The markets and the Olympics shared some commonalities this month. Records are being broken on a daily basis, very few spectators are attending the actual events and it does not have quite the same buzz as past Olympics. Same can be said for the financial markets as record cash sits on the sidelines waiting for the next 2008. For the first time since 1999, all three major U.S. stocks market indices closed in record breaking territory on the same day. This is quite a turnaround from the start of the year when global markets tumbled. The questions are: how did we get here and what keeps the markets moving higher?

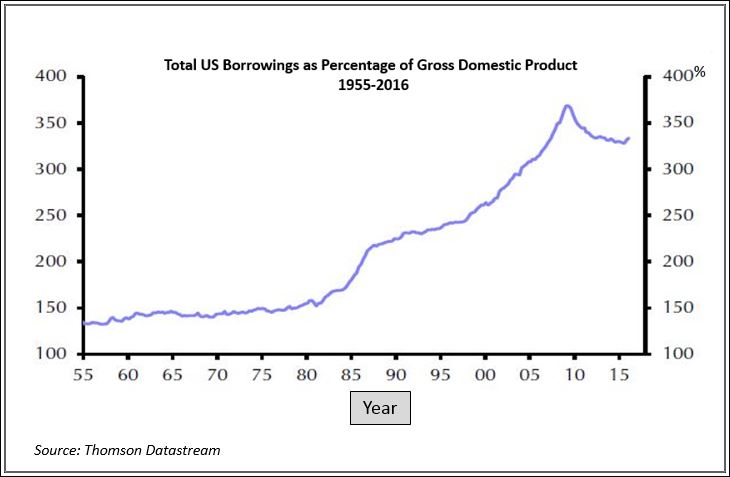

Global central banks explain some of the market strength as they continue to support risky assets with easy monetary policies. Investors are skeptical that the U.S. Federal Reserve will raise interest rates soon, while central banks in Europe and Japan have loosened monetary policy this year. This has left global stocks higher and bond yields at all-time lows. Stable oil prices and currency valuations are also giving stocks support. Oil prices rebounded to the mid-$40’s per barrel on expectations that the Saudis will push for limited production at the next OPEC meeting. The 2015 strengthening in the U.S. dollar has been replaced with relative calm. The stable dollar is helping U.S. corporate earnings as 70 percent of companies have reported quarterly earnings above the mean estimate, according to FactSet.

The economic numbers in August were generally good, and even weak economic news has been interpreted as good news for the market. Weak retail numbers showed sales growth was flat in July, and strengthened investors’ belief that the Fed is unlikely to raise rates when it meets next month. Good news has been treated as good news too. Inflation as measured by the CPI remains well below the Fed’s 2 percent target. The 0.5 percent gain in manufacturing output in July may be an indication last’s year’s dollar surge is behind us. Consumer confidence remains high in August with a reading in the low 90’s. The July employment report showed a second consecutive month of strong job growth.

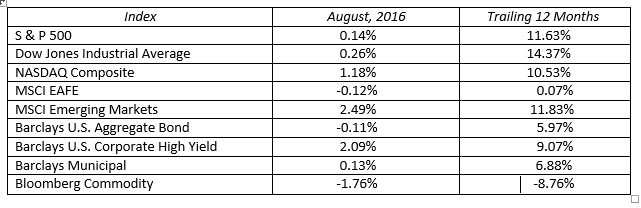

All things considered, the markets seem to be in their happy place. The combination of slow growth, low interest rates, accommodative central banks, recovering energy prices and stable currency has been a recipe for appreciation. For the month all major stock indices posted small gains, both here and abroad. The leading sectors were financials, energy and technology.

The yield on the 10-year U.S. Treasury Note traded in a very tight range, starting the month at a 1.49 percent yield and ending the month at a 1.57 percent. The Fed’s play book appears to be a repeat of last year as they likely implement one 25 basis point rate hike prior to year-end. The only real question is timing. Will it be a pre-election September or a post-election December move?

If you want to be an Olympian investor and go for the gold, you need to bring a similar level of discipline and commitment to your investment program. The spectator sees the champion athlete on the podium receiving their medal, but does not appreciate the hard work and sacrifice expended in achieving the reward. Success takes a lot of hard work and a little bit of luck. The journey to reach your financial goals takes time, patience, hard work and a positive attitude. Like the devoted athlete, keep striving to make your financial plan the best it can be.

MARKETS BY THE NUMBERS:

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222