The most recent 2 years in the US stock market have given investors many iterations of fear and concern. Whether that has been fear of various actions creating falling markets or fear of missing out on strong markets, investors have had many things to ponder and determine actions going forward.

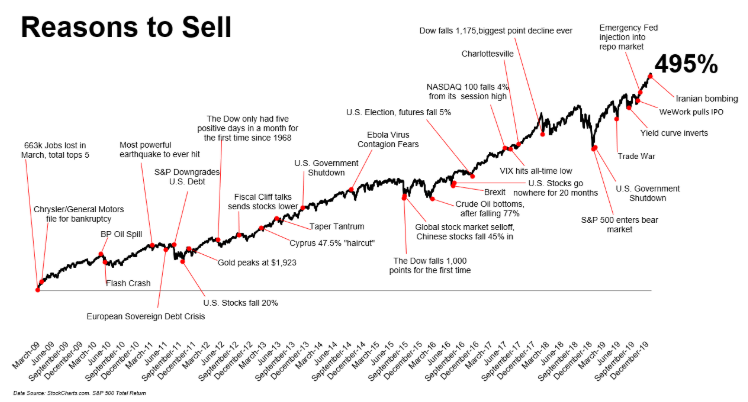

While issues can always seem unique and concerning, the fact that investors have things to worry about is one of the few consistent themes of the market. There will always be concerns that give investors pause, especially investors that are reliant upon their portfolios to meet their daily expense needs (like retirees). The below chart from “The Irrelevant Investor” blog reflects this in a chart that shows many, but not all, of the market concerns during a 495% rally in the S&P 500.

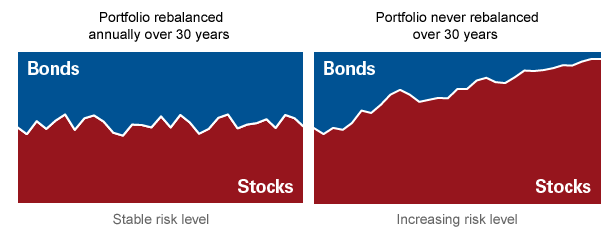

Investors will always have fears of staying in balanced against fears of missing out. During these times, the most prudent strategy is to take a step back and take an honest assessment of your current investment allocations to determine whether they align with your needs and objectives for the future. When stock markets have rallied aggressively, as we have seen especially over the past few years, a rebalancing strategy becomes critical to avoid excessive risk. The chart below from Vanguard shows what can happen without a consistent review and rebalance strategy. Over time, stocks have generally outperformed bonds, and investors who have not rebalanced begin to skew portfolios into ever greater amounts of risk. This is typically out of alignment with most strategic investment plans as the goal is to have higher risk in the early years (allowing for greater accumulation over a long period) and to protect to a higher degree as you begin to use those assets to meet your needs.

The Gradient Investment Committee remains relatively positive on markets. We believe valuations are elevated in the US, but not at levels that cannot sustain given lower interest rates and a growing economy. The US consumer is healthy, both from an employment and net worth perspective, which tends to be positive for stocks as well. However, markets have a way of correcting at any time and shocks to the system are often unpredictable. That is the precise reason we suggest rebalancing to protect recent gains. Even in the face of our optimism, there is nothing wrong with re-appropriating assets to take off some risk, but still benefit if the market continues to rise. In that regard, here are some suggestions for actions:

- Rebalance back to your proper risk levels

- Understand your investment plan

- Taking profits to rebalance provides a more automatic method of “buy low, sell high”

- Incorporate some “dry powder” to your asset plan

- Rotating to safer assets with less downside risk protects your gains

- Having those safe assets allows investors to be more opportunistic during corrections

- Incorporate assets that provide some protection (like the Gradient Buffered Index portfolio)

- Buffered notes provide some downside protection for falling markets

- Buffered notes also provide the ability to participate if markets continue to rise

To expand on these Market Reflections or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.