Stocks continued to show positive returns in April as company earnings reports began to prove what was widely anticipated – the U.S. is recovering and growing. Most indications of business fundamentals – whether recent positive economic data or a significant number of companies exceeding their estimates – suggest that the US economy is rebounding to a greater degree than anticipated and consumers are beginning to return to some level of normalcy.

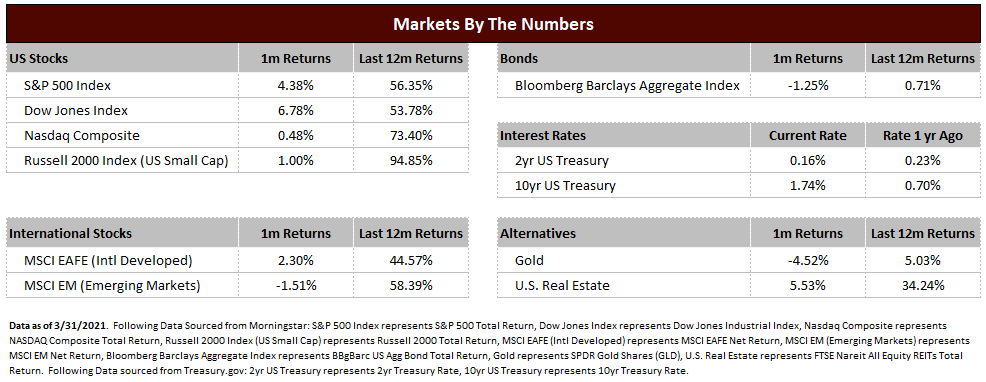

Stocks were up across the globe in April. The S&P 500 was up 5.34% for the month and has returned over 45% during the last year. Market returns are typically driven by three factors: earnings growth, dividends, and market valuation. Both earnings and dividends are growing and are a tailwind for market performance. Valuation, while expensive compared to history, has not significantly deteriorated as positive sentiment on the markets combined with still low interest rates have supported the above average valuations.

Conversely, the bond market has flattened over the last year as we have surpassed the year anniversary of the significant rate declines seen as a result of COVID-19 shutdowns. The 10-year U.S. Treasury rate on April 30, 2020 was 0.64% and ended April 2021 at 1.65%. Rising rates tend to be a headwind to bond values and is reflected in the -0.27% performance of the Bloomberg Aggregate Bond index over the last year.

As stated last month, the discussion in the markets was primarily centered around vaccinations and federal spending via a proposed infrastructure bill. As anticipated, the US is beginning to see a plateau and slow reduction in cases and deaths due to COVID. As vaccines continue to proliferate, this trend should continue. Second, the infrastructure bill is now a matter of political debate and we continue to expect this to be a longer discussion with several changes before finalizing for a potential vote.

Now that we are in the midst of companies reporting performance and providing updates to their outlooks for the year, there is a definite level of positivity about current business situations but also what is still forthcoming. There is little doubt that investors are receiving positive feedback for taking investment risk, and even potential negative data has been viewed through a relatively positive lens.

During these times, we believe it is prudent to maintain some level of balance and not to shift risk aggressively higher to chase returns. From what we can see, market performance can continue to grind higher from these levels as fundamental data continues to accelerate. However, corrections inevitably happen in markets and are typically driven by factors that come as a surprise. This is the primary reason to have a well-defined investment plan with a diversified set of assets. Safe assets always feel like wasted opportunities during times of significant market increase, but they also act as a form of ballast when the seas turn rough.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222