April 2022 was not kind to either bond or stock holders. Stocks were down significantly, and in what has been a pattern this year, bond markets did not provide any relief and were down as well. The predominant concern of the market remains inflation and is causing consternation regarding future economic health, the consumer’s ability to spend, and the actions of the Federal Reserve needed to control rising prices.

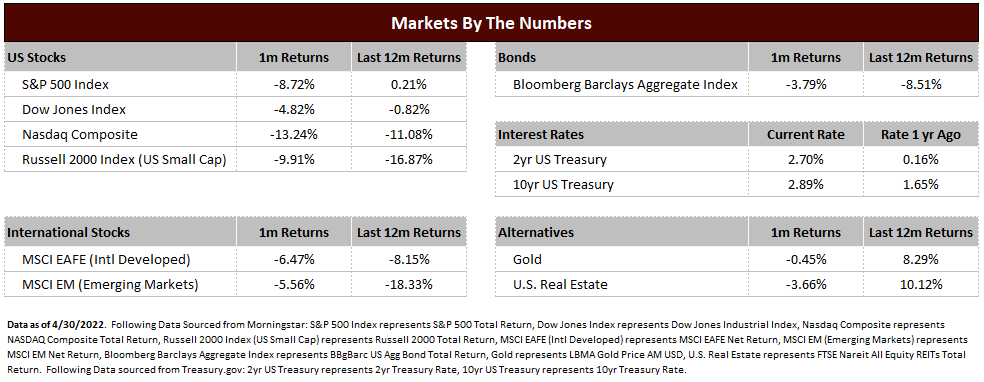

The S&P 500 index was down 8.72% in April, the worst month of performance since March 2020.1 Many of the underlying stocks have experienced performance far worse than the overall markets in 2022, especially stocks in the once high-flying growth space. Companies that were considered beneficiaries of the COVID shutdown have experienced a very difficult 2022, with companies such as Peloton (PTON), Zoom Video Communications (ZM), Netflix (NFLX), and Teladoc (TDOC) each down 45% or more year to date.2

Bonds, once again, failed to provide respite from the difficulties in the stock market. The Barclays Bond Aggregate Index (a widely used measure for the bond market) was down 3.79% in April and is now down 8.51% in the last 12 months. The bond market just experienced the worst quarter in 20 years4 and April continued on the negative trend. The most significant factor regarding bond weakness has been rising interest rates. Over the past year, the 2-year US Treasury rate has risen from 0.16% to 2.70% while the 10-year US Treasury rate increased from 1.65% to 2.89%. Rising rates have a negative influence on bond prices. Also, income generation from bonds were near all time lows in 2020 and 2021, which has left very little income to offset the price declines.

The source of nearly all market concerns is inflation. Rising prices, especially unconstrained rising prices, have a ripple effect across the economy and markets. For the economy, higher prices may create less ability for consumers to spend on things they want because the things they need (like gas and food) are more expensive. For companies, material costs and employee wages are rising due to high demand and low supply, which can have a negative impact on corporate earnings. Lastly, the actions to control inflation, usually done by the US Federal Reserve, also have a side effect of stifling growth and potentially causing a recession. Because inflation has been sustainably higher than anticipated, markets are responding to these events with caution. Bonds sell off because of the fear of continually rising interest rates and stocks sell off because inflation and subsequent Fed actions to control it could cause a future recession.

With all of this, we still have a relatively positive outlook from this point forward due to:

- A strong consumer that continues to show high demand for things like travel and restaurants

- Supply chain effects may alleviate to naturally lower the inflation rate as the year progresses

- Company earnings are still expected to grow by nearly 10% in both 2022 and 20233

If these fundamentals remain intact, the market decline into correction territory could provide an opportunity to add value and increase returns over the long term. While markets certainly have declined, the greatest damage was done in stocks with severely inflated valuations that have now come back to earth. High-quality companies that have receded despite no significant change to their earnings profile are now trading more cheaply than they have been over the past few years.

In short, it is our expectation that the market can stage a second half rally unless inflation continues to accelerate. We expect inflation readings to continue be elevated in the near term, but the inflation rate will reduce as we progress through the year. Lastly, we believe the Federal Reserve will raise interest rates, but much of the damage done in the bond market may have been done already.

Therefore, our recommendation is to remain within the scope of your investment plan and don’t completely avoid risk for safety. However, this is also not a time to overload on risk as there remains several economic unknowns, volatility remains high, and stocks aren’t cheap. However, for those investors that have held assets aside “for a rainy day”, investing a portion of that capital for long term higher returns may prove opportunistic at current market levels.

1https://www.washingtonpost.com/business/2022/04/29/markets-wall-street-april/

2stockcharts.com

3https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_042922.pdf

4https://www.morningstar.com/articles/1087132/13-charts-on-the-markets-first-quarter-performance

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222