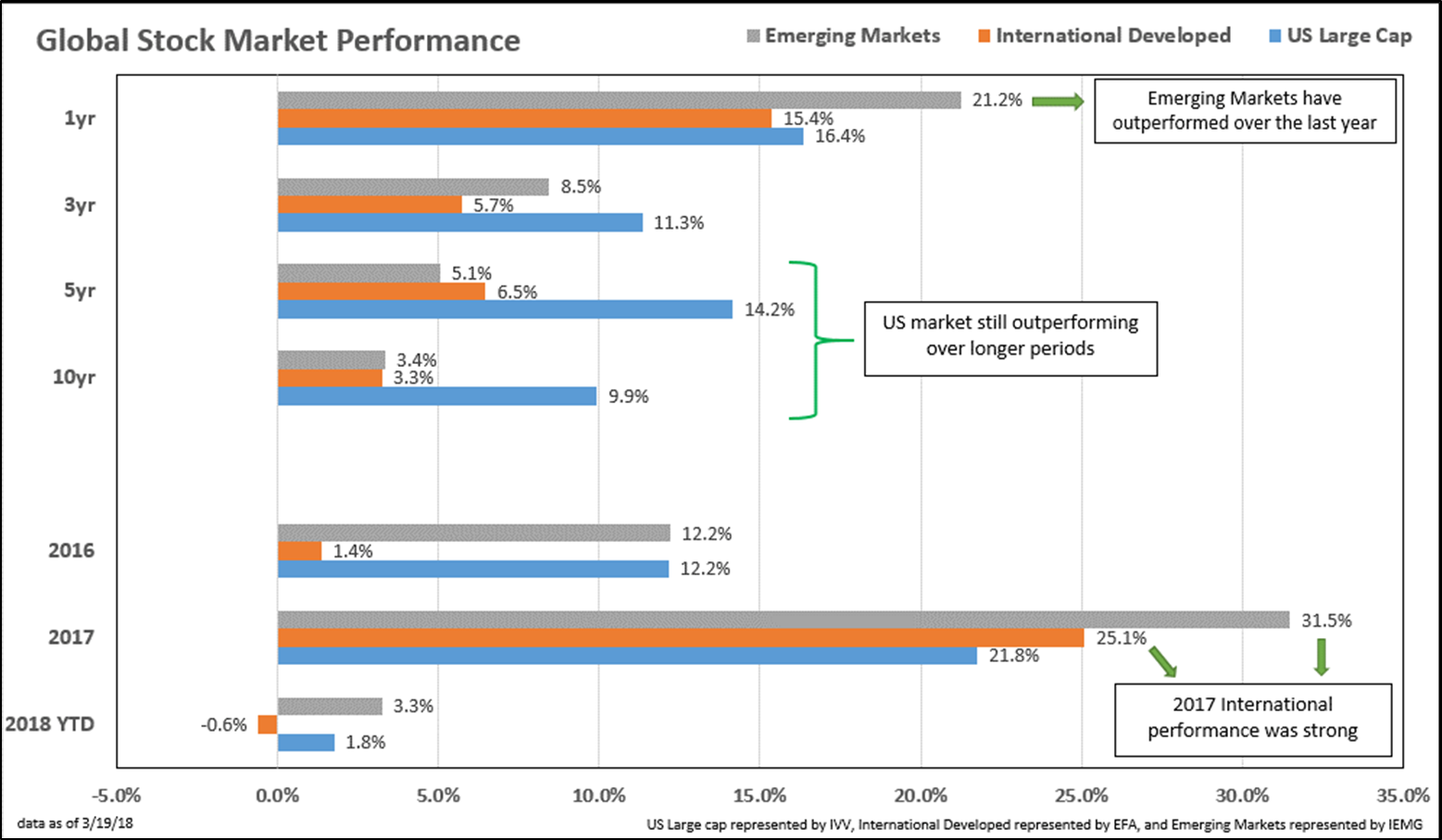

2017 was a strong year for international markets. The below chart reflects performance over several periods for US Large Cap stocks (blue bar), International Developed Stocks (orange bar), and Emerging Markets stocks (gray bar). International stocks, both developed and emerging, outperformed US markets in 2017. However, over longer periods, the US markets have outperformed international stocks.

International growth versus value

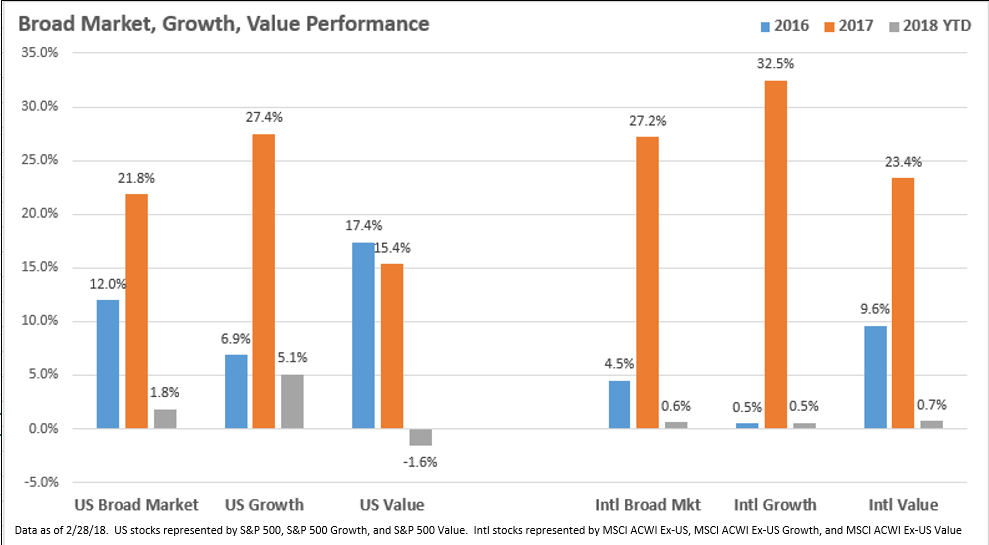

In regard to US markets, growth stocks have significantly outperformed their US counterparts in 2017 and into 2018. This trend has been seen in International markets as well. The below chart reflects performance of both US and international broad market, growth, and value stocks. In 2016 (blue bar), value stocks in both the US and international markets outperformed. In 2017 (orange bar), this trend reversed as growth stocks outperformed in both regions. Thus far in 2018, we have seen the same outperformance in growth in the US while the international stocks are more mixed.

Our international allocations and outlook

We are currently advocating for a balanced approach to US versus international stock allocations. While economic conditions and corporate earnings are favoring the US, valuations are favoring international stocks. Within our portfolios, there are several methods to gain exposure to international stocks.

- The G40i provides growth and income from high quality, dividend paying international stocks. The G40i is a very strong complement to G50 allocations as the investment philosophy is similar, but is invested completely outside the US.

- The ETF Endowment Series has allocations to international stocks across the conservative through growth spectrum.

- The Gradient Tactical Rotation (GTR) invests in one geographic sub-sector through a rules based tactical strategy based upon price momentum. The current allocation is fully invested in Emerging Markets stocks

In closing, it is our belief that an allocation to international stocks can be beneficial for diversified growth in investor portfolios. We believe that providing various sources of portfolio return, which includes asset class, geographic locations, and sector diversification, creates long term portfolio benefits that may enhance returns and lower volatility over time.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.