The first quarter was a wake-up call to all investors enjoying an extended period of higher stock prices, low volatility, and stable low interest rates. After multiple record setting stock market highs in January, the long awaited market correction became a February reality as stock prices fell 10% from their all-time highs. March provided additional price volatility as the market was left to negotiate a sea of cross currents.

The economic and political issues surfacing in the first quarter will continue to impact markets into and beyond the second quarter. The passage of corporate and personal tax cuts will provide fiscal stimulus to the economy. Simultaneously, the Federal Reserve is tapping the economic brakes by tightening monetary policy. The hot debate is whether there will be three or four rate hikes this year. The Fed raised the benchmark fed funds rate by a quarter percentage point to the 1.50-1.75% range in March.

The talk of tariffs and trade wars has the market on edge, adding to investor uncertainty. Quarterly corporate earnings releases will begin anew in mid-April. This round will be especially important as the market begins to reassess 2018 earnings estimates. The FAANG stocks (Facebook, Apple, Amazon, Netflix and Google/Alphabet), have provided long-term leadership to the stock market, and now these stocks are being stress tested. Geo-political risk is a constant worry, but tensions here are currently running high. Bottom line: expect market volatility to remain elevated.

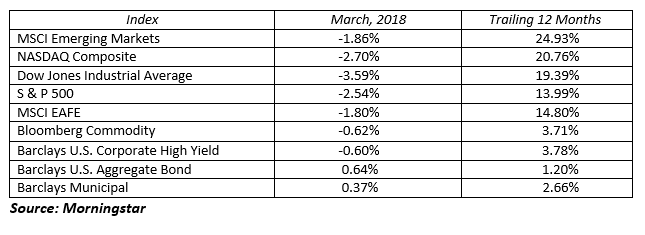

Despite all the noise and heightened anxiety, markets were down but not out in the first quarter. The Dow Jones Industrial Average endured two 1,000-point plunges but lost just under 2% for the three month period. This snapped a streak of nine consecutive up quarters for the Dow. Other major equity averages around the global were mixed for the quarter. The NASDAQ 100 and the MSCI Emerging Markets finished the quarter slightly positive while the MSCI EAFE and S&P 500 were slightly negative. From a sector standpoint, information technology +3.2% and consumer discretionary +2.8% were the biggest quarterly winners with telecom services -8.7% and consumer staples -7.8% the biggest losers.

In the bond market, prices declined as interest rates rose and credit spreads widened. For the quarter, the benchmark 10-Year U.S. Treasury yield jumped 34 basis points to yield 2.74%. The yield curve continued to flatten. The 2-Year Treasury rose by 38 basis points to end the quarter yielding 2.27%, while at the long end, the 30-Year Treasury rose 23 basis points to 2.97%. Despite the slow start to the bond market, we expect bonds to claw their way back to even by year end as future income will offset early year price declines.

Long-term investing is a marathon, not a sprint. In the big picture, the nine year bull market has done wonders for those investors with a long-term focus. Economic fundamentals are still very positive and can propel this market higher from here. Price corrections in the 5-10% range are normal and actually help create opportunities to buy at better valuations while providing further legs to bull markets. Stay patient, stay positive, stay invested.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222