2019 has been a strong year for U.S. equities, with the S&P 500 up over 28% through the middle of December. As we approach year end, investors will look to position their portfolios and allocations for 2020. After a strong year of performance, it is natural for investors to have some concerns about what the following year will have in store. A few recurring concerns on the minds of investors entering the New Year are:

- Slowing U.S. economic growth

- A historically long equity bull market with extended valuations

- China/U.S. trade tensions

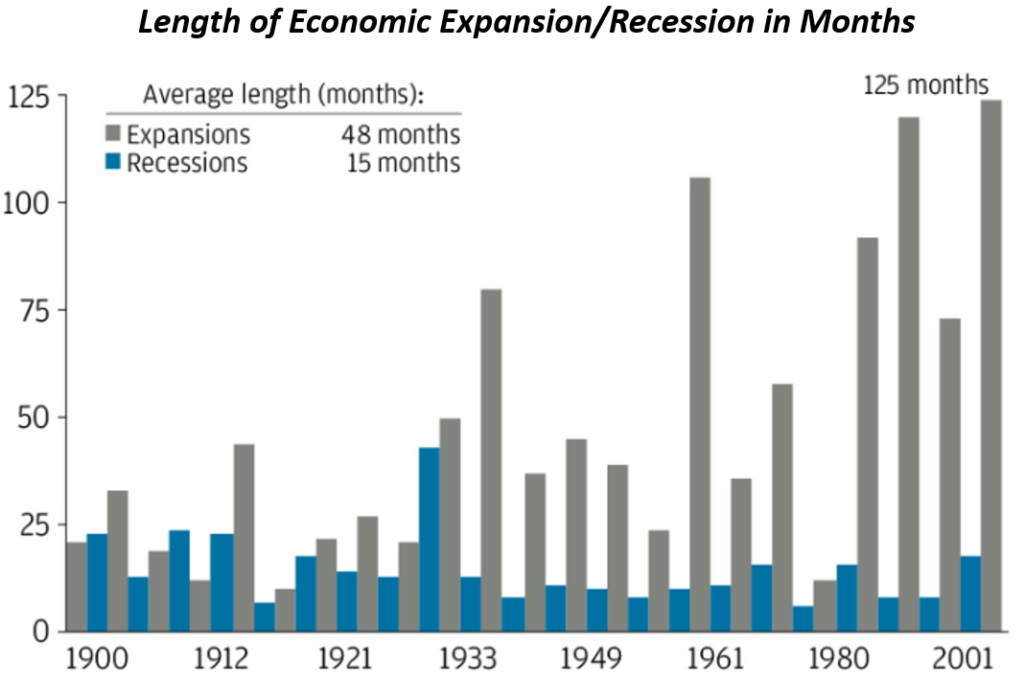

The U.S. Economy is a hot topic entering 2020 as investor expectations are for a lower GDP growth rate compared to last year. It is important to note that although the GDP growth is decelerating, it is still growing. Roughly 68% of GDP comes from consumer spending and with unemployment at 50-year lows, our expectation is for consumers to spend which will continue to drive the U.S. economy. U.S. GDP growth is forecasted by Morgan Stanley to close out 2019 at 2.3% and decelerate to 1.8% in 2020 and reaccelerate slightly to 1.9% in 2021. The chart below, from JPMorgan1, displays the continued strength of the U.S. economy going on its 125th month of economic expansion compared to the average expansion of 48 months.

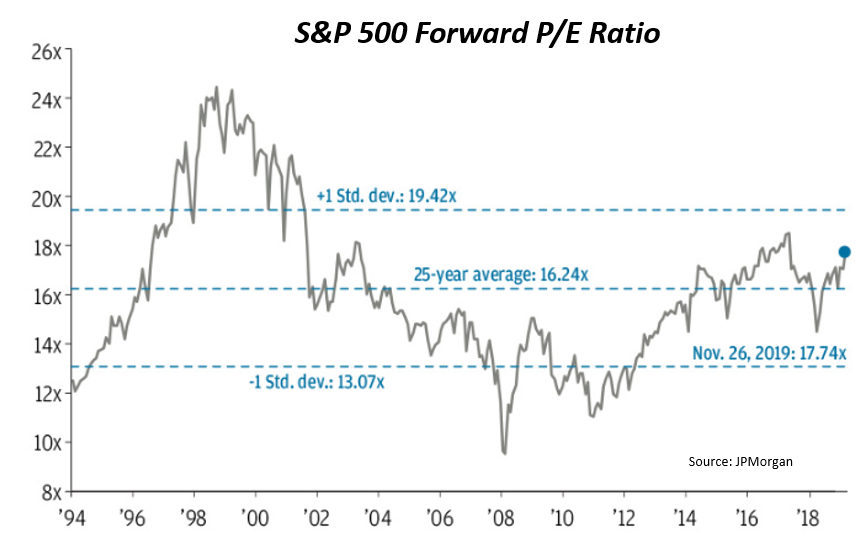

The strong returns of 2019 and continued length of economic expansion have some investors concerned that the bull market may be coming to an end. We continually express that time doesn’t kill bull markets but fundamental shifts in the economy and extreme equity valuations will. The graph below displays the current valuation of the S&P 500 at 17.74x, which is above the 25yr average of 16.24x. However, continued GDP growth, restrained inflation, low interest rates and moderate earnings growth should provide support for U.S. stocks to trend higher in 2020.2

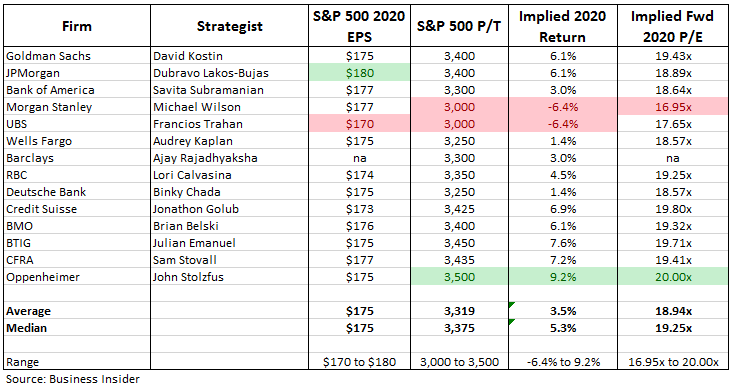

Additionally, below is a table of the top Wall Street experts and their S&P 500 target estimates for 2020, showing an average implied return of 3.7% as of 12/19/19.3

Lastly, trade discussion between the U.S. and China have seen many head fakes and although it is nearly impossible to know what goes on behind closed doors, the sentiment around the discussions are trending in a positive direction. On December 13th a Phase 1 agreement was signed requiring structural reforms in China’s trade and economic regime such as technology transfer, agriculture, financial services and intellectual property.

All in all, 2019 was a strong year for the markets and we feel conditions are in place for that trend to continue in 2020. As always, things can change in the investment markets, and we’ll be on alert for potential shifts that may occur throughout the New Year and make adjustments accordingly.

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.

Graphic Sources:

- https://am.jpmorgan.com/us/en/asset-management/gim/adv/insights/investment-outlook-for-2020/us-economy

- https://am.jpmorgan.com/us/en/asset-management/gim/adv/insights/investment-outlook-for-2020/us-equities

- https://www.businessinsider.com/stock-market-2020-forecasts-advice-sp-500-year-end-targets-2019-12