This quarter is one we will likely never forget. The coronavirus’ impact on our healthcare system, our financial health and our way of life has been severe. The speed and magnitude of this fallout has left everyone in a state of shock. Never in history has the U.S. stock markets fallen so far, so fast. This includes the Great Depression, the 1987 crash, 9/11 and the financial crisis of 2008. This bull market ended in violent fashion nearly eleven years to the date after it began.

Historically, stock market collapses are usually caused by economic factors such as rising unemployment or inflation, a slowdown in economic growth, consumer spending or consumer confidence. This quarter began with our economy in great shape on multiple fronts. The virus and the extensive effort to limit its spread instantaneously turned off almost all economic activity across the country. The financial impact to the stay at home policies implemented to flatten the virus curve has caused a rush to an event-driven economic recession. The short-term economic impact will be devastating as business and personal revenues have been seriously downsized.

The stock market is a discounting mechanism as it constantly processes the likelihood of future economic outcomes to arrive at today’s current price. Currently, the market has an expected time frame for a return to economic normalcy. We know if the economy rebounds quicker than the collective expectations, the markets will bounce back rapidly. If the virus keeps the economy shut down longer than expected, the markets will endure more pain. The government has initiated massive fiscal and monetary measures to cushion the damage to workers and companies both large and small.

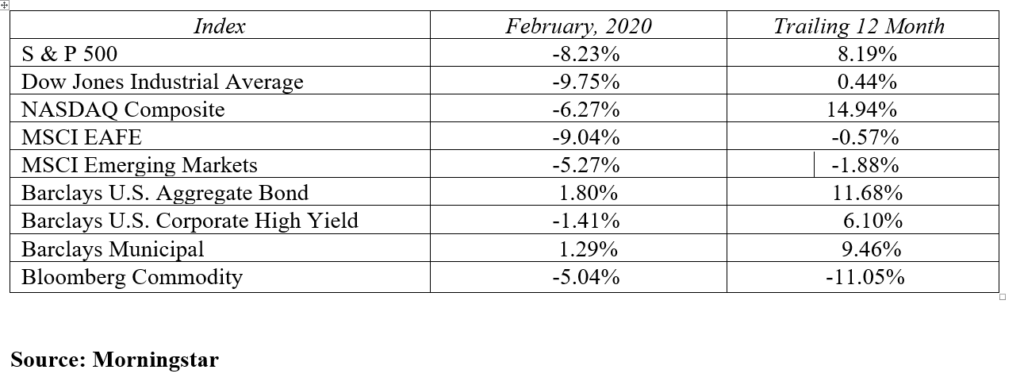

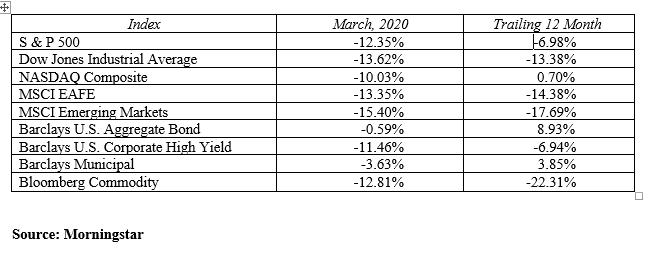

The quarter began like many of the previous 43 quarters with stock markets moving higher and the economy strengthening. February 12, 2020 seems like a lifetime ago when the major U.S. stock indices (Dow Jones Industrial Average, S&P 500 and the NASDAQ) closed at 29,551, 3,379 and 9,726, respectively. By quarter-end these indices fell 26%, 24% and 20% from the mid-February peak levels. The market volatility in stocks, bonds and oil in the second half of this quarter has been unprecedented. Daily asset price swings greater than five percent have become commonplace. This virus knows no borders and international markets have experienced similar pain. For the quarter, international developed stock markets were down 22.8% and emerging markets fell 23.6%.

