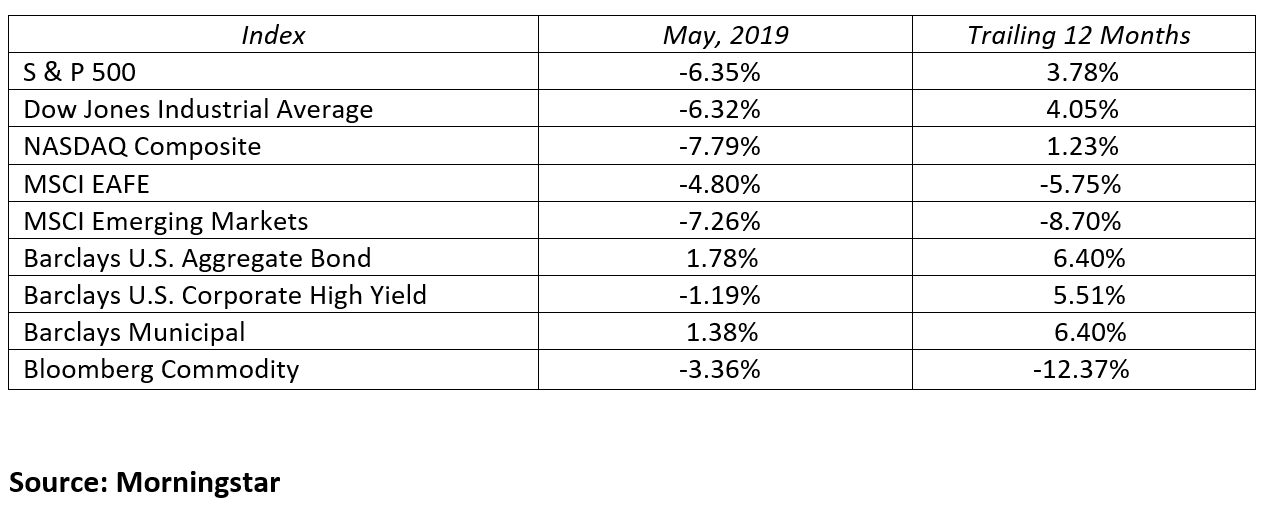

The second quarter was a microcosm of the previous three quarters. The quarter began with U.S. stocks trading higher into uncharted territory. The euphoria was short lived as expanded tariff concerns took center stage in May. This resulted in a swift 6.5% stock correction. Enter June and new market friendly comments from the Federal Reserve sent the stock market back into rally mode to finish the quarter on a strong note. As stocks rotated from bullish to bearish and back to bullish again, the bond market was quite resilient. Initially, long-term interest rates edged higher, but the mid-quarter stock correction, dovish comments from the Fed and lower global interest rates allowed yields to decline across maturities from 2-years to 30-years.

News on the economic front was generally positive in the second quarter. First quarter U.S. GDP was initially reported at a 3.2% growth rate and later revised to 3.1%, still well above the 2.4% expected rate. Economists are expecting 2019 GDP to produce 2-3% growth. The strong consumer has been the backbone of this economy and key metrics such as personal income, personal spending and retail sales all gained this quarter. The employment picture remains bright, and a 3.6% unemployment rate is the best in 50 years. Despite new tariffs and a strong dollar, the annual inflation rate is still running very close to the Federal Reserve’s 2.0% inflation target.

