Markets faced a second straight month of declines as geopolitical fears combined with existing inflation concerns increased market volatility and led to a rise in fear-based selling. Stock markets are now firmly in correction territory from the all-time highs seen on January 3rd, 2022.

The main issues facing investors right now are increasing risk from rising prices (inflation) and geopolitical events (Russia/Ukraine conflict). The issue is that these are somewhat correlated as well. Because of the economic sanctions and restrictions imposed on Russia, as well as the continuing effect on Ukrainian exports, commodities such as wheat and oil may continue to rise in price. This exacerbates the inflation already present in many goods and services due to high demand and limited supply. When you combine these concerns with the near certainty of the US Federal Reserve increasing interest rates to combat inflation, there is question as to how much the US economy and consumers can handle.

Despite these issues, not all the news in the markets has been bad – some news remains quite positive:

- COVID cases, hospitalizations, and deaths are falling dramatically

- Restrictions as a result of COVID are declining, which should begin to reduce supply constraints

- Economic growth, employment, and the US consumer remain relatively healthy

- The US has little to no reliance on Russian oil or gas

- The majority of S&P 500 companies have reported earnings that exceeded expectations

- Earnings growth projections for 2022 remain in the 8-10% range and companies are healthy

At the beginning of the year, we communicated that one of our caution flags for 2022 was the valuation of the market. Simply put, stocks were expensive. As a result of this correction, and the limited change to the fundamental forecasts, stocks are now cheaper than they were at the beginning of the year. Now, could stocks continue to fall and get even cheaper? Absolutely. Stocks are coming down from elevated levels, but they still are not cheap. Time will tell if valuations continue to decline for the markets, but the price paid for stocks is more reasonable now than three months ago.

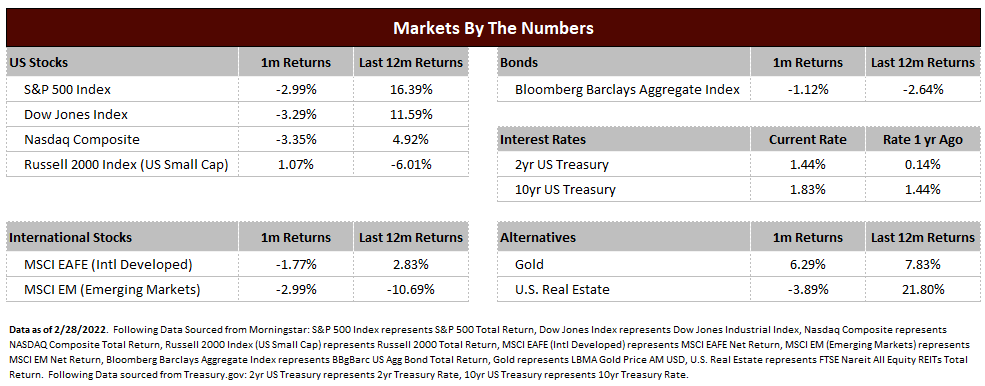

Another area we are seeing higher than average volatility is the bond market. Bonds typically provide ballast against stock market declines as investors look to bonds for safety when stocks are not working. This hasn’t been the case in 2022 as inflation and economic growth provide upside pressure to interest rates. When interest rates rise, bond prices fall. Furthering the difficulty in certain bonds is the elevated fear levels in the market, and investors during these times require higher premiums to take on default risk (called the credit spread). At the end of the year, credit spreads were near all time lows as there was little evidence of economic concern. Since that time, these spreads have been rising which also put pressure on bond prices.

Overall, most traditional investments have been challenging in 2022. Outside of precious metals like gold, there hasn’t been a lot of areas for investors to achieve positive returns year to date. These trends don’t last forever but can be painful when we are going through them.

These times are the most important to have a sound investment plan that incorporates both safety and growth assets. Times of high volatility usually means greater positive and negative swings and increased emotion as a result. Being concerned and emotional regarding investments is absolutely normal and should be expected. However, avoiding irrational action based on those emotions is the key to achieving your long term objectives.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222