Virus cases in the U.S. surged in July as cases now top 4.3 million. This number has doubled in just the past six weeks. This resurgence in virus cases has caused the economy to lose some momentum from improvements made in May and June when restrictions were first being relaxed. The spike in cases has slowed reopening plans and required some industries to scale back their forward revenue/profit guidance. The airline industry for one has been forced to reduce their flight schedules once again and are now looking for ways to permanently downsize their workforce to save money. While some industries are in the fight for their long-term survival other industries like technology, pharmaceuticals, and consumer staple companies have been thriving in the pandemic.

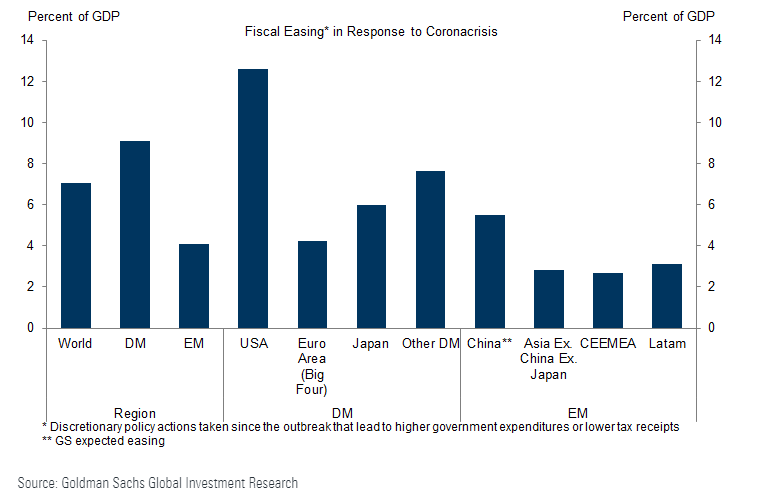

Despite the coronavirus’ impact on the economy, business, work, consumer spending, and our lifestyles; the stock and bond markets have exceeded most expectations since the March market crash. It is important to understand and appreciate the positive impact fiscal and monetary actions has had on the markets, workers and consumers over the past five months. Before Congress leaves for their next recess in early August, expect another round of fiscal stimulus. A $1 trillion stimulus bill is currently being discussed which would include another $1,200 stimulus check to qualifying households. Governmental assistance is a global event as many countries are desperately trying to avoid an extended recession. Data below shows government’s record fiscal stimulus as a percentage of their GDP. You can see the U.S. is leading the way in this regard, but everyone is participating.

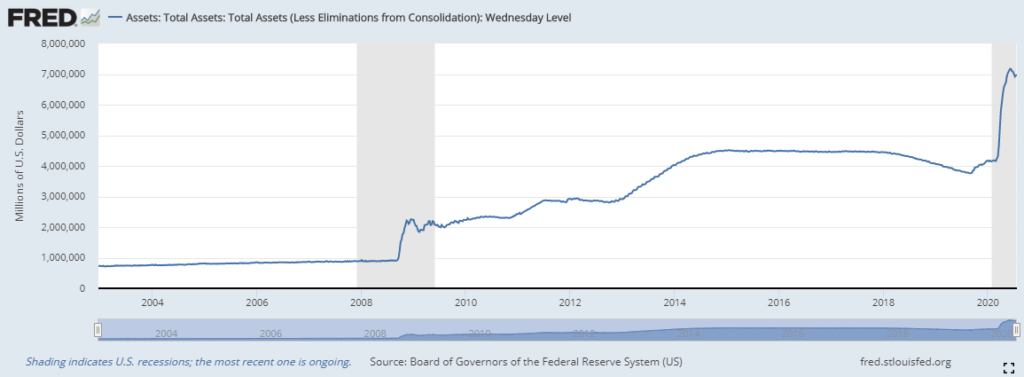

In addition to government actions, global central banks are backstopping the markets with unprecedented accommodative monetary policies. In the U.S., the Federal Reserve Bank has made liquidity a top priority making money readily available to banks and businesses. This is evident by the further expansion of the Fed’s balance sheet over the past five months. Prior to the 2008 recession the Fed balance was steady at the $800 billion level. To save the banking system and cushion the impact of the recession, the Fed expanded their balance sheet to $4.5 trillion while keeping key short-term interest rates targeted at zero for seven years. Just as the Fed was beginning to shrink their balance sheet and slowly raise interest rates, the coronavirus hit and the Fed returned interest rates to zero and expanded their balance sheet to a mind boggling $7.0 trillion.

