In last month’s commentary posted on May 1st, we highlighted the fact U.S. stocks were trading at all-time highs and reminded investors market corrections are normal. Unfortunately, the stock market wasted little time in generating a 6.4% correction. Losses continued to mount as the month wore on with the major stock indices piercing their 200-day moving average. This was the first May since 2012 with negative returns. The old Wall Street adage, “sell in May and go away”, is timely this year as we enter the summer months where June and August have historically been the two weakest performance months of the year. While our long-term investing approach does not condone seasonal market timing, the recent increased volatility is a reminder markets move in both directions.

This sell-off was somewhat self-induced as the U.S. turned up the heat on China with the threat of a new round of tariffs. The threat became reality as the administration raised tariffs from 10% to 25% on $200 billion of China imports. China responded by boosting its own import taxes on $60 billion of U.S. products. The path to a trade deal between the world’s two largest economies appears to be a long and winding road. Stay tuned as President Trump and Chinese President Xi are expected to meet at June’s G20 summit in Japan. Mexico was added to the trade discussion as President Trump announced a plan to implement tariffs on all Mexican imports. Trade was not the lone concern as headlines related to political tensions, a continuing strong U.S. dollar, free-falling interest rates, a partially inverted yield curve and some initial widening of credit spreads also caused the stock market to pause.

On the economic front, the April jobs number added an impressive 263,000 net new jobs, blowing away the 190,000 forecast. The jobless rate fell to 3.6%, the lowest reading since 1969. Personal spending showed strong growth of 0.3% in April and personal income was up 0.5%, thus keeping the consumer in the game. The second reading on first quarter GDP held strong with a 3.1% growth rate. The first-quarter earnings season is nearly complete. Stock market analytics firm FactSet notes that 76% of the S&P 500 firms have beaten consensus earnings-per-share estimates. Overall earnings for S&P 500 components have surpassed expectations by 3.8%.

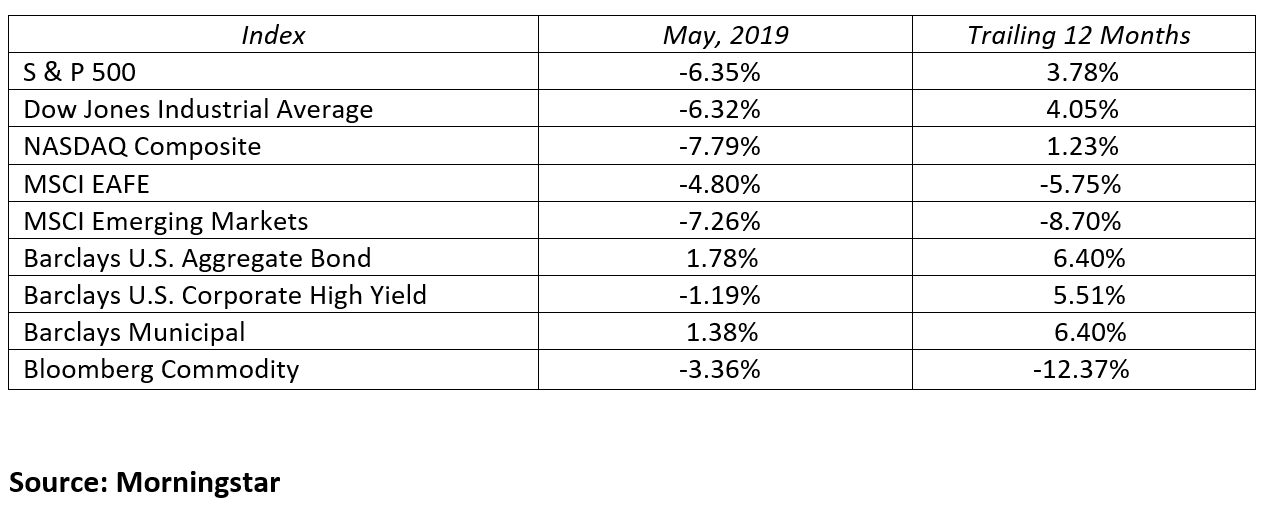

Stocks had a great start to the year, but ran into a brick wall in May. The pain was universal as all major stock markets were in the red. The NASDAQ Composite, S&P 500 and the Dow Jones Industrial Average gave back about one-third of this year’s gains with declines of 7.8%, 6.4% and 6.3% respectively in the month. The trade concerns are a global event and the international stock markets voiced similar concerns. The MSCI EAFE and emerging markets indices also lost 4.8% and 7.3% in May.

The Federal Reserve held interest rates steady as expected and noted solid job and economic growth with tame inflation. In their policy statement, the Fed reiterated their wait and see approach to the fed funds rate saying, “we don’t see a strong reason for moving in one direction or the other”. The market is now telling us the Fed’s next direction will likely be a Federal Reserve rate cut before year-end. Higher stock market volatility sent investors to the bond market to seek shelter. Yields collapsed across the curve in eye opening fashion creating attractive monthly returns in bonds. This month, the 2-Year Treasury note yield fell a remarkable 32 basis points to yield just 1.95%. With the fed funds rate pegged at 2.50%, it’s obvious the market is calling for a future Fed rate cut. Yields also collapsed on the 30-Year Treasury bond as its yield shrunk 35 basis points to 2.58%. In May, the 10-year Treasury note rallied with its yield declining from 2.41% to just 2.14% at month end. The rally in the bond market raises the question, “does the bond market know something the stock market does not?” Time will tell, but lower U.S. Treasury yields, a yield curve inversion and wider credit spreads are worthy of our attention.

On the commodity front, the market witnessed oil and gold moving in different directions. West Texas Intermediate crude oil price per barrel fell back into the low $50s after trading in the mid-$70s just eight months ago. Oil, down 12.0% this month is now back at February levels. Gold on the other hand is at a seven week high of $1,305 per ounce as nervous investors look to precious metals for relief.

Ups and downs like this come with the territory, but it’s imperative to stay patient and think long-term instead of short-term. Every time period has headline risks that investors must confront. This time is not different. Remember, underlying the headlines is a strong economy with solid corporate earnings, a confident consumer, and fair stock valuations. Stay invested for the long haul and let your long-term objectives and risk tolerance guide your investment decisions.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222