Over the trailing twelve months the U.S. stock markets experienced three distinct corrections. Each of these corrections were preceded by the major U.S. stock indices reaching new all-time highs.

In the fourth quarter of 2018, a combination of higher short-term interest rates, hawkish comments from the Federal Reserve, a looming inverted yield curve, trade tensions between the U.S. and China, a government shutdown, slower global economic growth, falling oil prices and investor fear brought the S&P 500 down 13.5% for the quarter. After a great start to the New Year, enter the May stock market correction. This one month sell-off was somewhat self-induced as the U.S. turned up the heat on China with the threat of a new round of tariffs. The threat became reality as the administration raised tariffs from 10% to 25% on $200 billion of China imports. The S&P 500 reacted with a 6.8% correction. Corporate earnings and belief of multiple rate cuts became June and July’s rally cry. August quickly became the third round in this mini correction cycle as the S&P 500 retreated 6.0% during the height of this month’s sell off.

The August setback actually began in the afternoon on the last trading day in July when the Fed cut the fed funds rate by 0.25% noting “global developments” and “muted inflation” as their rational. In the post decision press conference, Fed Chairman Powell framed the cut as a “mid-cycle adjustment”. Investors immediately interpreted this to be a one and done rate cut; they were expecting more. If this wasn’t enough, the next morning the markets were greeted with a presidential tweet announcing a new round of 10% tariffs on the remaining $300 billion of Chinese imports effective on September 1st. This one-two punch sent the market into a violent tailspin. The fallout in global stock prices sent gold prices higher in a typical flight to safety trade, and global interest rates went into a freefall causing bond prices to rise.

On the economic front, the news was not so dire. The July employment numbers released by the U.S. Department of Labor showed 164,000 jobs created. The headline jobless rate held steady at 3.7%. Monthly job growth has averaged 140,000 over the past three months, 47,000 lower than the 2018 average. Retail sales surged in July as did durable goods orders. Lower mortgage rates are beginning to revive the weakening housing market. On the flip side, we saw a slump in industrial production, a rise in import prices and some softening in very strong consumer confidence numbers.

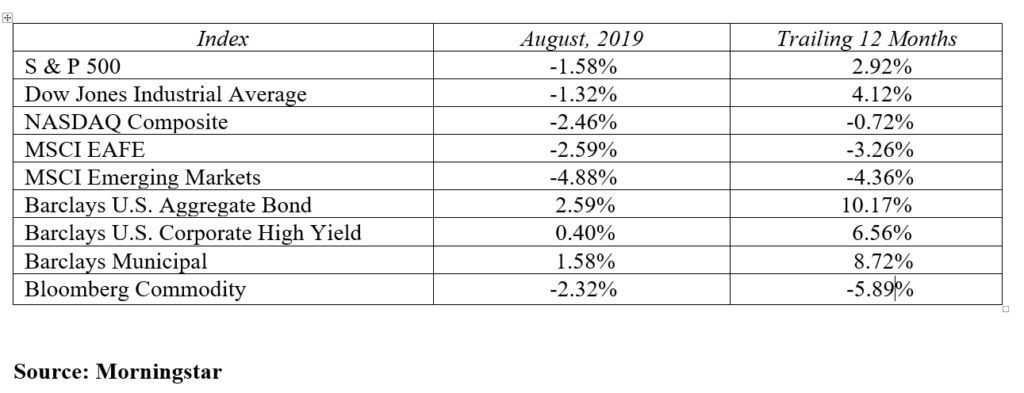

Stocks around the globe gave way to multiple pressure points. The combination of falling interest rates, negative interest rates, inverted yield curves, trade wars, tariffs, Hong Kong protests, central banks, Brexit, geopolitical risk and fears of recession collectively brought global stock markets down. When the dust settled at month end, the Dow Jones Industrial Average, NASDAQ Composite, and the S&P 500 lost 1.32%, 2.46%, and 1.58%, respectively, in August. International stocks continued to reflect economic uncertainty as the MSCI EFAE and emerging markets indices declined 2.59% and 4.88%, respectively.

Interest rates and the shape of the yield curve made front page headlines in August. An inverted yield curve has become the poster child for signaling the next recession. In August, we had the first inversion between the 2-year Treasury and the 10-year Treasury note. Recession fears and a flight to quality trade sent global interest rates to zero and in some countries well into negative territory. In the U.S., the 2-year Treasury note yield fell 39 basis points to end August yielding 1.50%. With the fed funds rate now pegged at 2.00%, it’s obvious the market is still calling for multiple future Fed rate cuts yet this year. The bottom fell out on longer term yields as the 10-year and 30-year Treasury securities declined a mind boggling 52 and 57 basis points respectively bringing their yields to 1.50% and 1.96%.

The August downturn and spike in market volatility can be emotionally unsettling for most investors. This is an appropriate time to rise above the current headlines and assess your financial plan in the context of your long-term financial goals. Today the market is worried about a slowing economy, an inverted yield curve, recession and a 10-year bull market in stocks coming to an end. The focus of your concerns should not be directed at the market, but rather on your own financial plan. The key questions to ask yourself are:

- Am I invested at an appropriate level of risk?

- Is my asset allocation in sync with my long-term financial goals?

- Does my portfolio have proper diversification?

- Will the plan meet my income needs over time?

- Does my plan keep me ahead of inflation?

The market is not under your control. Your financial plan is under your control. Don’t let the market take control of your financial plan. When the going gets tough, like it did during the last three corrections, stay true to your plan. Stay invested at a risk tolerance designed for your situation and avoid the common pitfalls. Do not allow the market to take control of your financial plan.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222