The third quarter is history and markets are standing tall despite warnings of seasonal weakness and further trade concerns. U.S. stocks, led by the red hot growth sector, set two records this quarter. This is now the longest running bull market ever and major indices achieved all-time record levels in September. Growth has been an important factor as U.S. GDP growth hit 4.2% in the second quarter. Supportive fiscal policy, confident consumers, strong corporate earnings and low interest rates may likely keep momentum positive through year end.

The Federal Reserve is sticking to their well-telegraphed game plan of gradually raising short-term interest rates 25 basis points per quarter. The September move marks the fourth consecutive quarterly rate hike bringing the targeted Fed funds rate to 2.00-2.25%. The journey to a normalized monetary policy is underway as the Fed simultaneously tries to shrink their balance sheet while raising short-term interest rates. The Fed needs to get all their tools back in the tool box before the next economic downturn hits. So far so good, but they will need years to completely finish the job as the balance sheet reduction project is in its infancy.

Trade and trade agreements are still a hot potato for the markets. Despite all the facts, tweets, and opinions, the market is taking much of this uncertainty in stride. President Trump announced a preliminary agreement with Mexico to modernize NAFTA and the market applauded. Even Canada joined at the very last minute. China and the U.S. continue to up the tariff ante. While the end game is unknown, it appears ramping up the rhetoric and action is becoming less of a market negative. A final trading agreement between the two economic powerhouses may well prove to be a future bullish catalyst for stocks.

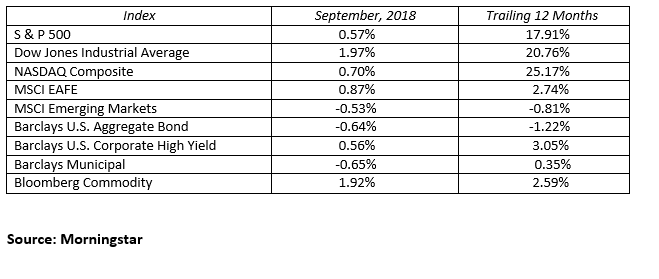

The strong U.S. dollar, along with trade tariffs, have taken their toll on the foreign markets. To date, the U.S. stocks have fared much better than both international and emerging markets. The Dow Jones Industrial Average was the lead dog in the third quarter gaining 9.63% while setting an all-time high. The S&P 500 and the NASDAQ composite also had a strong quarter gaining 7.71% and 7.41% respectively. The two major international indices (MSCI Emerging Markets and MSCI EAFE) were mixed for the quarter at -1.09% and +1.35% respectively. Growth stocks are still outperforming value stocks around the globe.

The bond market is dealing with multiple cross currents, but the tide is taking interest rates marginally higher, causing prices to decline. The benchmark 10-Year U.S. Treasury spent most of the quarter yielding just below three percent but ended the period yielding 3.05%, up 20 basis points in the quarter. The yield curve continued to flatten, as the 2-Year Treasury rose by 29 basis points to end the quarter yielding 2.81%, and the 30-Year Treasury rose 21 basis points to yield 3.19%. Someday bonds will once again offer value. Until then, own short duration bonds for liquidity and portfolio risk control.

Portfolio diversification is the most important tool to achieve your long-term financial goals. We diversify to manage risk and protect against unwanted volatility. Short-term market moves can entice investors to abandon a well-diversified approach at exactly the worst time. The record rally into quarter end raises questions better left unasked. Questions like, “why do I own bonds?”, “why do I have a cash position?”, “why do I own international stocks?”, and “why don’t I have all my money in Amazon and Apple?” The correct answer is diversification. Protecting your nest egg through diversification does not need an apology. U.S. growth stocks are currently the best place to be, but leadership rotates over time. The right asset allocation allows your portfolio to weather all storms and will keep you invested for the long haul.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222