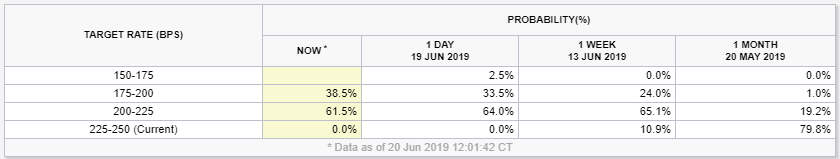

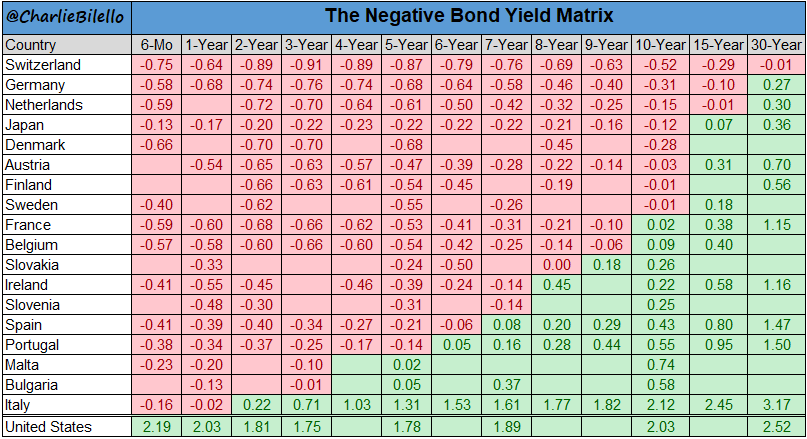

The current U.S. economic expansion began 10 years ago and still has additional room to run in our opinion. While growth has been modest throughout this recovery, the length of stable economic growth with low inflation has been impressive. While the next recession may be a few years away, some early warning signs are worthy of surveillance. An inverted yield curve has preceded the last seven recessions by 14 months on average. The yield curve from the 3-month T-bill to 10-year Treasury note is currently inverted, but the more widely recognized 2-year to 10-year segment of the yield curve is still positively sloped with yields of 1.75% to 2.00% respectively. International growth is slowing as strained trade relations pressure economic activity, but growth is still positive. JP Morgan publishes a monthly multi-factor recession risk monitor; currently they project a 43% probability of a recession a year from now, up from a 25% probability a year ago.

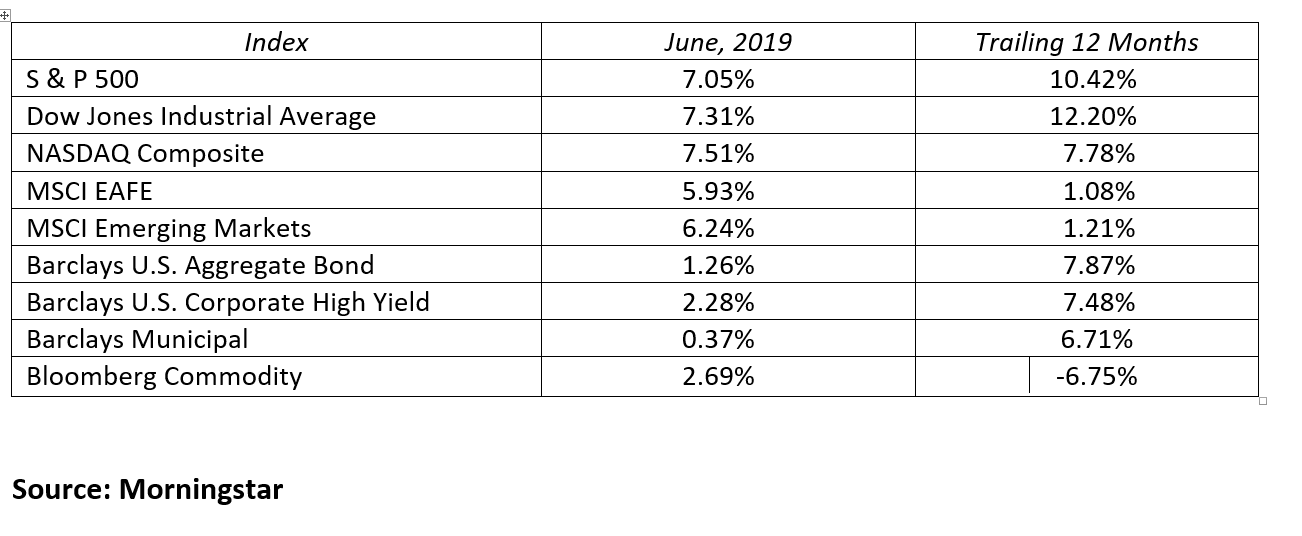

Lost in all the headline noise is the fact financial markets are off to a great start this year. Midway through the year most stock markets are enjoying double digit returns. The NASDAQ Composite, S&P 500 and the Dow Jones Industrial Average are up 21.3%, 18.9% and 15.4% respectively. The two key international stock benchmarks, MSCI EAFE and the MSCI Emerging Markets, trailed the U.S. markets but still posted 14.0% and 10.6% year-to-date increases. Bonds, stocks and gold do not always move in tandem, but they have this year. The Barclays Aggregate Bond index is up 6.1% year-to-date. High yield bonds are also performing well, showing gains of 9.9% this year while gold is up 13.0%.

The second quarter market gyrations provide an excellent opportunity to reflect on some investment observations:

- Stocks are in the middle of a secular bull market, so long-term investors will benefit from staying invested for the long haul.

- Market timing is not a sustainable investment strategy. The whipsaw nature of the second quarter is a perfect example of the nimbleness required to stay a step ahead of the market.

- Headline risks are a constant distraction that must be downplayed. Let your long-term objectives and risk tolerance guide your investment decisions, not your emotions.

- Market corrections, like the one experienced in May, are very normal. Use corrections as opportunities to buy risk assets at lower prices.

Patience is a virtue and successful long-term investors like Warren Buffet choose to view their portfolio in appropriate 5, 10, or 15 year time horizons. Trust your financial plan. Trust the markets. Focus on your long-term goals and do not let tomorrow’s headlines shake your confidence or derail your plan.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.