For those wondering why the markets are performing as well as they are, these two charts speak volumes.

The economic numbers released in July showed some improvement, but there is still a long road back to the 2019 economy. The July unemployment report showed 4.8 million jobs added, well above expectations. The unemployment rate stands in double digits at 11.1%, though much improved from the 14.7% April number and a far cry from the December 3.5% unemployment rate. The Purchasing Managers Index rebounded nicely to 47.9 (June’s number reported in July) from 37.5 in the previous monthly report. The reading is still below 50 which signals contraction. Inflation is still well under control with core CPI running at 1.2% year over year. The University of Michigan Consumer Sentiment Index dipped to 73.9 reflecting the angst among consumers in this uncertain environment. This number hovered around 100 before the virus and now sits at a multi-year low. As expected, second quarter GDP annualized quarter over quarter number was reported down 32.9%. This was the worst quarterly economic decline ever.

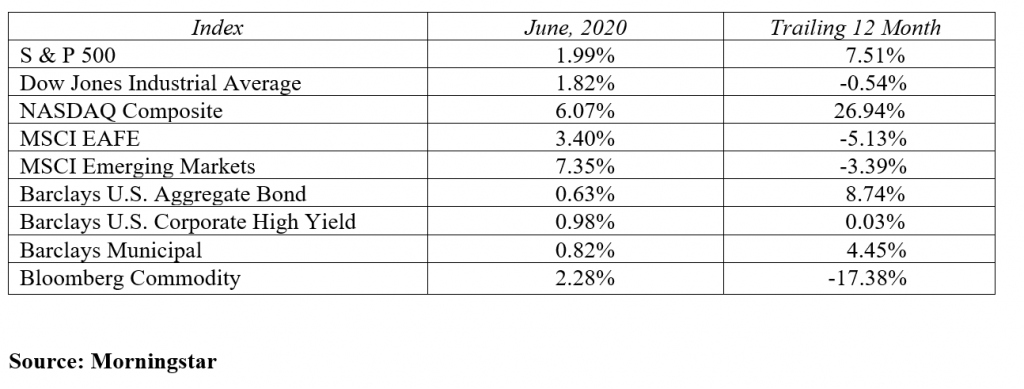

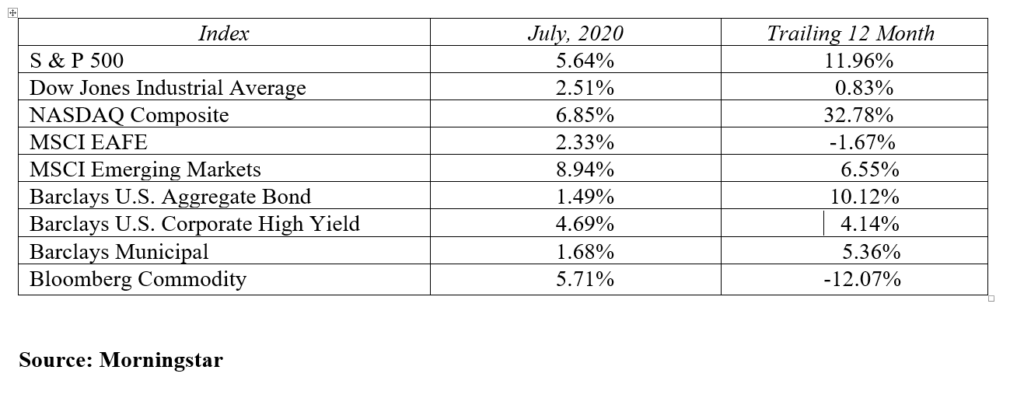

Despite all the current news and anxiety regarding the resurgence of the pandemic, the stock market continues to move onward and upward. Big technology names have provided the leadership with the NASDAQ composite trading at record levels north of 10,000. Names like Amazon, Apple, Tesla, Netflix and Facebook find new all-time highs on a regular basis. The NASDAQ returned 6.9% in July followed by the S&P 500 up 5.6% and the Dow Jones Industrial Average posted gains of 2.5% in the month. International stocks also had a profitable month with international developed stock markets rising 2.3% and emerging markets adding an impressive 8.9% in the past three months. Gold also had a big month crossing the $2,000 an ounce barrier as the U.S. dollar weakened.

