Headlines in the second quarter kept market volatility elevated. The market moving headlines covered a wide range of economic and political topics. First quarter corporate earnings reported this quarter were outstanding. The Federal Reserve raised short-term interest rates by 0.25% as expected and projected two more rate hikes this year. The contentious G-7 meeting put trade and tariff disputes back in the limelight. China retaliated in response to the U.S. tariffs, and Trump threatened to double down on China. The North Korean summit calmed fears of a potential nuclear showdown. The court decision on the AT&T/Time Warner merger came down clearing the way for a takeover without conditions. Unemployment rates hit historic lows as the economy continued to move upward.

The third quarter will have its own version of breaking news which the market will need to sort out. Obviously second quarter corporate earnings growth will be closely watched, tariffs will be monitored and the mid-term elections will begin to take center stage. News happens, but markets generally move according to fundamental factors of earnings, valuation and economic activity. It’s from these fronts that our market optimism lives. Consumers with jobs and confidence are a powerful economic force. Couple this with lower taxes, less government regulation, strong corporate profits and low interest rates and you have a recipe for future prosperity.

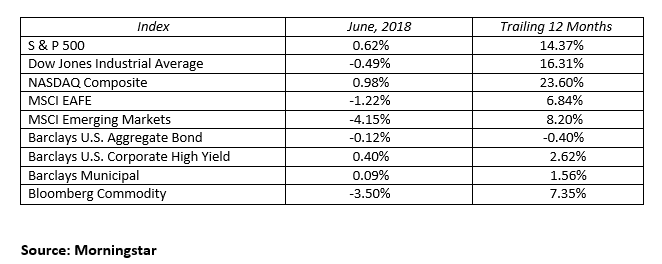

After a tenuous first quarter, the global stock markets produced mixed results. On the winning side: U.S. stocks proved superior to international stocks and emerging markets, small and mid-sized U.S. companies outpaced large capitalization multinational companies, and growth companies outperformed value. After nine consecutive positive return quarters, the Dow Jones Industrial Average posted a negative return in the first quarter, but began a new winning streak in quarter two. An eight day losing streak near the end of the quarter downsized the results in the second quarter, but the index stilled managed a 1.26% gain. In addition to the Dow, the NASDAQ Composite gained 6.61% and the S&P 500 increased 3.71% this quarter. International stocks did not fare as well with potential tariffs looming. The two major international indices (MSCI Emerging Markets and MSCI EAFE) were down 7.96% and 1.24%, respectively, for the quarter.

In the bond market, prices rallied after the benchmark 10-Year U.S. Treasury bounced off a 3.11% high yield and returned to its comfort zone in the high two percent range, but still left interest rates higher for the quarter. The benchmark 10-Year U.S. Treasury yield moved up 11 basis points to yield 2.85%. The yield curve continued to flatten. The 2-Year Treasury rose by 25 basis points to end the quarter yielding 2.52%, and the 30-Year Treasury rose just one basis point to 2.98%. Owning bonds in your portfolio will not hurt you, nor will they help your assets grow. Their value will either be an insurance policy against a stock market correction or a source of liquidity and price stability.

Unfortunately, long-term investing does not result in values moving in a straight line higher. The market and portfolios go through periods of varying performance. The best defense against market volatility is proper diversification. Structure your portfolio for multiple objectives (growth, income and principal preservation) in allocated amounts that align with your risk tolerance and long-term financial goals. The right asset allocation allows your portfolio to weather all environments and will keep you invested for the long haul.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222