We consistently discuss the benefits of “buying low and selling high”. We are not alone in this regard as many successful investors, including Warren Buffett, tout the advantages of “value” investing. While value is primarily defined as an investment trading below intrinsic value, there is significant debate about the proper way to measure value for a stock. In addition, recent research suggests that valuation has little to do with short term future returns, but is very important for long term returns.

In regard to determining value, the price to book value metric has been a widely used valuation measurement. Book value measures the amount of tangible assets on the balance sheet, and includes things like inventory, cash, and real estate. Historically, a lower price relative to the book value per share indicates a value stock. Recently, there has been debate on how accurate book value represents stocks in an economy that is heavily reliant on services rather than tangible goods (such as the U.S. economy). According to Barron’s, service oriented stocks have large percentages of their values in intangible assets like brand name, intellectual property, or customer loyalty. These assets don’t show up on the balance sheet and would not be included in price to book value calculations. Therefore, are we excluding investments as “value” stocks simply because the usual measurement system does not properly calculate their value?

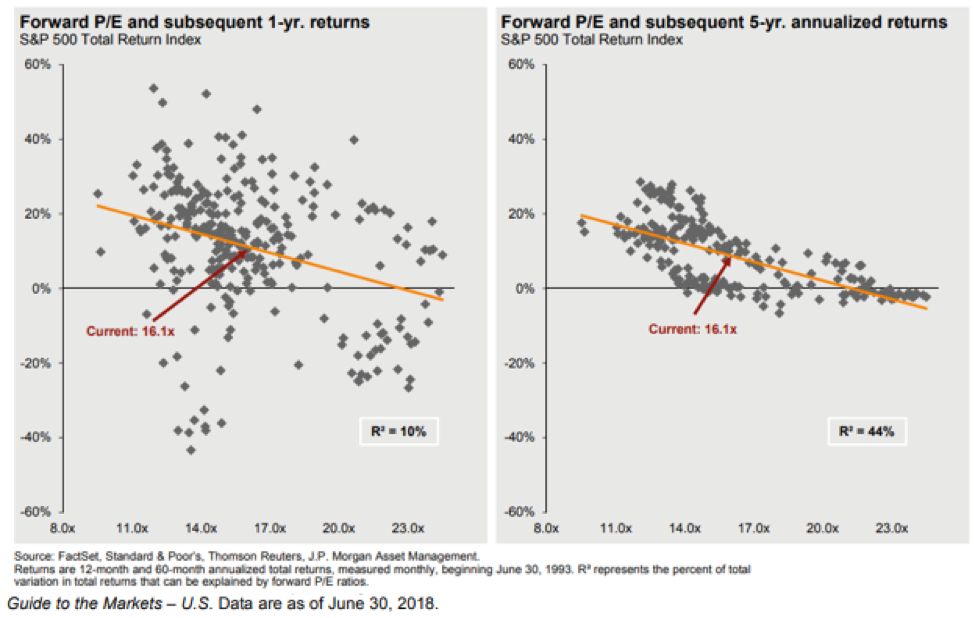

With regard to valuation and the influence on future returns, analysis has shown that valuations don’t have a significant impact on returns in the short term, but have been shown to have a large impact on longer term returns. The JPMorgan Guide to the Markets reflected this in the below charts. On the left, you see that 1 year returns are relatively random across the valuation spectrum, but over 5 years (the chart on the right) returns are heavily influenced by how much you pay for the investment.

What this means for investors is that assessment of value is not a one-metric analysis. Factors like price to earnings, cash flow, and the future outlook of the business are all worthwhile metrics to assess a stock’s value. Second, in the short term, many different drivers can supersede valuations when it comes to returns. However, as the time period expands, paying attention to company value and “buying low” and “selling high” tends to reward investors over time.

Sources:

- The Reformed Broker

- Pension Partners

- Barron’s

- JPM Guide to the Markets

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.