The bond market is in a period of calm and it may stay this way for an extended period of time. The Federal Reserve acted quickly to move key short-term interest rates back to zero back in March. They stated publicly that the zero interest rate policy would likely be in place until 2024. The U.S. Treasury yield curve appears to be in a lockdown of its own with rates lower again in the past month. The 2-year U.S. Treasury note declined 5 basis points to yield just 0.11% at month end. At the longer end of the yield curve, 10-year note fell 11 basis points to yield 0.55% while the 30-year U.S. Treasury bond had a significant decline of 21 basis points to yield just 1.20% at month end. Mortgage rates are now at all-time lows helping support the housing market. Both high yield and investment grade corporate debt saw a continued narrowing of credit spreads which explains their strong relative performance this month.

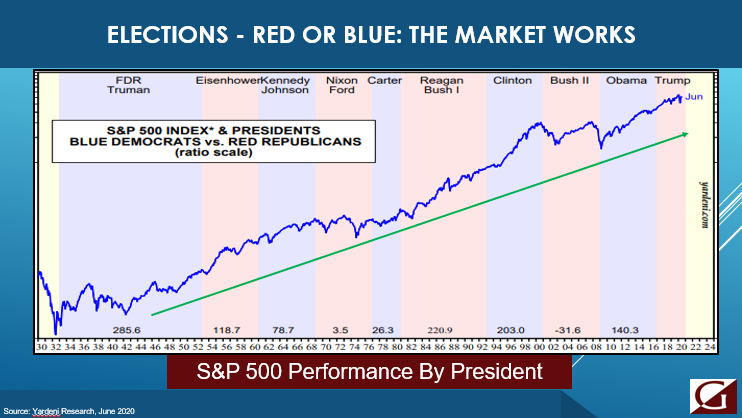

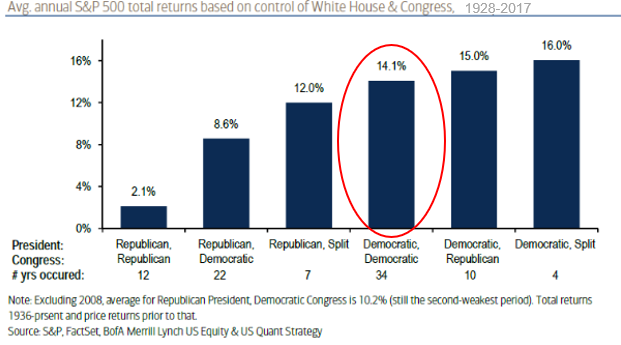

Forecasting the market is challenging in normal economic times. In these extraordinary times of viruses, social unrest, China tensions and a quickly approaching presidential election, predicting the market’s next move is basically impossible. For the glass half full crowd, you can gain comfort from the aggressive fiscal and monetary policies in place and the possibility of an effective virus vaccine sometime in 2021. For the pessimists out there, you likely see the glass as completely empty. The negative news can feel overwhelming at times, but remember every time period has its wall of worry to climb. During this period of uncertainty it may seem like the wall is insurmountable, but only because it is the wall directly in front of us. The market will climb this current wall of worry and then start the next climb over new worries once today’s concerns are behind us. Instead of focusing on where the market may or may not be headed, stay focused on your investment goals, objectives and risk tolerance. There you have control. The markets will take care of themselves over time.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222.