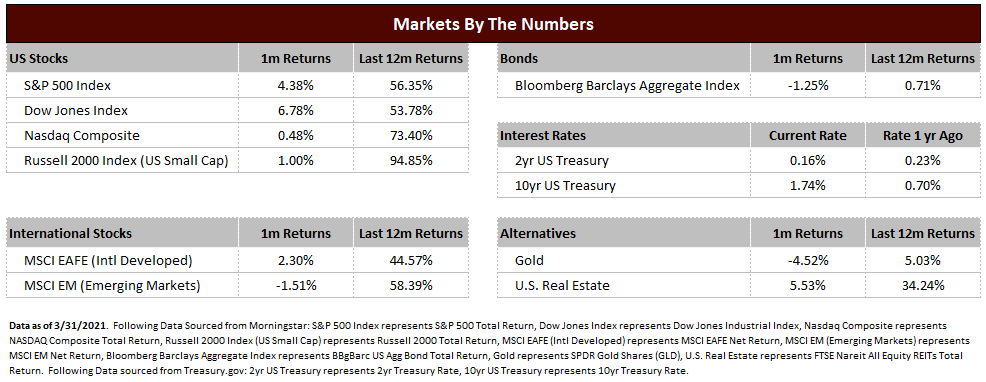

The markets had another relatively strong month in March. It has now surpassed a year since the severe market correction due to initial COVID-19 shutdowns, and the one-year return data is beginning to reflect the significant comeback we have witnessed in the stock market. The S&P 500 and Dow Jones indices are both up over 50% since last March. As is often the case with the stock market, the time to buy is often when it feels the worst to do so.

In the bond market, the continued rise of longer-term interest rates has had a negative influence on bond prices. While the U.S. Federal Reserve has kept short term rates near zero since March 2020, 10-year treasuries (a proxy for long term interest rates) bottomed at 0.52% in August 2020 but ended March 2021 at 1.74%. The economic recovery and potential inflation rising as a result of spending initiatives has played a role in this rise and this trend could continue if economic growth and inflation accelerate through 2021.

Currently, the U.S. market is mainly focused on the amount of vaccines being deployed (shots into arms), the effect of recently passed stimulus, and the infrastructure bill being proposed (spending). Regarding vaccine deployment, state eligibility is widening in almost all circumstances with many states now allowing all adults to be eligible. This has come as a result of increased vaccine supply levels and the expectation those supply levels will continue to rise going forward. While this has led to significantly lower COVID cases, hospitalizations, and deaths compared to the peak months, there has been a recent flattening out on the progress as states have eased restrictions. This situation is worth monitoring but should begin to improve again in the future as a higher percentage of the U.S. population is vaccinated.

The current administration continues to press their budget agenda and the predominant focus has been toward the recently passed stimulus measures to support the economy and a large spending agenda aimed at improving the U.S. infrastructure. It is our expectation that the infrastructure agenda will be a slower process than the recently passed stimulus measures and may go through significant changes prior to an actual vote. Whether it passes or is not, the direction of both federal and monetary policy is clearly pointed toward expansion and there is no suggestion of it letting up any time soon.

Going forward, we continue to see opportunities for the market to grind higher while the picture for bonds is less attractive.

- Economic expansion should accelerate along with job growth, especially in hospitality and restaurant industries which are still well below prior peaks.

- Consumers are in relatively healthy financial shape and, with easing COVID restrictions, will be able to begin to spend more aggressively.

- U.S. business earnings growth should accelerate as a result of greater spending and less restrictions

All these items tend to be positive for stocks. They also tend to lead to increased interest rates which act as a headwind for bond prices. Further, potential inflation as a result of high levels of growth and liquidity can be negative for both assets but is more damaging to bonds.

It is our opinion that investors maintain course and stay invested within their plan. It is unlikely that the levels of return that we have witnessed over the last year continue at the same pace going forward, but that doesn’t mean stocks should be abandoned. Also, while we do see a headwind to bonds, investors should not look at this as a reason to eliminate safe assets from their portfolio. Recognize that the balance in a portfolio is done to not only diversify but to provide ballast in times of both prosperity and unpredictability.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222