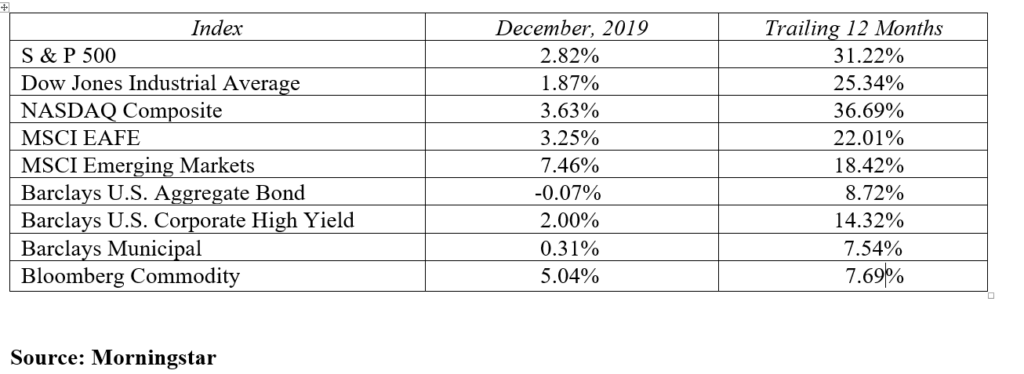

The year of 2019 began with a strong rally in the stock market and ended in the same impressive manner. Gains were realized across the board as all major asset classes fully participated in this rally making it one of the best years in a great decade for the financial markets. Annual stock returns around 30% erased the memory of a difficult fourth quarter in 2018.

The 2019 fourth quarter delivered a series of never ending new record highs for all major U.S. stock market indices. The NASDAQ Composite, S&P 500 and the Dow Jones Industrial Average all reached levels once considered unreachable in the near term. The Dow crossed 27,000, 28,000 and approached 29,000 in just the last quarter. The technology heavy NASDAQ rode the rally wave surpassing the 8,000 and 9,000 markers in three short months.

The catalysts for this market success can be found in the economy, policy developments and individual company results.

The economy continues to expand at a 2.0% rate with inflation remaining low. The fully employed consumer is confident, buying homes and spending freely. The consumer represents two-thirds of our economy, so a strong consumer is vital for future growth. With unemployment running at 3.5% and wages rising, the consumer is in great shape. The manufacturing sector has been a drag on economic growth this year, but its decline is showing signs of bottoming. The service sector remains strong.

On the policy front, the Federal Reserve and trade disputes have been the leading stories. The Federal Reserve had their hand in supporting the markets with a fourth quarter 25 basis point rate cut. This marked their third and final fed funds rate cut this year. Expect the Fed to spend 2020 on the sidelines. After their December meeting, Fed chair Jerome Powell announced, “as long as incoming information about the economy remains broadly consistent with our outlook, the current stance of monetary policy will likely remain appropriate.” Stated another way it could read: it’s an election year, we like where we are and will stay out of the way.

Trade policy has been a hot topic all year and the fourth quarter finally brought some clarity. The USMCA trade agreement made its way through the U.S. House of Representatives and soon should be a done deal. U.S. and China verbally agreed on an initial step toward a broader trade deal and should be signed on January 15th. As a result of this phase-one deal, new U.S. tariffs that were slated to go into effect on December 15 were canceled. The 15% tariffs imposed on $110 billion of Chinese goods back in September now fall to 7.5%. In return, China commits to buying greater quantities of American crops, factory goods, and energy products. This phase one trade deal should mark the end of the trade war escalation and put the economy on sturdier footing in 2020. With the Fed on the sidelines and trade less of an uncertainty, expect 2020 economic growth to tick up toward 2.5%.

Stock market analysts were pessimistic about corporate earnings as we entered 2019 and the end result supported this view as earnings were basically flat for the year. Earnings growth for 2020 is projected to grow at single digits, as margins may come under some pressure from rising wages and other higher costs. As always, earnings will be an important component to the stock performance in 2020. A potential turnaround in worldwide economic growth and resolution on trade uncertainties may prove to be positive catalysts for the start of the new decade.

Our outlook for 2020 is for the U.S. stock market to gain roughly 10%. The economy will remain stable led by a strong consumer, full employment and low interest rates. We see interest rates hovering between 1.75% and 2.25% on the 10-year U.S. Treasury note. U.S. Stocks aren’t cheap, but the 17-18x price-earnings multiple should hold, especially with rates so low. We still prefer the U.S. stock market over international stocks, but emerging markets appear poised for better relative performance in 2020.

After big years in the markets like last year or the 2008 market meltdown, investors are often faced with the question, “what should I do now?” Let’s tackle that question with some prudent things to do:

- Revisit and reassess your risk tolerance and current financial situation

- Rebalance your portfolio back to your targeted asset stock/bond mix

- Seriously consider your investment time horizon and act accordingly

- If your time horizon is over 5 years, think and invest for the long-term, not the next trading day

- Stay invested and be true to your plan, as “going to cash” is usually a fool’s game

One final thought. Markets tend to run in bullish and bearish cycles, some secular (long-term) and some cyclical (shorter-term). History teaches us that secular markets tend to last for about 20 years. Time will tell, but maybe we just finished the first half of a 20-year secular bull market in stocks. Keep your portfolio diversified and invested at an appropriate risk level. Don’t forget to stay invested and compete in the second half.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222