Both stock and bond markets rallied in July despite economic data that reflects softening conditions and continued high inflation. Investors were encouraged by company earnings reports that showed a less bleak picture than feared. Overall, while we are certainly not out of the woods completely, the trend in July was better than the difficult markets experienced year to date through June.

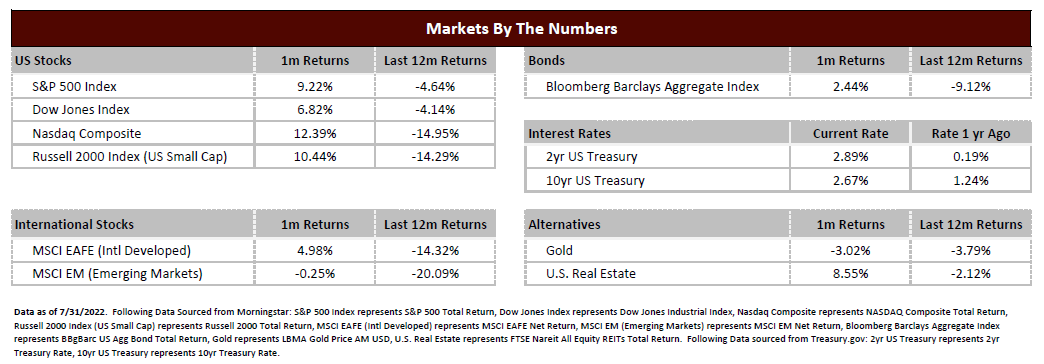

Stock markets staged a rally in July with the S&P 500 and Nasdaq up more than 9% and 12% respectively. International stocks were mixed as developed markets were positive while emerging markets were slightly negative. Despite the significant rally during the month, both US and International markets have had negative performance over the past year.

Bond markets experienced a rally in July as well, with the Bloomberg Barclays Aggregate Index up over 2%. The performance was driven by a precipitous decline in the 10-year US Treasury Rate which fell from a recent high of 3.49% on June 14, 2022 to 2.67% by the end of July1. When interest rates are declining, bond prices typically rise. Similar to the stock market, the bond price rally in July was strong, but the yearly performance is still negative as interest rates remain significantly higher than this point last year.

With regard to the economy, the early data on inflation in July was not promising. The inflation rate came in at 9.1%, a new 40-year high2. Inflation remains the number one concern of investors, but the recent discussion points have shifted. The concern isn’t as much regarding demand and the elevated prices themselves, but rather how these price increases will slow demand while the methods used to control inflation (raising interest rates) will be so aggressive that it will send us into recession. This concern was further exacerbated by the most recent GDP report, which showed a second straight quarter of decline3. This is not the official determinant of a recession, but two quarters of GDP decline has been a rule of thumb to reflect past recessions.

Contrary to economic data, corporate earnings have been a little better than expected and certainly better than the sentiment of investors going into earnings season. As of 7/29/22, 56% of the S&P 500 companies have reported earnings for the second quarter. Of the companies that have reported, 73% have exceeded their estimates of earnings for the quarter. Currently, the expectations for earnings growth in 2022 and 2023 are 9% and 8% respectively4. If this growth rate proves accurate, this is a relatively healthy backdrop for stocks.

In short, there are currently conflicting signals between trends in the economy and the trends in corporate earnings. Also, after a period of significant decline and subsequent rally, there are always questions about whether this was the beginning of a new bull market or just a short pause in a prolonged bear market. While we never know with certainty ahead of time, there are early signs that give us some hope for the future. Price declines for things like gasoline, corn, and wheat – which have a direct influence on consumer pocketbooks – are a positive sign for consumer’s ability to continue to spend to support the economy. We continue to listen to company analysis on their current earnings but, even more importantly, what they are discussing with regard to outlooks for the remainder of the year. Lastly, we are watching for any changes to a strong job market and the effects of pricing on consumer behavior.

Even if this period is determined as a recession or not, stock market investors are always focused more toward the future than the past. While we never know the absolute bottom in advance, history would tell us that the companies in the US market are adaptable, efficient and have weathered storms in the past and come out stronger on the other side. Therefore, investors who are patient, prudent, and have a well-defined investment plan are rewarded over the long term.

https://fred.stlouisfed.org/series/DGS10

https://www.cnbc.com/2022/07/13/inflation-rose-9point1percent-in-june-even-more-than-expected-as-price-pressures-intensify.html

https://finance.yahoo.com/news/q-2-us-gdp-gross-domestic-product-economic-activity-123214911.html

https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/

Earnings%20Insight/EarningsInsight_072922.pdf

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.