The last two weeks of January hinted that the coronavirus might negatively impact the financial markets. The late January sell off was mild and U.S. stocks quickly reversed course and rose to new all-time highs by mid-February as employment and manufacturing numbers showed strength. Shortly thereafter, some companies began to publicly quantify the negative financial impact from the coronavirus and the markets retreated from their all-time highs. When the virus began to spread aggressively outside of China’s border through Europe, Korea and the Middle East, the bottom quickly fell out of the global stock markets.

The speed and magnitude of this correction shocked all investors as $5 trillion in market value vanished in one week. The roughly 12% stock decline was painful, but not without precedent. Stocks and viruses have a history and this time around is not that different, so far. Back in 2003, the SARS virus was the top story leading a 12.8% decline over a 38-day period. In late 2015, the Zika virus caused a 12.9% decline. After these viruses ran their course, the markets eventually recovered to hit new highs.

After the dramatic week that we all endured, it’s important to put things into perspective.

- S&P 500 was up over 30% in 2019

- Year-to-date the S&P 500 is down 8.3%

- The bull market in stocks is eleven years strong

- Corrections are a fact of life in all bull markets

- The last meaningful correction was in the fourth quarter of 2018 and a correction was overdue

- Interest rates are low and the economy is still positive

The catalyst for this correction has been biological. It is fear based, not fact based. If all of these fears come to fruition, the economic facts will eventually change and the correction will be justified. If the coronavirus is adequately contained or a vaccine is developed, this market will rebound as quickly as it sold off.

The U.S. began the year on solid economic ground and so far nothing has changed. Companies with significant exposure to China are going to be affected as China has basically been shut down for a month. Supply disruptions are real and can have a temporary negative impact on those companies. If a pullback in earnings or economic activity does transpire, it will likely be short lived and offset in the year ahead. The U.S. consumer holds the key to future economic prosperity. The depth and duration of the coronavirus scare will influence consumer confidence and ultimately the magnitude of any further correction.

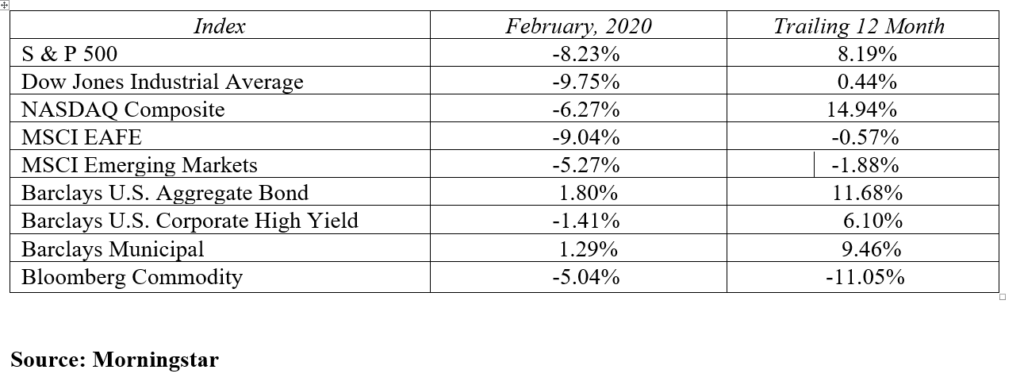

Obviously, this was a tough period for stocks as every major market looked to discover a bottom to rebound from. Global equities endured their worst declines since the 2008 financial crisis in the last week of February. Commodities also plunged as concerns about the coronavirus sending the global economy into a recession. Gold was a bright spot as fear drove investors to the buy the safe haven asset. In February, U.S. stocks were down 8.2% as measured by the S&P 500. International developed countries and emerging markets were also hit hard falling by 9.0% and 5.3% respectively. Oil fell 13.6% for the month coming off its worst week since 2008. Most of the price declines so far were panic driven. There may be more panic to come if the virus worsens. If the coronavirus lingers, weak consumer demand could induce an economic slowdown. At some point a great buying opportunity will emerge.

Despite all the fear based stock market turmoil, the bond market was a major beneficiary as interest rates moved even lower. This flight to quality trade sent interest rates to all-time lows. U.S. Treasury yields on 2-5 year maturities traded below one percent for the first time ever and the 10-year Treasury note was not far behind, closing the month yielding 1.13%. The yield curve has maintained its positive upward slope with 2, 5, 10 and 30-year maturities yielding 0.86, 0.89, 1.13 and 1.65 percent respectively at month end. The already hot housing market will now have even lower mortgage rates available for new buyers and those homeowners looking to refinance their existing mortgages.

After the disastrous week that was, the Federal Reserve weighed in with some comments to help calm market fears. The comments assured investors they are closely monitoring the effect of the coronavirus on the economy and stand ready to cut short-term interest rates if necessary. Fed watchers are now projecting there is a 100% chance of a 50 basis point rate cut by or at the next Fed meeting on March 18, 2020. While a Fed rate cut may provide a psychological benefit to the market, it will do little to change the trajectory of this virus lead market correction. When the biological threat is deemed under control, the market will heal.

For those investors who have implemented a systematic plan of portfolio rebalancing, please be reminded this strategy works well in both directions. In recent monthly commentaries, we addressed the power of using market strength to rebalance your portfolio back to its targeted risk tolerance by selling stocks (the outperforming asset) and buying bonds (the underperforming asset). For those investors who took this step – congratulations. You now have the opportunity to rebalance in the other direction. Stock market weakness, like we just experienced, opens the door to raise the risk of your portfolio back to target by selling bonds at higher prices and buying stocks at lower prices. For those investors with a solid asset allocation and proper diversification, just keep on plugging. Don’t panic in the face of fear, do not let fear dictate your next investment move and most of all stay invested for the long haul.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222