The choppy markets of 2018 continued to move higher in July as investors reacted to the news of the day. The headwinds were generally self-induced as Washington rolled out more tariffs in an effort to deliver a world with fewer tariffs. The final answer here is unknown, but any long-term improvement to free and fair trade will not come without some short-term pain. The market is handicapping this on the fly, and the days when we saw corrections seemed to correlate with escalating fears of expanding the trade wars. The tailwinds pushing the market upward, on the other hand, have been a result of strong corporate earnings or positive economic data.

This ebb and flow of positive and negative information is evident as the second quarter earnings season hit full stride in late July. Two of the FANG stocks were severely punished when earnings and outlooks for Netflix and Facebook fell well short of expectations. As a group, the FANG stocks are down 10% from their June highs. On the flip side, other companies like Coca Cola, Caterpillar, Pfizer, Apple and Datawatch posted great financial results and shareholders were rewarded. On the economic front, the U.S. generated a 4.1% GDP growth number in the second quarter which is beginning to reflect the positive effects on our economy of tax cuts, reduced regulations and a confident consumer.

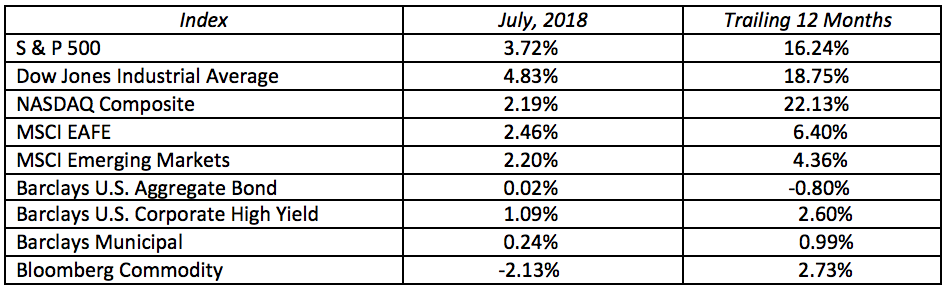

Stocks had their best month since January. International stocks, emerging markets and the U.S. stock markets all posted healthy gains for the month. The two major international indices (MSCI Emerging Markets and MSCI EAFE) were up 2.20% and 2.46%, respectively, in July. The much followed S&P 500 gained 3.72% while the Dow Jones Industrial Average posted an impressive 4.83% return for the month. The technology and biotechnology focused NASDAQ Composite added 2.19% as the FANG correction weighed on the index.

In the bond market, prices fell slightly after the benchmark 10-Year U.S. Treasury yield began a move back up toward the magic 3.0% point. The benchmark 10-Year U.S. Treasury yield moved up 11 basis points to yield 2.96%. The yield curve continued to flatten: the 2-Year Treasury rose by 15 basis points to end the month yielding 2.67%, and the 30-Year Treasury rose 10 basis point to 2.98%. While interest rates on longer term bonds are still low by historical standards, the short end of the yield curve is beginning to offer value as the 2-Year Treasury approaches 3.00%. We still believe owning fixed income securities in your portfolio will not hurt you, nor will they help your assets grow. Their value will either be an insurance policy against a stock market correction or a source of liquidity, income or price stability.

Expect heightened volatility to continue as we move down the road on trade and into the heat of the mid-term elections. Politics, elections, tweets and rhetoric are background noise which needs to be toned down. Earnings, valuation and economic results will shape the degree of volatility and the direction of the market. The latter are fundamentals which we monitor closely and ultimately drive long-term price movements. Our current market optimism comes from the solid fundamentals of strong earnings and economic growth. Stay invested and focus on the fundamentals, not the noise.

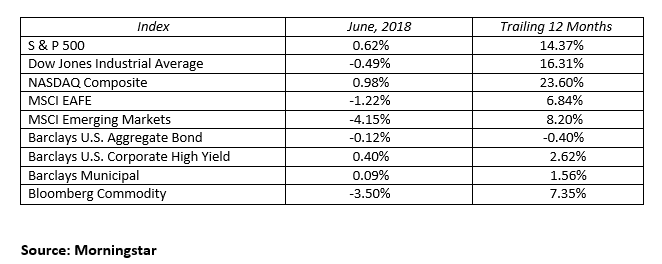

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222