It’s finally here. The long awaited 2020 Election Day is upon us and the final election results and the eventual policy decisions may impact economy and the markets for years to come. The markets seem to be a bit on edge as the pending election can still move us in a variety of directions. Besides the election itself there are concerns of a contested election, a spike in COVID-19 cases, civil unrest, uncertain future fiscal stimulus and further shutdowns are all weighing on the markets this November. This is a recipe for increased market volatility as investors try to put 2020 behind them.

While the pollsters and political prognosticators struggle to provide clarity to the election outcomes, the market itself has a long history of accurately forecasting presidential elections. In the 23 presidential elections since 1928, 14 had U.S. stock market gains in the three months prior to the election. In 12 of those 14 instances, the incumbent party won the White House. In the nine elections preceded by a three-month stock market loss, the incumbents were replaced by the opposition party. As always there are exceptions to the rule. In 1956, 1968 and 1980, this theory did not hold. Still, being correct 20 out of 23 times (87%) is a compelling success rate when it comes to the market’s ability to accurately forecast the presidential election. 1

In the three months leading up to the 2020 election, the U.S. stock market as represented by the S&P 500 did post a meager gain of 0.37% after surviving a 5.6% decline in the last week of October. Historically, the positive three-month return tells us President Trump will be re-elected to a second term. In this upside-down year, anything is still possible. Be prepared to expect the unexpected. 2

Lost in all the political headlines was news that the U.S. economy was continuing its comeback. The most impressive number released in October was third quarter GDP which showed a record 33.1% annual growth rate. Granted this announcement was on the heels of a record 31.4% decline in the second quarter, but still was welcomed news. Other economic numbers gave investors optimism. Durable goods orders were up 1.9% month over month, nonfarm payrolls added 661,000 jobs in September, the unemployment rate dipped to 7.9% from the previous month’s 8.4%, core Consumer Price Index (CPI) was a tame 1.7%, Producer Price Index (PPI) was 1.2% on a year-over-year basis, retail sales grew 5.4% year-over-year, and the housing market remained strong. 3

The stock market hit a speed bump in mid-October as investors reacted to a global resurgence of the virus, fear of more economic shutdowns, realization that any U.S. fiscal stimulus would be a post-election event, and anxiety over the election itself. The S&P 500 entered October at a level of 3,380. It peaked at 3,540 on October 12 and then gave those gains back and more, finishing the month at 3,270. Other major stocks indices also finished October in the red. The NASDAQ Composite lost 2.3% in October while the Dow Jones Industrial Average and the S&P 500 also posted negative returns of 4.5% and 2.7% in the month. International stocks had mixed results with international developed stock markets falling 4.0% and emerging markets were the one bright spot climbing 2.1% in October. 4

With the Federal Reserve on permanent hold and inflation under control, the U.S. Treasury yield curve was stable once again. During October, the 2-year U.S. Treasury note rose 1 basis point to yield 0.14% at month end. Longer maturities saw the yield on the 10-year note and the 30-year U.S. Treasury bond move higher. Interest rates on the 10-year and 30-year each rose 19 basis points bringing their month end yield to 0.88% and 1.65% respectively. Concerns of mounting federal deficits and future inflation are continuing to steepen the yield curve. Mortgage rates remain low however, helping to sustain the strong housing market. Credit spreads in both high yield and investment grade corporate debt narrowed marginally during October. 5

As we look to the future it is important to have both a short-term and a long-term outlook for the economy, the stock market and the bond market. Over the next three months the likelihood for a post-election fiscal stimulus plan is high, and if enacted this should be favorable tailwind for the markets. Regardless of the election outcome, the short-term looks positive. One caveat is a contested election which could derail any post-election relief rally and stall any stimulus program into next year.

A longer-term outlook will come into better focus after the results of the 2020 elections are known. The market is familiar with Trump’s policies and will likely respond favorably to four more years of business-friendly decisions from Washington. If the Democrats take control of Washington, the markets will need to adjust to a new sheriff in town. Higher taxes and more regulations will likely take a longer-term toll on the markets.

Still looming is the pandemic and the impact it will have on the economy. Obviously, a successful vaccine sooner rather than later could give the markets a huge boost heading into 2021. Regardless of your political leanings or COVID-19 beliefs, your portfolio should be well balanced heading into the election and year end. Take the breaking news of the day in stride, control your emotions as best you can and keep your portfolios well-diversified at a risk level designed for your personal financial situation.

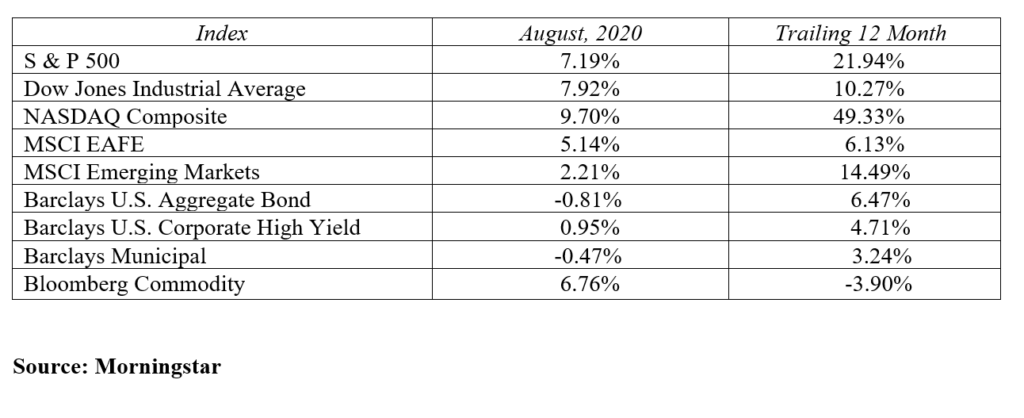

MARKETS BY THE NUMBERS:

Sources: