As the first month of the new year unfolded, there are several different issues currently at the forefront of investors’ minds. A new administration is beginning to rollout more detailed policies regarding their agenda, and these actions have provided divergent opinions on how this will affect the economy. Issues surrounding COVID and the restrictive polices enacted to contain further spread and loss of life are being weighed against a vaccine distribution effort that provides hope that we can begin the process of a return to normalcy. Lastly, we have experienced a unique market event that has caused certain stocks to rise significantly with extreme volatility, captured the attention of the media, and introduced obscure financial terms like “short squeeze” into the national conversation.

Let’s begin with the last point first. There has been a recent list of stocks that have performed extraordinarily well in a short period of time. These stocks are heavily “shorted”, which simply means borrowing an allotment of shares in order to profit from the decline in the price of that stock. Shorting stocks is done predominantly by large financial institutions such as hedge funds. What we have witnessed is a collective group of individual investors using social media on Reddit and the trading platform Robinhood to target these hedge fund holdings. These investors have profited off the need for hedge funds to repurchase shares rapidly to “cover” their borrowed stock. This rapid covering accelerates these individual stock prices higher and is called a “short squeeze”.

While this activity certainly garners attention, and for some can be profitable, historically these instances of collective mania have ended in pain and loss for most participants. We would not call this current activity “investing” – this is rampant speculation. At Gradient Investments, our objectives are to provide clients with a sound investment plan to achieve their long-term goals within the parameters of their risk tolerance. While this speculative action may be tempting, especially as prices rise significantly, it is not in keeping with our investment philosophy and we will concentrate our efforts elsewhere.

Turning to other matters of the markets, the ebbs and flows of COVID continue to be the predominant driver of the global economy. The newly established Biden administration has detailed plans to accelerate vaccination rollouts and provide further stimulus to individuals to weather the continued restrictions. The benefit of these activities is they may allow for a speedier recovery and eventually turn savers back into spenders for businesses hurt by these restrictions. The potential cost is the unproven nature of these efforts combined with greater deficit spending, higher overall US debt, and potentially high inflation.

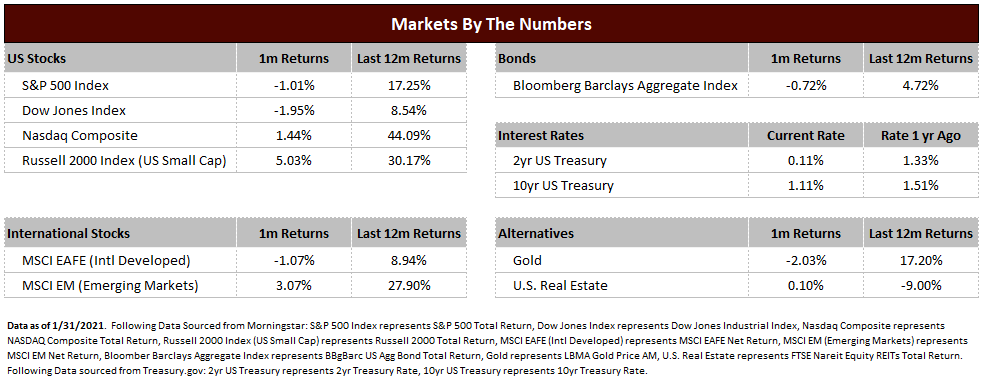

Market performance was mixed during the month. Stocks came out of the gate roaring as the momentum seen in the later part of 2020 continued into 2021. As the month ended, however, news regarding continued shutdowns lengthening the stalled economy began to weigh on market performance. The large stock indices, the S&P 500 and Dow Jones, were slightly down for the month but have rallied significantly over the last year. Small cap and emerging market stocks continued their recent strength during January. In the bond market, long term interest rates rose above 1% for the first time since March 2020 in anticipation of higher economic growth and potentially higher inflation. This had a negative effect on bond prices during January.

Overall, there is still hope of better economic times forthcoming, with actions that could suppress the negative effects of COVID and allow businesses to fully engage with consumers. The markets, however, have not recently been perfect reflections of economic activity, but instead have maintained resilience during the most challenging times while looking forward to brighter times ahead. In general, portfolios have performed quite well during this time of economic difficulty, and now is a good time for review to ensure that your current allocation fits with your specific needs and the risk you are willing to accept. Periodic reviews help to keep portfolios aligned with your investment plan and adjust as those needs change. Adjustment and rebalancing do not require drastic action, but they do offer the ability to refocus and refine portfolios as needed.