The third quarter seemingly packed a year’s worth of market action into three fast moving months. Regardless of your stock market, interest rate or economic viewpoint, there was something for everyone in this fluid and volatile quarter.

Quarter three began in bullish fashion as most of the major stock benchmarks jumped by 1.5% or more in the first week of July. A key catalyst for this quick start was the Department of Labor’s June jobs report that said the U.S. economy added 224,000 net new jobs – which was 60,000 more jobs than most forecasters predicted. The momentum to new all-time highs ended in the final trading hours of July as the Federal Reserve announced their first interest rate cut in over ten years. Normally a 25 basis point rate cut would be positive news, but post decision comments by Chairman Powell disappointed investors and ignited what would eventually become a 6.5% correction in stock prices. From the August lows, the stock market climbed back within reach of new all-time highs the end of September. A second 25 basis point rate cut in mid-September and a verbal agreement to reopen trade negotiations by representatives from the U.S and China gave the markets renewed hope heading into quarter end.

The quarter produced modest gains in global stock markets with major price fluctuations on a month to month basis. Fast growing companies have provided much of the leadership in this long running bull market. Once a year in each of the last four years, cheaper value stocks have unsuccessfully tried to lead the way, but any strength in those cheaper value companies has proven temporary. This scenario played out again in the third quarter as value stocks outperformed growth stocks. It appears growth companies will once again reassume their market leadership. Housing was the strongest sector and the energy sector was once again the laggard. This is the first quarter since 2009 when dividend yields on the S&P 500 exceeded the yield on the 30-year U.S. Treasury Bond. This fact, along with bearish investor sentiment gives stocks a potential positive setup for the fourth quarter.

Our stock market thoughts are:

- Corporate earnings grow 5% year over year.

- PE ratios represent fair value at 17x.

- U.S. economy continues to expand while international economies are slowing.

- Focus on U.S. stocks relative to international stocks.

Overall, this was a remarkable quarter in the fixed income market. The quarter began with interest rates low and thoughts of rates moving significantly lower seemed improbable. Fear of an inverted yield curve signaling the next recession motivated investors to sell stocks and buy bonds. The rapid move to lower yields caught most investors by surprise. The quarter began with key U.S. Treasury yields for the 2, 10 and 30-year maturities at 1.75%, 2.00%, and 2.52% respectively. By early September these same benchmark yields resided at 1.47%, 1.47% and 1.95%, marking the first time the 30-year U.S. Treasury bond yielded less than 2.00%. By quarter end, stocks moved to within 2% of their all-time highs and Treasury yields moved higher.

Our bond market thoughts are:

- Interest rates will likely remain low for an extended period of time.

- Softness in the global economies combined with low inflation will support bond prices.

- Central banks around the world have accommodative monetary policies.

- The impact of trillions of dollars of negative global interest rates has created a rate ceiling.

The U.S. economy is growing at a moderate pace. The one-time tailwind from last year’s tax cuts and reduced regulations turned 1% GDP growth into 3% GDP growth. Now the economy is settling into 2% growth as manufacturing and consumer confidence data are beginning to show signs of slowing. The growth is still impressive in the face of economic weakness from Europe, China and Japan. On the positive side: the U.S. remains at full employment, productivity growth continues to impress and low mortgage rates are supporting the housing market. Future corporate earnings estimates have been systematically reduced by Wall Street analysts this year, possibly paving the way for positive earnings surprises down the road. Two percent GDP growth coupled with low inflation can keep long-term expansion fires burning well into 2020.

Eyes now turn to another round of quarterly corporate earnings and an all-important holiday sales season. These factors, along with the ever evolving headlines, will determine the short-term price action. The noise from the markets will intensify as we move into year-end and another election year in 2020. Ignore the noise and remain patiently committed to your long-term personal financial plan.

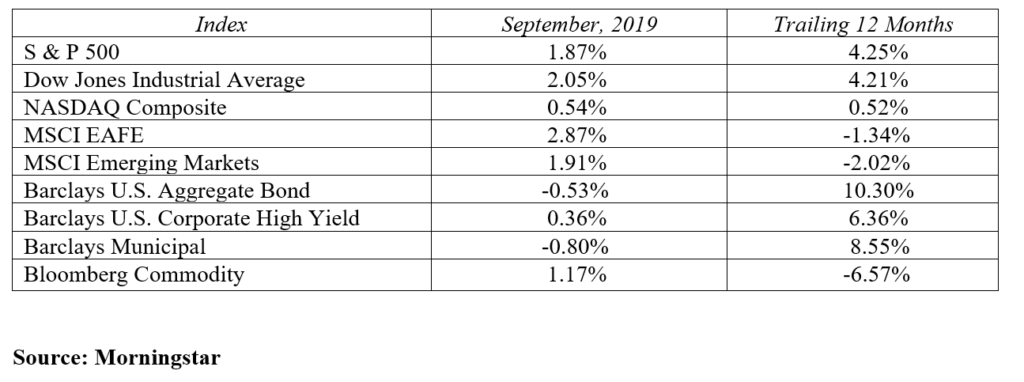

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222