It is important to have and maintain the proper perspective and attitude in your financial journey. The lenses through which we view the world shapes both our market and political views. When your eyes become older, or shall we say more experienced, you realize two lenses may be required to see clearly. Bifocals perform a great service for those of us seeking clarity. As investors, we should use one set of lenses to assess the political landscape, and another set to analyze the markets. Separating your political views from your market assessment will provide a much sharper market focus. A key role of Nevada Retirement Planners is to help you navigate through all the noise and distraction, while getting your portfolio keenly focused on your financial goals.

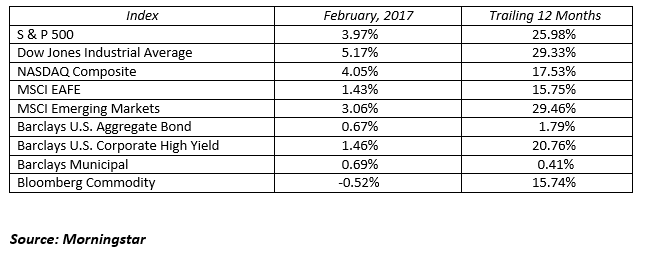

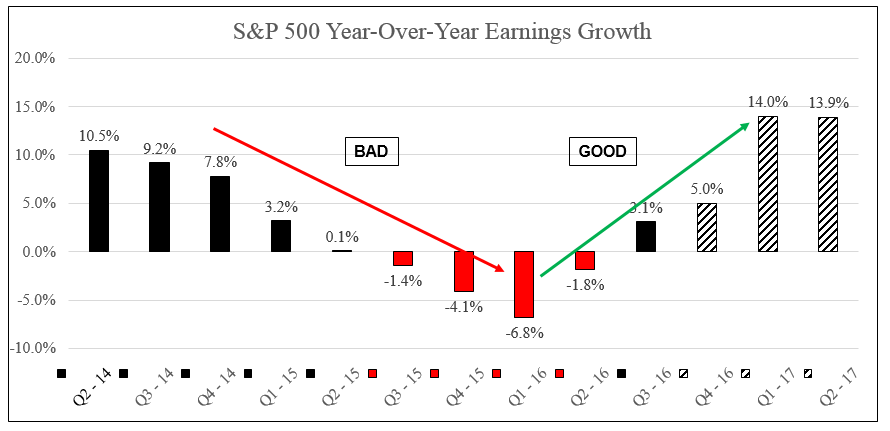

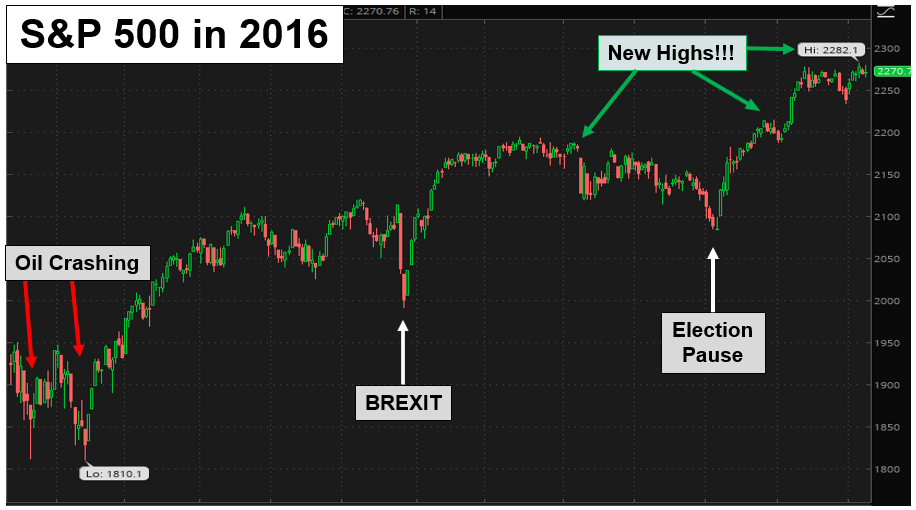

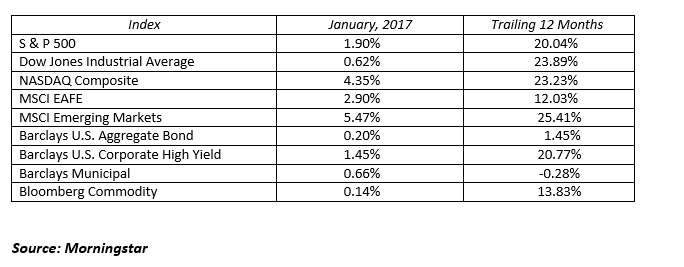

Let’s focus on the markets. In February, the bull market in U.S. stocks continued its run to levels never before seen. Dow 20,000, once an unreachable peak is now 812 points in the rear view mirror and Dow 21,000 is knocking on the door. It was a remarkable month for stocks with only five down days and twelve consecutive record breaking closes for the Dow. Market leadership came from the consumer goods, healthcare, and financial sectors. Apple was the one thousand pound gorilla in the room, gaining an amazing 12.8% in the short month. Healthcare was led by Pfizer and Johnson and Johnson with returns just below 10%. Banks had a solid month across the board as the prospects of higher interest rates would improve net interest margins and the proposed peel back in regulation provided additional fuel for their rally. Basic materials took a breather led by declines in some of the major oil companies like Exxon which was down just over 4%. The U.S. stock market as measured by the S&P 500 gained 3.97% in February, outpacing the emerging markets and international markets which returned 3.06% and 1.43% respectively.

