Last month’s political headlines heightened everyone’s anxiety. Fortunately, the month of May provided an opportunity for investors to take a breath and refocus on the solid fundamentals underlying this long running bull market. Let’s look at some of May’s highlights which gave investors reasons to believe:

· First quarter corporate earnings grew at 24.6% year over year

· Valuations of the S&P 500, as measured by price earnings ratios, declined to 16.4 times forward earnings per share from 20 times at year end

· Employment situation supports a strong economy and a confident consumer – modest job growth along with a 3.8% unemployment rate

· Federal Reserve keeps fed funds rate unchanged

· April consumer price index reported lower than expected inflation

· April producer price index reported lower than expected inflation

· Monthly retail sales showed modest gains despite poor weather

· Consumer confidence recorded a 128 reading, a historically strong number

The skeptics have their reasons for being negative on the market and the world in general. Their arguments will include:

· Higher interest rates will choke off the stock market rally

· Higher oil prices (hit $80 in May) will lead to higher inflation

· The Federal Reserve’s monetary tightening will curb future economic growth

· Political risks surrounding trade wars, NAFTA, tariffs, and saber rattling will weigh on the markets

Every market over time has its own wall of worry to climb. This is normal. In the big picture, corporate earnings are outstanding and valuations have transitioned from rich to fair. Invest with confidence.

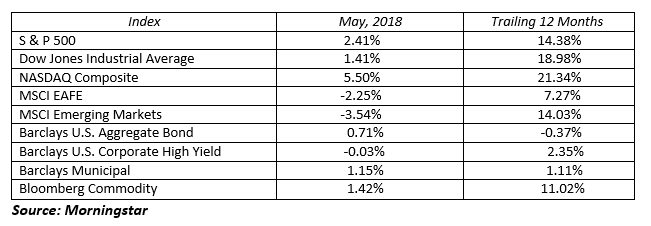

U.S. stock markets got some of their mojo back with moderate gains across the board. Strength in the technology sector put the NASDAQ Composite in the pole position for the month and for the trailing twelve month performance. It returned 5.50% in May followed by the S&P 500 at 2.41% and the Dow Jones Industrial Average at 1.41%. International stocks did not fare as well in May with the MSCI EAFE down 2.25% while the MSCI Emerging Markets lost 3.54%.

From a sector standpoint the market found leadership in technology, real estate investment trusts and energy as oil price climbed to recent highs. The laggards were consumer staples, communication services and the long forgotten utilities sector.

The bond market flirted with a 3.00% yield on the 10-year U.S. Treasury Note for an extended period before it finally broke through mid-month. Then political concerns in Italy and the potential impact on the European Union caused a flight to quality trade as investors flocked to buy U.S. Treasuries. For the month, the benchmark 10-Year U.S. Treasury yield decreased 8 basis points to 2.83%, down from its May 17th closing high yield of 3.11%. The 2-Year Treasury declined 9 basis points to end the month yielding 2.40%, while the 30-Year Treasury fell 11 basis points to yield an even 3.00%.

The yield curve flatten modestly in May, but retains its positive slope. An inverted or negatively sloped yield curve has received considerable attention in the past few months. An inverted yield curve (one where short-term interest rates are higher than long-term interest rates is rare), has accurately predicted the last three recessions and stock market tops. There is no need for immediate worry. After the yield curve goes inverted, a stock market top is 10 months away on average and a recession is 15 months away on average.

The Berkshire Hathaway annual meeting was held in Omaha, NE this month. This two day event with legendary investor and company founder, Warren Buffett, receives massive media coverage. This is the one time each year when the media focuses on investing rather than trading. Here at Gradient Investments, we strive to promote the benefits of long-term investing, just like Mr. Buffett. Unfortunately, the financial headlines and hype presented in the media every day is so often driven by very short –term trends and trades.

Are you an investor or a trader? Hopefully you are an investor. If not, start by filtering all of the daily background noise and allow yourself to take a longer-term view of the world and become a world class investor.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222