Markets stumbled out of the gate in 2022 after a very strong end to 2021. In January, most global asset classes were down as the primary concern of investors transitioned from COVID to rising inflation. While market corrections are unpleasant for stock investors, they are common over time and the volatility derived from a correction can create opportunities to add value over the long term.

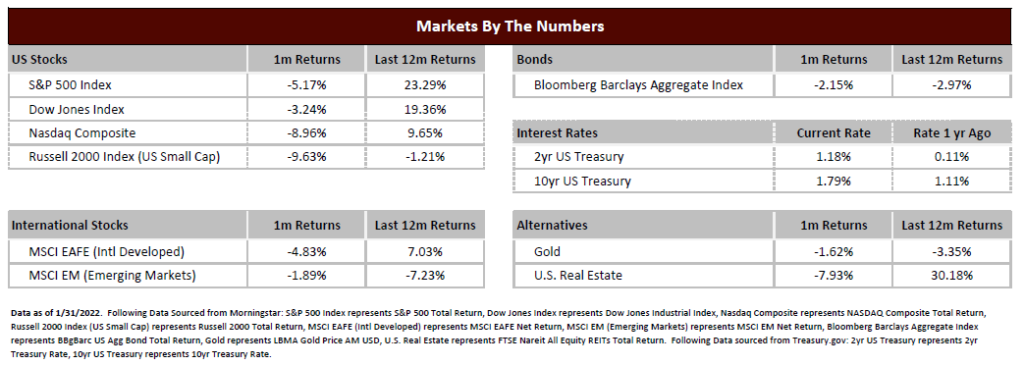

The S&P 500 index declined by 5.17% as investor concerns around inflation and what the US Federal Reserve would have to do to curb inflationary prices created selling pressure on stocks. NASDAQ stocks, which are more weighted toward growth technology and biotech, fared worse than the overall markets and had their worst January since 2008. US small cap stocks and both international developed and emerging market stocks also faced declines for the month.

For the bond markets, interest rates were the primary detractor for the Barclays Aggregate Bond Index. The 10-year US Treasury rate increased from 1.52% to 1.79% during the month, creating a headwind for bond prices. This has been the general trend over the last year as the widely utilized bond index has had negative performance during that time.

During stock market corrections, there is typically a wide swath of reasons provided for the price declines. At no time in market history have there been zero concerns in the markets – it is simply a function of investing for an unknown and uncertain future. The primary concern is now inflation. We are at the highest levels of inflation since 1982 which has real consequences for the economy as companies have to pay more for employees and raw materials. Those increased costs can also suppress the spending appetites of US consumers. Higher inflation also tends to spur the Federal Reserve into action as one of their mandates is keeping inflation at controlled levels. Currently we are well above their inflation threshold and, as a result, Fed commentary has transitioned from “if” to “when and how much” on the trajectory of rate increases. The concern that comes from rate rises is the Fed becomes overly aggressive and chokes off the growth of the economy.

In our opinion, inflation and the Fed reaction are worth monitoring but are manageable risks. We expect inflation to be elevated for the remainder of the year, but we see a path for deceleration in price growth in the summer. Further, while the Fed is transitioning away from the support it has given the economy since COVID, it doesn’t automatically mean we are nearing the end of growth in the US economy.

When we examine the fundamentals, our stance is still relatively positive. US consumers are healthy, have jobs, and their wages are rising. Additionally, there is pent up demand for spending that hasn’t been fully unleashed yet due to continuing COVID cautiousness. Companies are generally beating their earnings expectations, and growth is expected to continue at an above average pace despite the headwinds from rising prices. Lastly, as a result of the recent correction, stock price valuations have come down. Stocks are still not cheap, but the valuations for some companies have now come to levels where they are more attractive than they’ve been since the significant decline in 2020.

Based on this data, our fundamental forecast and outlook has not changed. We still expect bonds to have a challenging 2022 as we expect interest rates continue to rise throughout the year. For the stock market, we still believe markets can work higher, but our expectation of higher volatility in 2022 has already come to fruition. Corrections are a normal part of investing and the relative calm of last year is the exception, not the rule. Staying invested through the challenging times, and remaining nimble and flexible toward opportunities, remains the best approach to meeting the long-term objectives for your money.

If it is a commentary: To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222