by Jeremy Bryan

Stocks came out strong in January as attitudes regarding the economy and corporate earnings began to strike a more positive tone. While it can be argued that not much has changed from a data perspective, investors clearly have reacted differently, and that sentiment change has driven markets higher.

Based on recent economic data, the US economy is remaining resilient. Gross Domestic Product (GDP) reflected continued growth in the US economy, unemployment rates remain near 50-year lows, and recent inflation trends have suggested the worst may be behind us.

Typically, investors aren’t as concerned about what has already happened, but what is ahead. It has largely been assumed that economic data on US growth and jobs would begin to slow. The concern is whether the actions undertaken to slow inflation would lead us into slower growth but no recession (“soft landing”) or place us into recession (“hard landing”).

Corporate earnings reports and the outlooks from companies for the year ahead will be closely monitored to give investors insight into the health of the economy and the possibility of a recession. Clearly, there has been a slowing of activity in certain segments, with many companies in the technology space announcing layoffs after several years of aggressively hiring to support growth. Other industries are expressing prudence and caution, but many have also suggested that the strength in the job market has kept the US consumer active and spending.

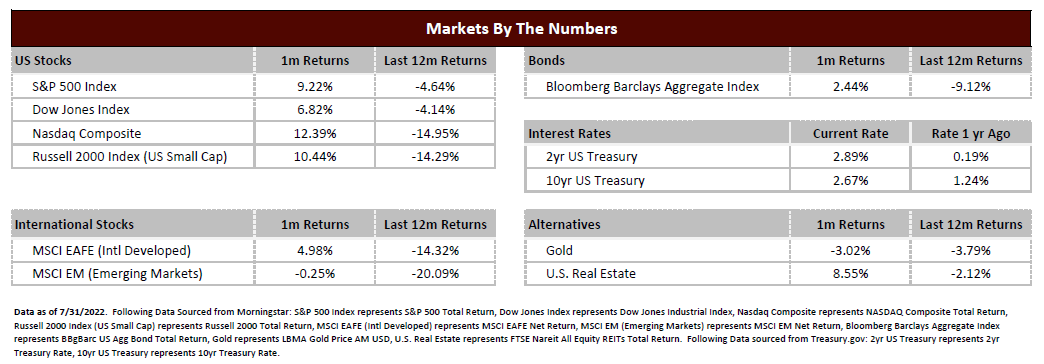

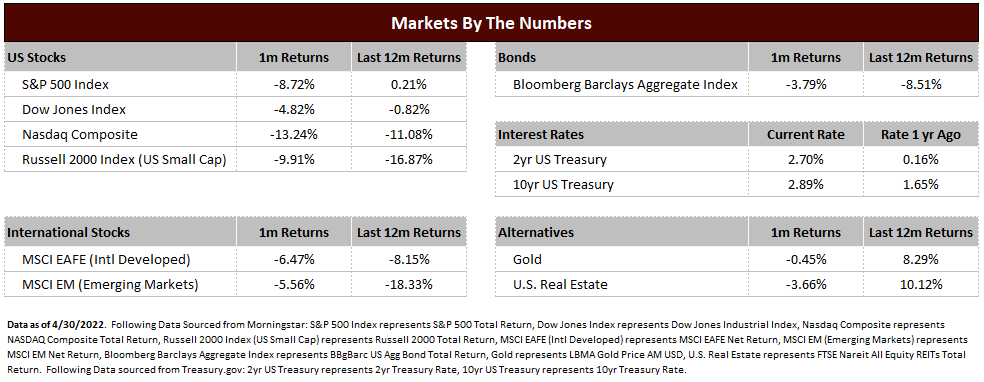

From the stock side, the lack of significant deterioration and the higher potential of a “soft landing” has provided the backdrop for a January rally. Further, many of the stocks and sectors hit hardest by the decline in 2022 have reversed trends in January and have been very positive. The Nasdaq index, which is comprised of growth stocks, had a difficult 2022 but had the strongest rebound in January. Small cap stocks were also significant performers during the month after a difficult time last year.

Bond performance also rebounded in January after experiencing one of the worst years in history. Long term interest rates declined, which provided the largest buoy to bond performance during the month. Finally, alternative assets like gold and real estate also had strong months as investors began to re-engage across asset classes. The question is, after a strong month, can we sustain this rally for the year? Historically, a strong January tends to have a positive correlation with above average returns in markets. Second, it is a rare event that stock markets experience back-to-back negative years, last happening in 2000-2002.

Also, the current consensus expectation of a recession is not a great predictor of market performance going forward. In our opinion, the logic follows that if something is widely expected, the realization of the event should not be a terrible surprise. So, if we were to slip into a very short and shallow recession in 2023 with a period of slight decline and job loss that doesn’t exceed 6%, it is our opinion that the bottom of the market may already be in place, and we could have already started toward the next bull market.

We would caution, however, that this doesn’t mean there aren’t concerns in the market, nor does it mean that volatility is a relic of the past. Inflation trends are getting better, but that doesn’t mean they can’t revert. Company outlooks have been prudent, but that doesn’t mean they can’t worsen. Job loss, and consumer worries about their jobs, could have a negative effect on spending.

This is why we balance our optimism with prudence. This is done by advocating for a blend of growth and safe assets, and having an investment plan that is oriented around your long term objectives and risk tolerance. Markets are incredibly hard to predict from year to year but staying invested through the bad times to be rewarded by the good times remains the best way to achieve the goals for your money.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.