Interest rates, which have gone absolutely nowhere this year, should begin to drift higher as the economy continues to grow and Washington discovers fiscal policy once again. Fiscal policy is important to the Federal Reserve because it provides them more latitude to implement a more restrictive monetary policy. Chairwomen Janet Yellen made clear in testimony to Congress that rate hikes are “on the table” for their March meeting and I imagine each Fed meeting this year. The Fed needs to return to a normalized monetary policy before they can begin addressing their bloated $4.5 trillion balance sheet. The Fed has a long way to go and raising the Fed Funds rate is just the beginning.

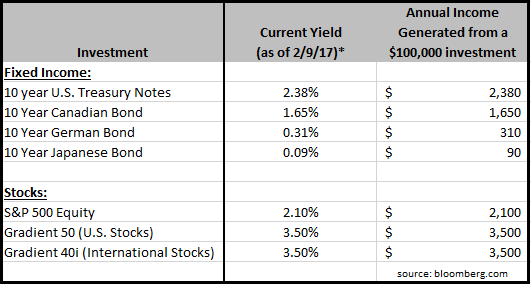

Higher interest rates mean lower bond prices. Time also plays an important role in bond price action. We believe the rate rise this year will be gradual. This means the income earned from bonds over the course of the year will have the opportunity to cushion the price decline. This path is less painful than an immediate rise in interest rates which causes a sudden price decline. In this scenario, investors need twelve months of income to repair the effects of a sudden rate increase. It’s okay to own bonds for the basic reasons of income, principal preservation or volatility control, but temper your expectations from this asset class. Earning the coupon alone would make for a great year in bonds.

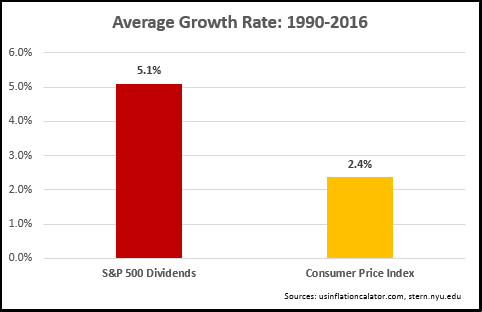

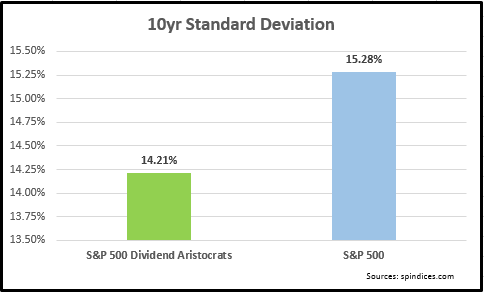

Whether your t-shirt reads, “Make America Great Again” or “Dump Trump”, please check it at the door and embrace the financial markets on their own merits. As explained in last month’s commentary, we are positive on the global stock markets in 2017 and cautious on the outlook for bonds. The path will not be a straight line higher, rather periods of strength followed by consolidations as news and revised expectations are priced into the markets. If watching cable news is now a hobby, either embrace the perceived chaos you hear every night or change channels if your market view is being swayed. Nothing trumps a solid financial plan. Stay on your path.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222