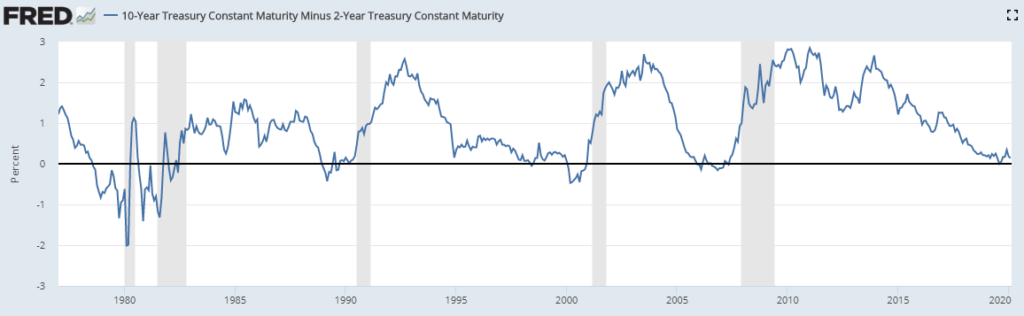

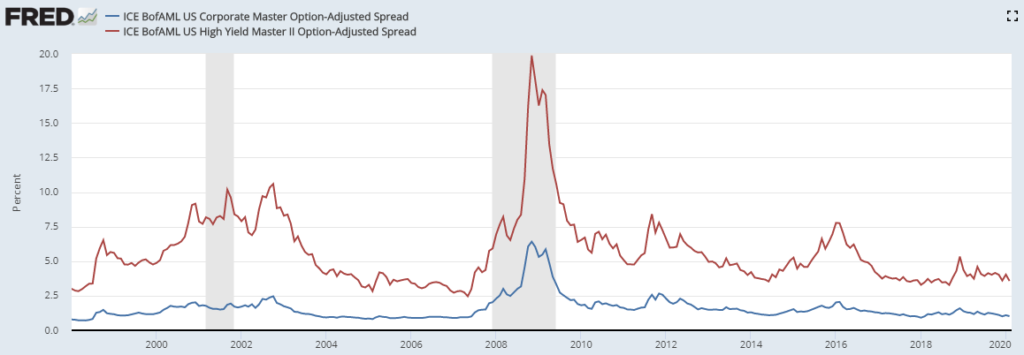

The bond market reaction to this economic shock was quite predicable. The flight to quality trade was in full force. In these situations, investors sell risk assets like stocks, preferred stocks, high yield bonds and corporate bonds to buy U.S. Treasury notes. This causes treasury interest rates to drop, causing their prices to rise. Interest rates differentials for riskier bonds like corporate bonds and junk bonds rise, driving their prices lower. This phenomena was evident in the first quarter returns as Barclays Long Term U.S. Treasury Index was up 20.9%, while the Barclays High Yield Bond Index was down 12.7%.

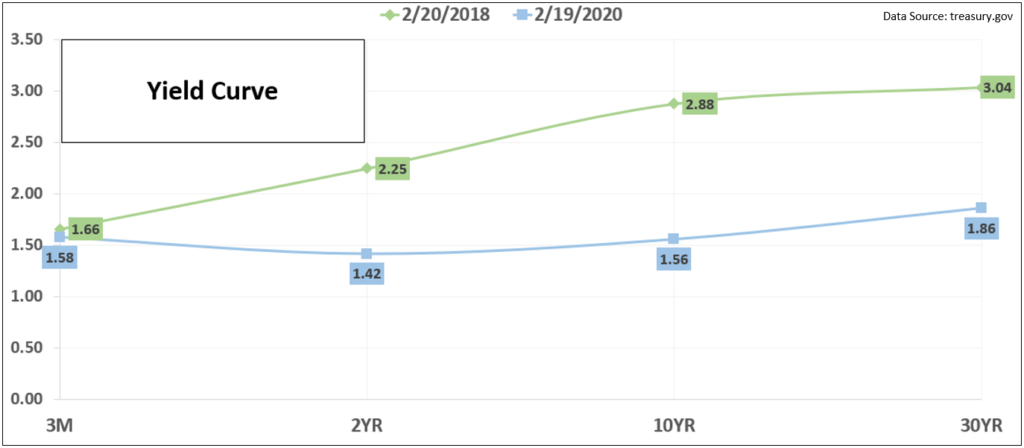

The Federal Reserve board took immediate action, prior to their scheduled March meeting, to return the fed funds rates to zero as they did in the ’08-’09 recession. In addition to these fed rate cuts, the Federal Reverse said they will do whatever it takes to provide massive amounts of liquidity to the financial system. At quarter end, the treasury yield curve settled in at these yields: 2-year 0.23%, 5-year 0.37%, 10-year 0.70% and 30-year maturities at 1.35%. We even saw negative yields momentarily for the first time at the very front end of the yield curve.

Investors, advisers and money managers alike are put to the test during times of market crisis. This is certainly one of those times. It’s imperative not to panic during times of market stress. The anxiety and pain are real, but it is essential to look beyond today’s turmoil and focus on tomorrow’s opportunities.

The virus will end, the markets will rebound and life will return to normal. Hang in there, be patient and together we will get through this crisis. Lean on your carefully constructed financial plan for support and as the basis for any subsequent actions. Focus on all the positives in your plan including income generation sources through social security, pensions, fixed indexed annuities, and bonds. Remind yourself of the long-term benefits of stock ownership and view your allocation to stocks with the long-term time frame that it deserves. Take a deep breath, stay calm and remain confident in your financial plan.

To expand on these Market Commentaries or to discuss any of our investment portfolios, please do not hesitate to reach out to us at 775-674-2222