October was a positive month for the market, with some of the largest companies in the world driving positive performance back to all-time highs. The worries that came in September were swept away in October; even as economic data is starting to show some signs of softness. It’s clear that the current market trend is upward. Investors are not searching for as many reasons to sell but instead looking for opportunities to buy.

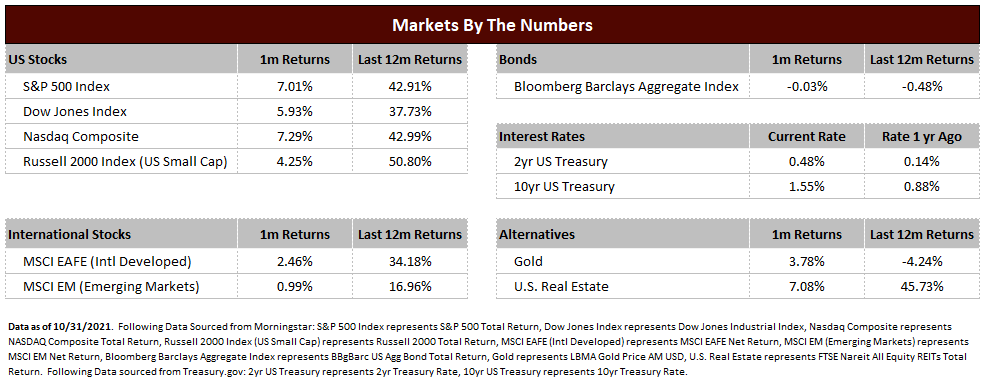

Stock markets in the US were strong in October. The S&P 500 was up 7.01% during the month and the Russell 2000 (small cap stocks) were up 4.25%. International stocks weren’t quite as strong but were still up as developed market stocks were up 2.46% and emerging markets were up 0.99%.

US large cap stocks were led by some of the largest companies in the world. Microsoft (MSFT) is up over 50% in 2021 and the market capitalization of the company ended the month at a staggering $2.49 Trillion. This market cap has now superseded the second largest company, Apple (AAPL), with a market cap of $2.48 Trillion. The most recent entrant to the Trillion Dollar Market Cap club, Tesla, is now up over 57% this year after a rapid rise in October.

Bond performance continues the stagnation seen since the massive outperformance during the COVID driven correction of 2020. Interest rates are higher than the levels of last year, creating a headwind to performance for both treasury and investment grade bonds. Despite the stagnation, flows into bond funds and ETFs remain steady as investors continue to use bonds for low levels of income but also to protect portfolios from potential future stock market declines.

Despite the market trending positively, economic and fundamental business data hasn’t been as overwhelmingly positive. GDP estimates, which reflect US economic growth, are still positive but have been trending down as supply chain issues have caused product delays and higher prices on goods and services. Companies have also been reporting earnings in October, and while year over year growth remains strong, the levels of positivity have been watered down somewhat by supply chain constraints and the rising cost of labor.

While these trends are worth monitoring, Gradient Investments still views the level of demand from a healthy US consumer as the predominant reason to remain positive. Supply problems and higher prices may persist in the short term, but fixing these issues is usually an easier task compared to trying to stimulate demand from an uneasy consumer. Supply chains will adjust to meet demand, and a healthy consumer with a desire to spend usually is a good recipe for US businesses.

As the last 2 months have shown, fears residing in markets in one month can transition to high levels of exuberance in the next month. It is important to not react to a roller coaster of news and information that can create an emotional short-term response that will derail long term efforts. The best way to do this is by building a fully tailored, well designed investment plan that can protect assets but also participate in market upside and keeping the risk aligned with your personal objectives.